Answered step by step

Verified Expert Solution

Question

1 Approved Answer

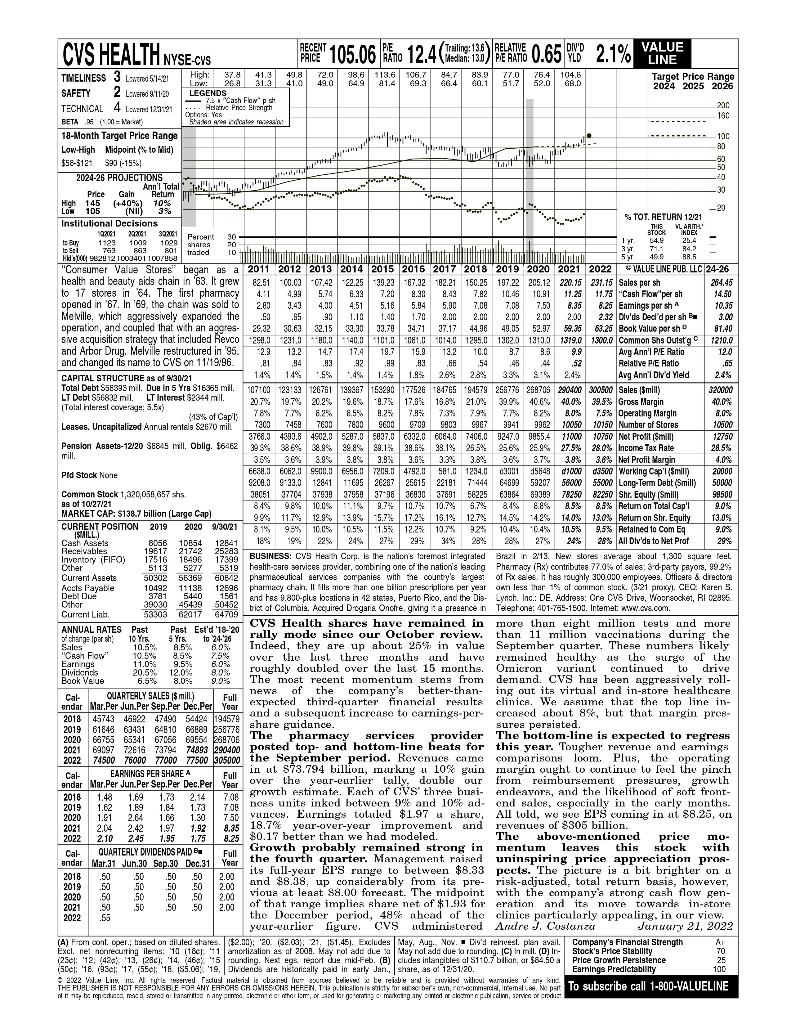

Estimate the discount rate for your stock In order to estimate the Free Cash Flow valuation model, you will need a discount rate for CVS

- Estimate the discount rate for your stock

In order to estimate the Free Cash Flow valuation model, you will need a discount rate for CVS based on the Asset Beta (not the Equity Beta discount rate you used in the dividend discount models and RIM that you calculated in the Assignment for Chapter 6.1-6.1).

- To begin with, you need to calculate the Asset Beta. Use the Valueline report to get the Equity Beta, the LT-Debt to use as your estimate of debt, and the Market Cap as your estimate of equity (as reported on the left of the report as of 09/30/21). You can assume that the tax rate is 21%. Show your work.

- Estimate the discount rate using the CAPM model with the asset beta you calculated in Question 1a. You can assume that the 90-day TBill rate is 3% and that the stock market risk premium is 8%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started