Estimated Cost of Debt Calculate the after-tax estimated cost of debt capital: a. Input the interest expense from the Income Statement below. b. Calculate the average amount of interest-bearing debt using the Balance Sheet below. c. Calculate the pretax borrowing rate for debt. d. Refer to the income tax footnotes below to determine the statutory tax rate. e. Calculate the after-tax cost of debt capital.

| Interest Expense | |

| Average amount of Interest-Bearing debt | |

| Pretax borrowing rate for debt | |

| Statutory tax rate | |

| After-tax Borrowing Rate for Debt | |

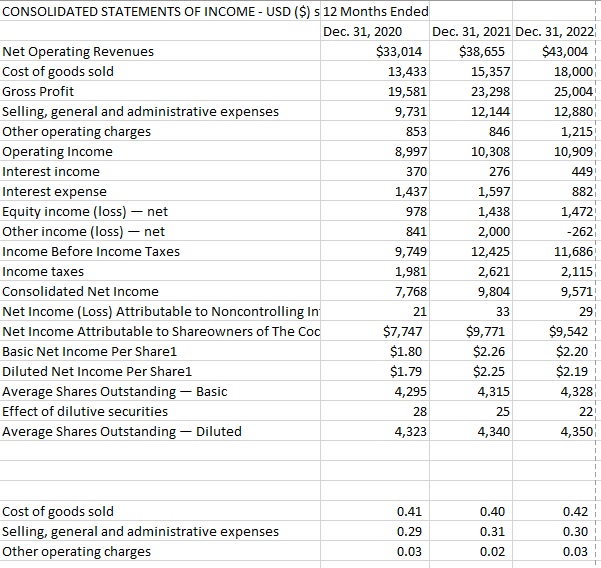

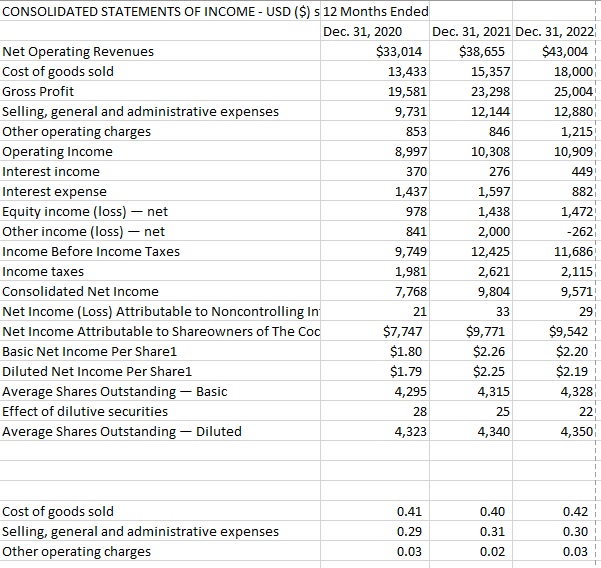

Income Statement:

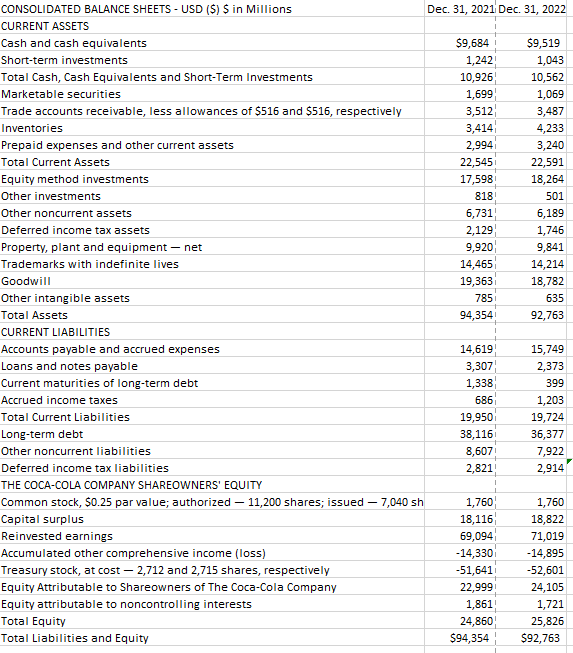

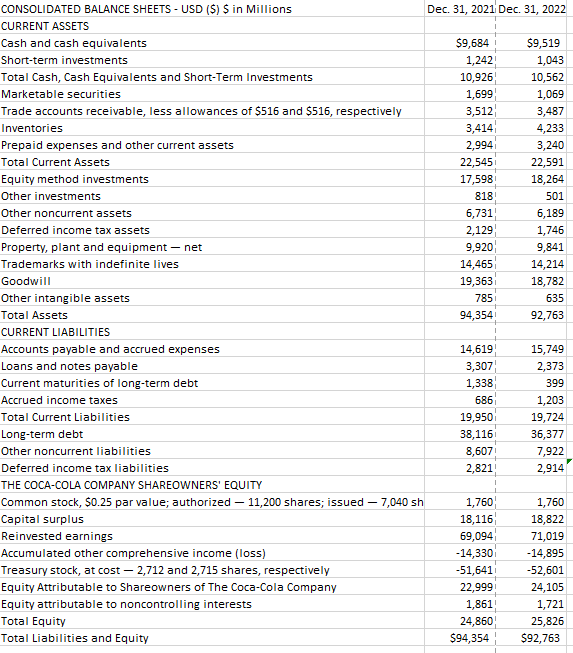

Balance Sheet:

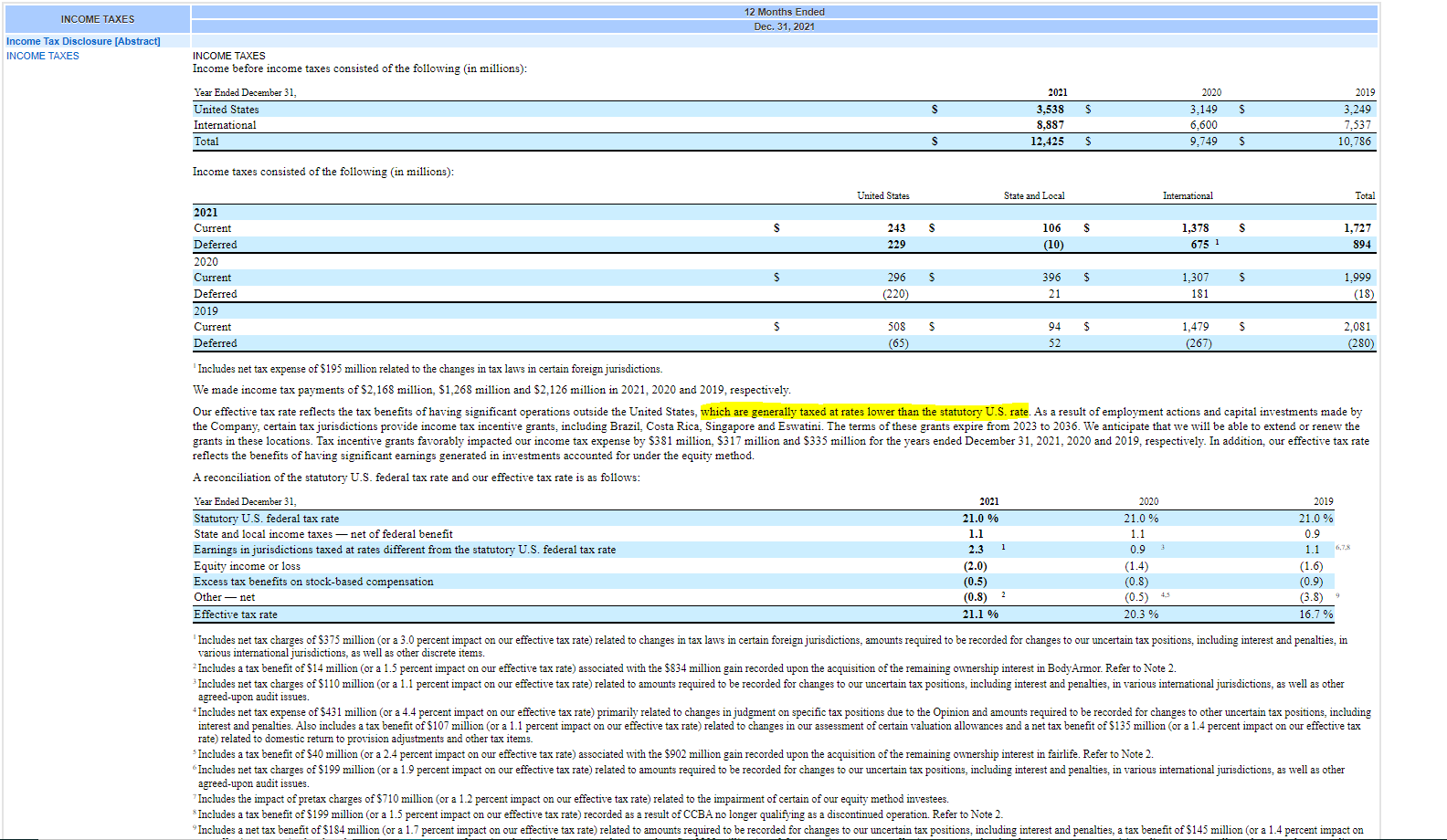

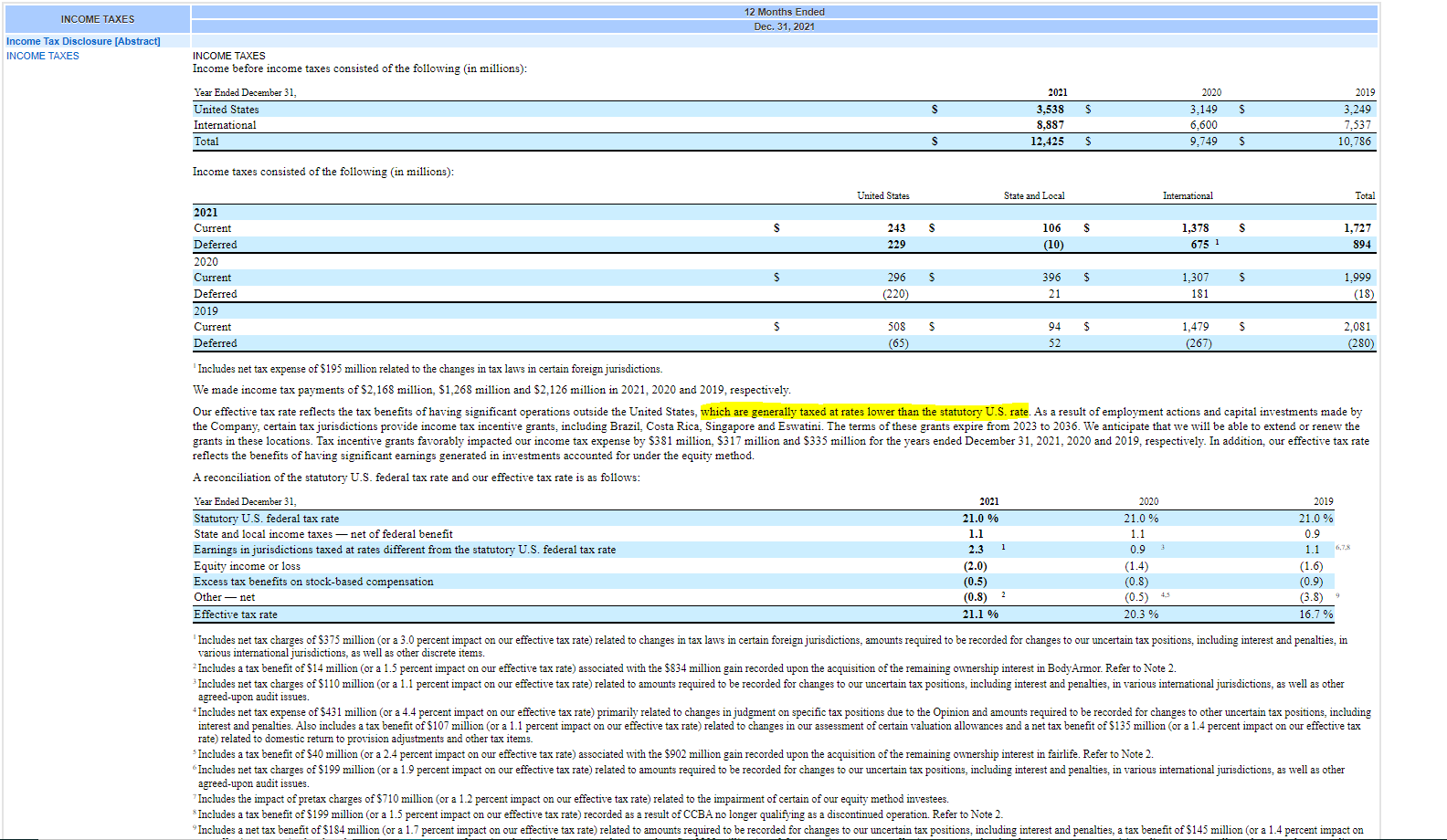

Income Tax Footnotes:

CONSOLIDATED BALANCE SHEETS - USD (\$) $ in Millions Dec. 31, 2021 Dec. 31, 2022 CURRENT ASSETS Cash and cash equivalents Short-term investments Total Cash, Cash Equivalents and Short-Term Investments Marketable securities \begin{tabular}{r|r} $9,684 & $9,519 \\ \hline 1,242 & 1,043 \\ \hline 10,926 & 10,562 \\ \hline 1,699 & 1,069 \end{tabular} Trade accounts receivable, less allowances of $516 and $516, respectively 3,512:3,487 Inventories Prepaid expenses and other current assets Total Current Assets Equity method investments \begin{tabular}{r|r} 3,414 & 4,233 \\ \hline 2,994 & 3,240 \\ \hline 22,545 & 22,591 \\ \hline 17,598 & 18,264 \\ \hline \end{tabular} Other investments 818:501 Other noncurrent assets Deferred income tax assets Property, plant and equipment - net Trademarks with indefinite lives Goodwill Other intangible assets Total Assets CURRENT LIABILITIES Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Total Current Liabilities Long-term debt Other noncurrent liabilities Deferred income tax liabilities THE COCA-COLA COMPANY SHAREOWNERS' EQUITY Common stock, $0.25 par value; authorized 11,200 shares; issued 7,040sh Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock, at cost 2,712 and 2,715 shares, respectively Equity Attributable to Shareowners of The Coca-Cola Company Equity attributable to noncontrolling interests Total Equity Total Liabilities and Equity various international jurisdictions, as well as other discrete items. Includes a tax benefit of $14 million (or a 1.5 percent impact on our effective tax rate) associated with the $834 million gain recorded upon the acquisition of the remaining ownership interest in BodyArmor. Refer to Note 2 . agreed-upon audit issues. rate) related to domestic return to provision adjustments and other tax items. Includes a tax benefit of $40 million (or a 2.4 percent impact on our effective tax rate) associated with the $902 million gain recorded upon the acquisition of the remaining ownership interest in fairlife. Refer to Note 2 . agreed-upon audit issues. Includes the impact of pretax charges of $710 million (or a 1.2 percent impact on our effective tax rate) related to the impairment of certain of our equity method investees. Includes a tax benefit of $199 million (or a 1.5 percent impact on our effective tax rate) recorded as a result of CCBA no longer qualifying as a discontinued operation. Refer to Note 2 . CONSOLIDATED BALANCE SHEETS - USD (\$) $ in Millions Dec. 31, 2021 Dec. 31, 2022 CURRENT ASSETS Cash and cash equivalents Short-term investments Total Cash, Cash Equivalents and Short-Term Investments Marketable securities \begin{tabular}{r|r} $9,684 & $9,519 \\ \hline 1,242 & 1,043 \\ \hline 10,926 & 10,562 \\ \hline 1,699 & 1,069 \end{tabular} Trade accounts receivable, less allowances of $516 and $516, respectively 3,512:3,487 Inventories Prepaid expenses and other current assets Total Current Assets Equity method investments \begin{tabular}{r|r} 3,414 & 4,233 \\ \hline 2,994 & 3,240 \\ \hline 22,545 & 22,591 \\ \hline 17,598 & 18,264 \\ \hline \end{tabular} Other investments 818:501 Other noncurrent assets Deferred income tax assets Property, plant and equipment - net Trademarks with indefinite lives Goodwill Other intangible assets Total Assets CURRENT LIABILITIES Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Total Current Liabilities Long-term debt Other noncurrent liabilities Deferred income tax liabilities THE COCA-COLA COMPANY SHAREOWNERS' EQUITY Common stock, $0.25 par value; authorized 11,200 shares; issued 7,040sh Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock, at cost 2,712 and 2,715 shares, respectively Equity Attributable to Shareowners of The Coca-Cola Company Equity attributable to noncontrolling interests Total Equity Total Liabilities and Equity various international jurisdictions, as well as other discrete items. Includes a tax benefit of $14 million (or a 1.5 percent impact on our effective tax rate) associated with the $834 million gain recorded upon the acquisition of the remaining ownership interest in BodyArmor. Refer to Note 2 . agreed-upon audit issues. rate) related to domestic return to provision adjustments and other tax items. Includes a tax benefit of $40 million (or a 2.4 percent impact on our effective tax rate) associated with the $902 million gain recorded upon the acquisition of the remaining ownership interest in fairlife. Refer to Note 2 . agreed-upon audit issues. Includes the impact of pretax charges of $710 million (or a 1.2 percent impact on our effective tax rate) related to the impairment of certain of our equity method investees. Includes a tax benefit of $199 million (or a 1.5 percent impact on our effective tax rate) recorded as a result of CCBA no longer qualifying as a discontinued operation. Refer to Note 2