Question

estimate the cost of equity and WACC for Air New Zealand. You can assume that Beta 5Y on the information sheet is the equity

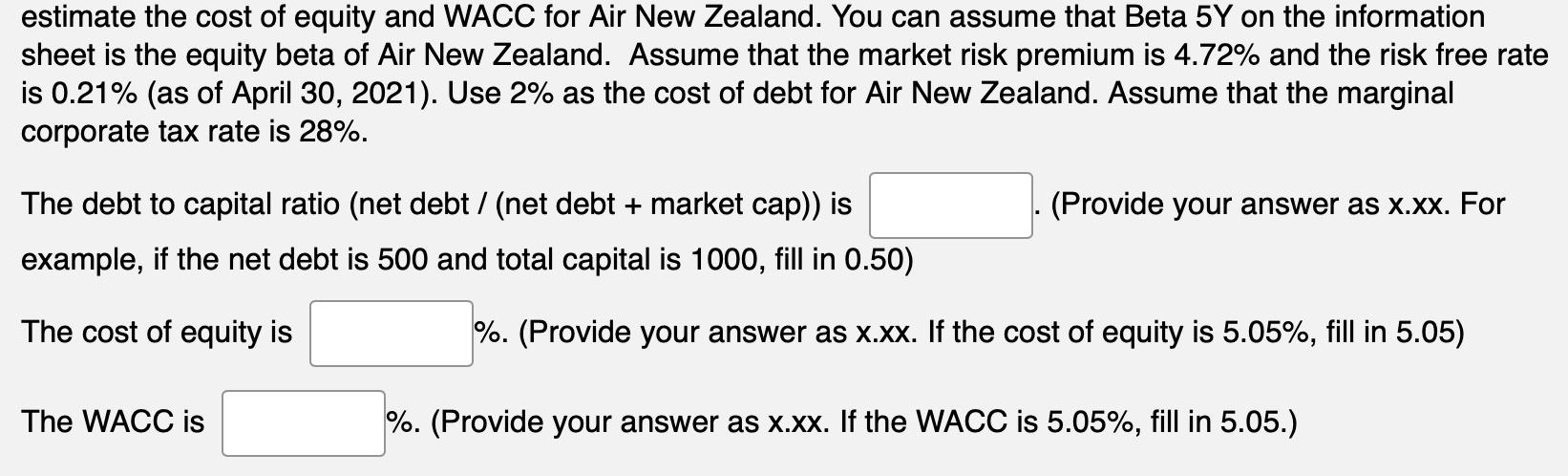

estimate the cost of equity and WACC for Air New Zealand. You can assume that Beta 5Y on the information sheet is the equity beta of Air New Zealand. Assume that the market risk premium is 4.72% and the risk free rate is 0.21% (as of April 30, 2021). Use 2% as the cost of debt for Air New Zealand. Assume that the marginal corporate tax rate is 28%. The debt to capital ratio (net debt / (net debt + market cap)) is example, if the net debt is 500 and total capital is 1000, fill in 0.50) The cost of equity is The WACC is (Provide your answer as x.xx. For %. (Provide your answer as x.xx. If the cost of equity is 5.05%, fill in 5.05) %. (Provide your answer as x.xx. If the WACC is 5.05%, fill in 5.05.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Estimating Air New Zealands Cost of Equity and WACC Given Inform...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Financial Management

Authors: Eugene F Brigham, Phillip R Daves

14th Edition

0357516664, 978-0357516669

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App