Question

Estimated factor loadings (betas) for the Mystery Fund, according to the Fama-French 3 Factor model (FF3), are reported in the table below, along with annual

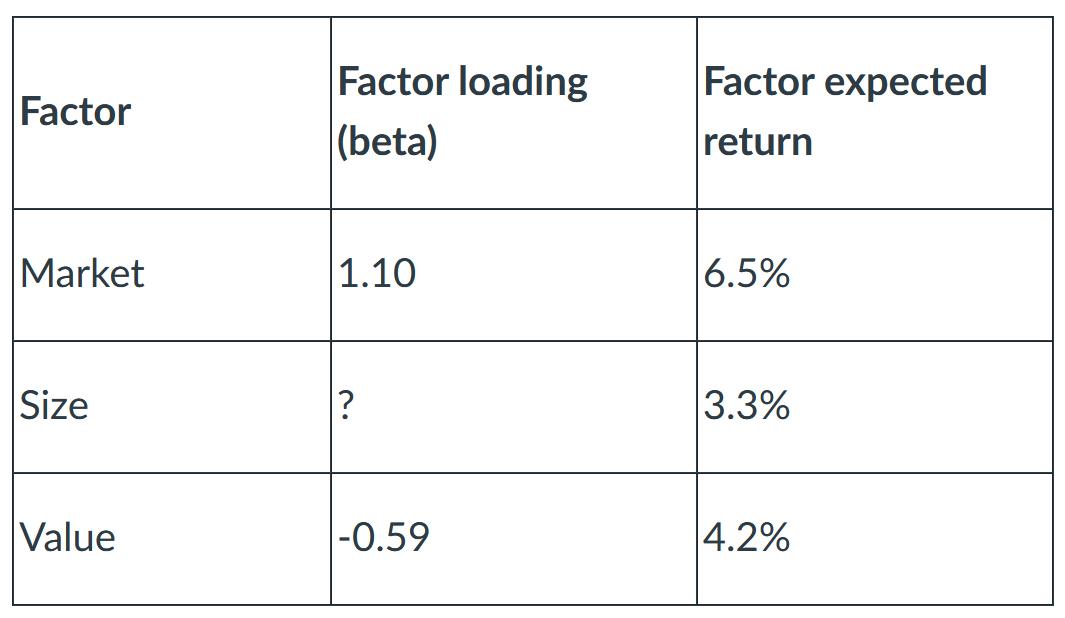

Estimated factor loadings (betas) for the Mystery Fund, according to the Fama-French 3 Factor model (FF3), are reported in the table below, along with annual factor expected returns.

If the Mystery Fund's annual return was 10%, its FF3 alpha was 5%, and the risk-free rate was 2% over the same period, what was the fund's FF3 size beta?

Factor loading Factor expected Factor (beta) return Market 1.10 6.5% Size ? 3.3% Value -0.59 4.2%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer We can use the information provided to solve for the FF3 size beta of the Mystery Fund Heres ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Probability And Statistics

Authors: William Mendenhall, Robert J. Beaver, Barbara M. Beaver

13th Edition

0495389536, 9780495389538

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App