Question

Estimate forecasts for the next 5 years. Income Statement forecast assumptions a. Assume sales will grow 2.0% each year from Year +1 through Year +5.

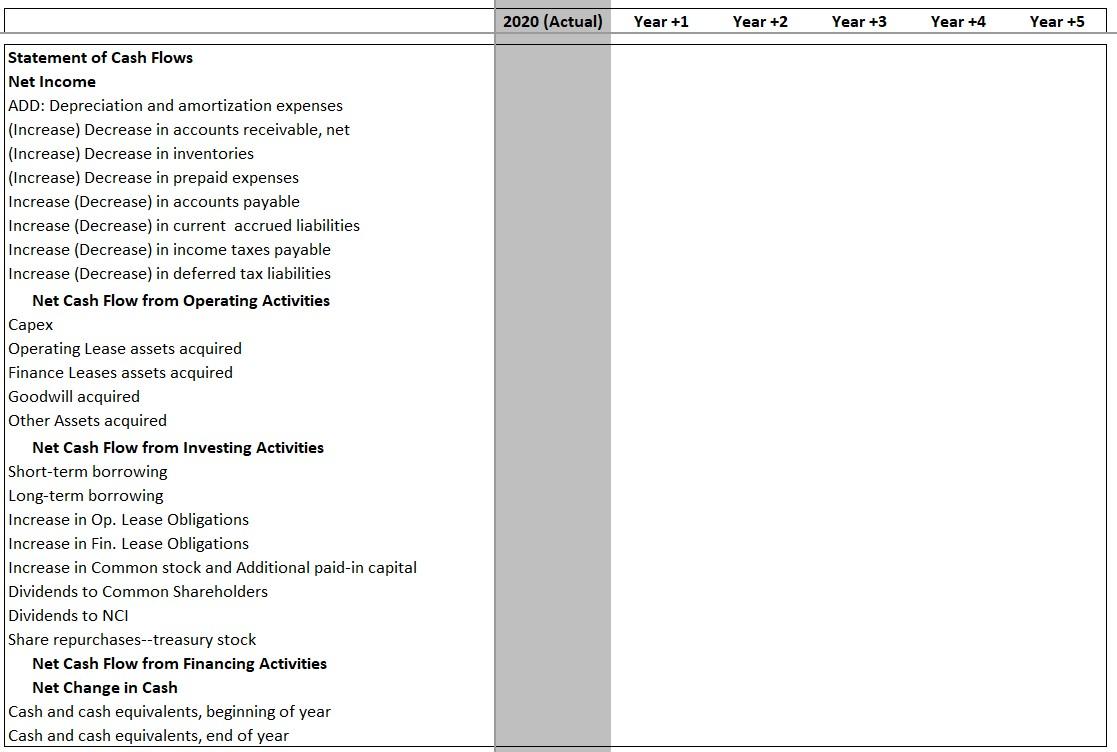

Estimate forecasts for the next 5 years.

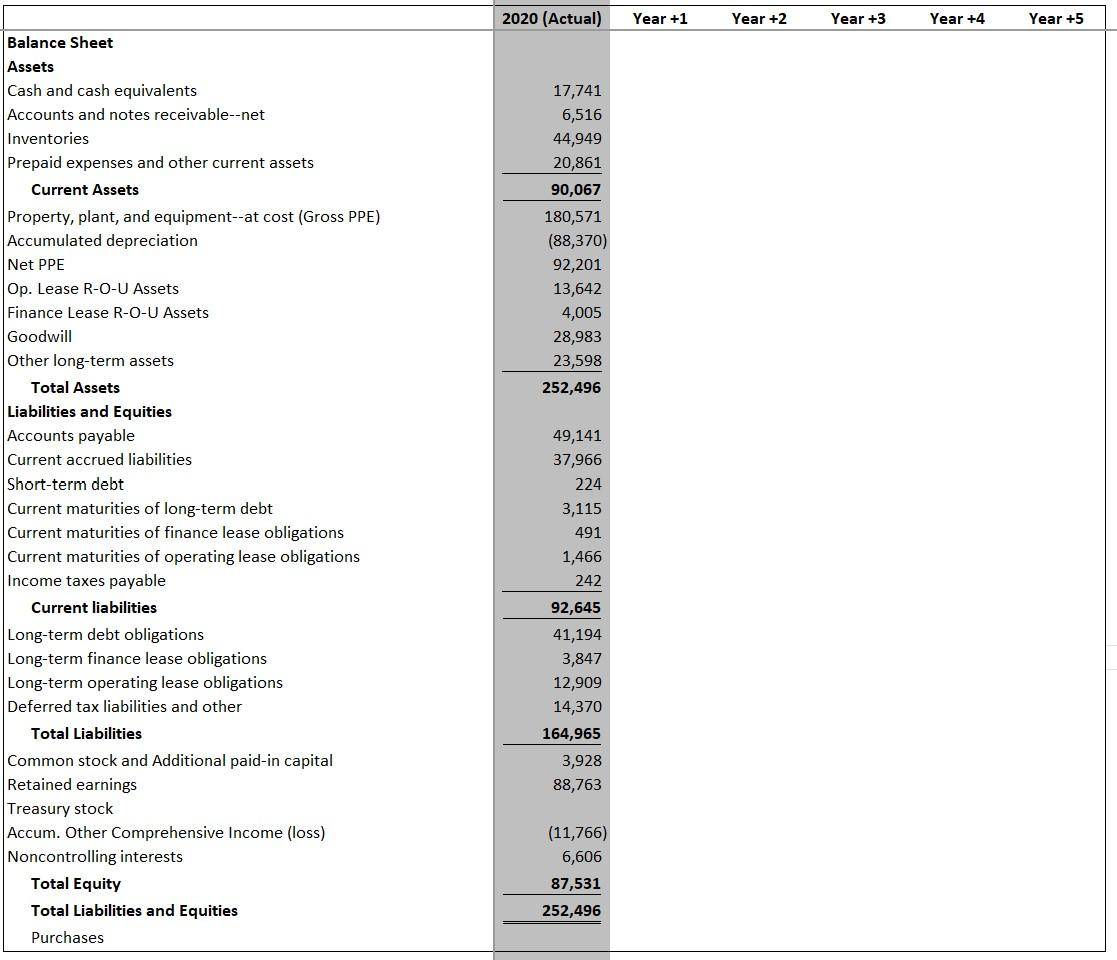

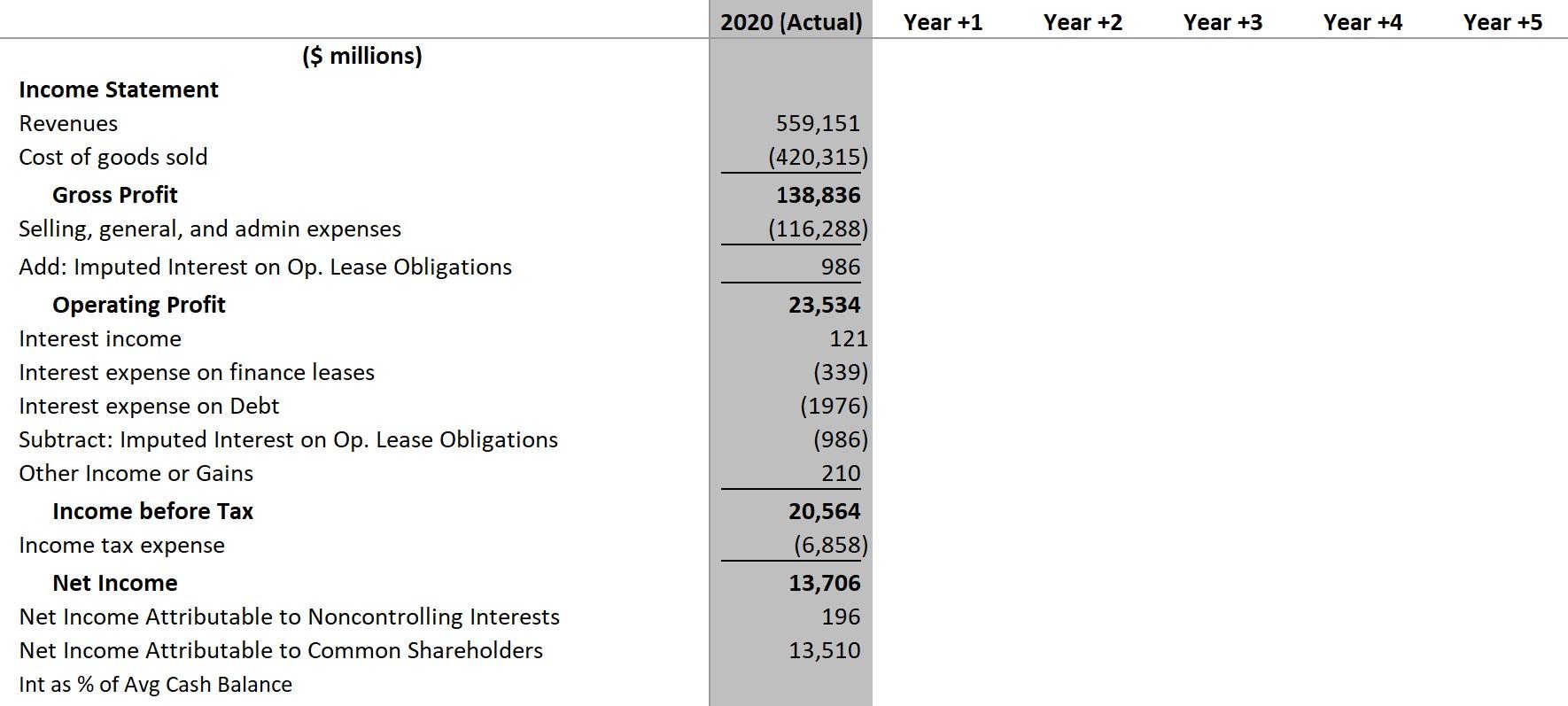

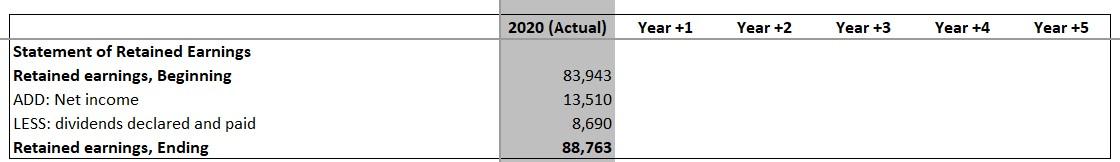

Income Statement forecast assumptions a. Assume sales will grow 2.0% each year from Year +1 through Year +5. b. Assume that the cost of goods sold to sales percentage will continue to be 75.2% of sales for Year +1 to Year +5. c. Assume that operating, selling, general and administrative expenses will continue to average 20.8% of sales for Year +1 to Year +5. d. Assume that interest income will be 1.5% of average cash balances (that is, the sum of beginning and end-of-year cash balances divided by 2) for Year +1 through Year +5. (Note: Projecting the amount of interest income must await projection of cash on the balance sheet.) e. Assume a 5.5% interest rate for all outstanding borrowing (short-term and long-term debt, including the current portion of long-term debt) for Year +1 through Year +5. Compute interest expense on the average amount of interest-bearing debt outstanding each year.(Note: Projecting the amount of interest expense must await projection of the interest-bearing debt accounts on the balance sheet.) f. Assume that the 6.1% interest rate will continue to apply to all outstanding operating lease obligations and the 6.8% interest rate will continue to apply to all outstanding finance lease obligations (current and long-term lease obligations). Compute interest expense amounts on the average amount of operating and finance lease obligations outstanding each year. (Note: Projecting the amounts of interest expenses must await projections of the lease obligations on the balance sheet.) g. Assume other income and gains to be zero for Year+1 through Year+5. h. Assume that Walmarts effective income tax rate will be 31.0% of income before taxes for Year +1 through Year +5. (Note: Projecting the amount of income tax expense must await computation of income before taxes.) i. Assume that the portion of net income attributable to noncontrolling interests in the future will continue to yield a 5.0% rate of return in Year +1 through Year +5. For simplicity, assume that the dividends Walmart will pay to the noncontrolling interest shareholders will equal the amount of net income attributable to these noncontrolling interests in Year +1 to Year +5.(See NCI Sheet in Clorox forecasting problem to get some tips).

Balance Sheet Forecast Assumptions a. Use Cash as the flexible financial account b. Assume that the ending accounts receivable balance will grow with sales growth. c. Assume that ending inventory will be equal to 40 days of cost of goods sold, in Year +1 to Year +5. d. Prepaid expenses are assets that include prepayments for ongoing operating costs such as rent and insurance. Assume that prepayments will grow at the growth rate in sales in Year +2 through Year +5. However, at fiscal year end 2020, Walmart includes $19,200 million in this account for assets associated with a business being held for sale. We will assume that the sale of the business will be completed in Year +1. Therefore, subtract $19,200 from the ending balance in 2020 to project the ending balance for Year +1. e. Assume that capital spending on new property, plant, and equipment will continue to be $10.0 billion each year from Year +1 through Year +5. f. For depreciation expense on existing PPE and new PPE, compute straight-line depreciation expense based on an average 17-year useful life and zero salvage value. Depreciation on new PPE starts in the same year as the year in which new PPE is acquired. g. Assume that the Operating and Finance lease assets will grow at the same rate of growth in Gross Property, Plant, and Equipment during Year +1 through Year +5. h. Assume that goodwill and other long-term assets will grow at the same rate as Sales. i. Assume that ending accounts payable will continue to approximate 42 days of inventory purchases in Years +1 to +5. j. Accrued Liabilities decreases by 12,195 million in Year+1 and will grow at 2% from Year+2 through Year+5. k. Assume that income taxes payable and deferred tax liabilities grow at 2.0% per year in Year +1 through Year +5. l. Assume that Walmarts short-term debt, current maturities of long-term debt, and long-term debt will grow at 3.0% per year in Year +1 through Year +5. m. We will assume that the short-term and long-term obligations under operating and finance leases will grow at the same rate as the lease right-of-use assets during Year +1 through Year +5, which in turn equals the rate of growth in property, plant, and equipment. n. Assume that Walmarts common stock and additional paid-in capital will continue to grow at 13.0% per year in Year +1 through Year +5. o. Assume that Walmart will maintain a policy to pay dividends equivalent to 45% of net income attributable to Walmart shareholders in Year +1 through Year +5. p. Assume that Walmart will continue to use $6,000 million per year to repurchase common shares in Year +1 through Year +5. q. Assume that accumulated other comprehensive income will not change. Equivalently, assume that other comprehensive income items will be zero, on average, in Year +1 through Year +5.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started