Question

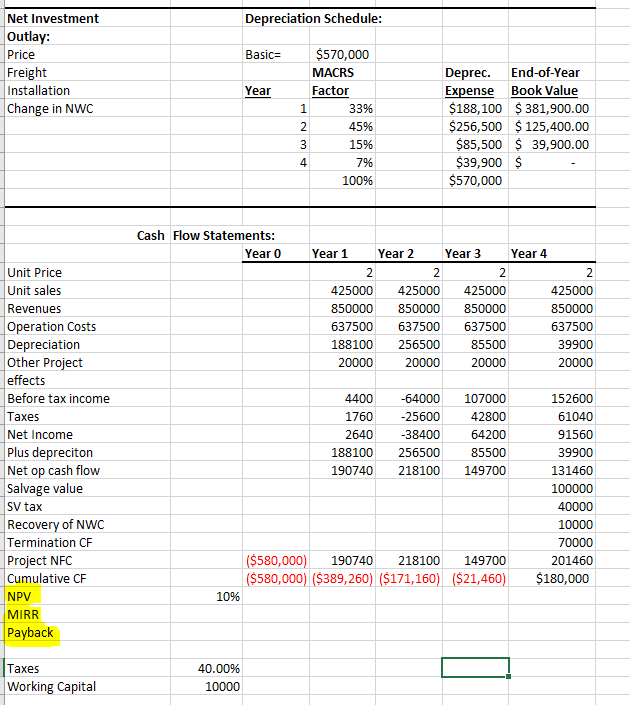

Estimate the projects operating cash flows. (Hint: Again use Table 1 as a guide.) What are the projects NPV, IRR, modified IRR (MIRR), and payback?

Estimate the projects operating cash flows. (Hint: Again use Table 1 as a guide.) What are the projects NPV, IRR, modified IRR (MIRR), and payback? Should the project be undertaken? [Remember: The MIRR is found in three steps: (1) compound all cash inflows forward to the terminal year at the cost of capital, (2) sum the compounded cash inflows to obtain the terminal value of the inflows, and (3) find the discount rate which forces the present value of the terminal value to equal the present value of the net investment outlays. This discount rate is defined as the MIRR.]

Can you help me solve NPV MIRR and Payback? Please show work.

Depreciation Schedule: Basics Net Investment Outlay: Price Freight Installation Change in NWC Year $570,000 MACRS Factor 1 33% 2 45% 3 15% 4 7% 100% WN Deprec. End-of-Year Expense Book Value $188,100 $ 381,900.00 $256,500 $ 125,400.00 $85,500 $ 39,900.00 $39,900 $ $570,000 Cash Flow Statements: Year o Year 1 Year 2 Year 3 Year 4 2 2 2 2 425000 425000 425000 425000 850000 850000 850000 850000 637500 637500 637500 637500 188100 256500 85500 39900 20000 20000 20000 20000 *** Unit Price Unit sales Revenues Operation Costs Depreciation Other Project effects Before tax income Taxes Net Income Plus depreciton Net op cash flow Salvage value SV tax Recovery of NWC Termination CF Project NFC Cumulative CF NPV MIRR Payback 4400 1760 2640 188100 190740 -64000 -25600 -38400 256500 218100 107000 42800 64200 85500 149700 152600 61040 91560 39900 131460 100000 40000 10000 70000 201460 $180,000 ($580,000) 190740 218100 149700 ($580,000) ($389,260) ($171,160) ($21,460) 10% Taxes Working Capital 40.00% 10000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started