Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Estimated Income Tax Gross income (wages, salary, investment income, and other ordinary income) Less adjustments to income (see current tax regulations) Equals adjusted gross income

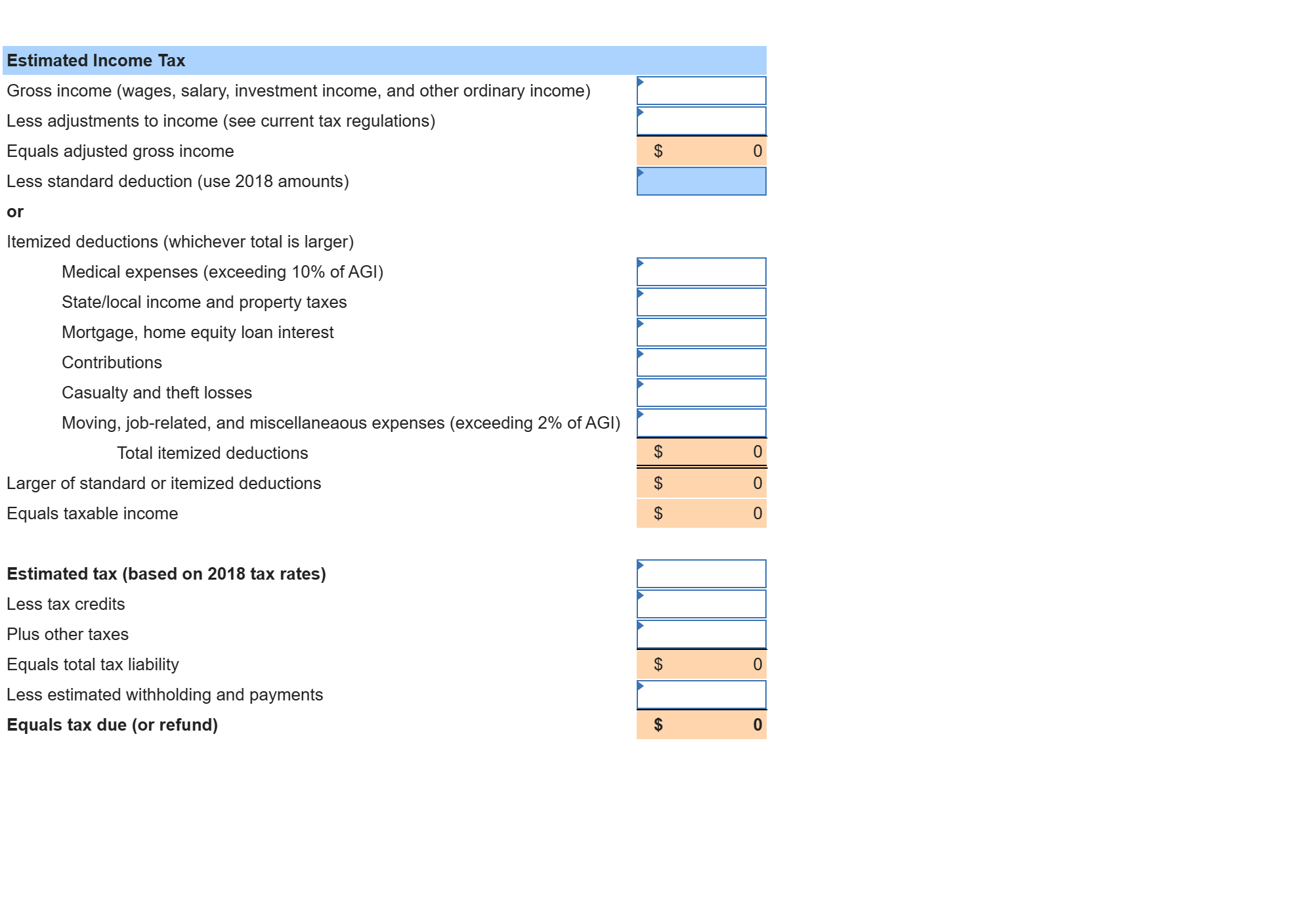

Estimated Income Tax Gross income (wages, salary, investment income, and other ordinary income) Less adjustments to income (see current tax regulations) Equals adjusted gross income Less standard deduction (use 2018 amounts) or Itemized deductions (whichever total is larger) Medical expenses (exceeding 10% of AGI) State/local income and property taxes Mortgage, home equity loan interest Contributions Casualty and theft losses Moving, job-related, and miscellaneaous expenses (exceeding 2\% of AGI) Total itemized deductions Larger of standard or itemized deductions Equals taxable income \begin{tabular}{|c|c|} \hline 7 & \\ \hline & \\ \hline & \\ \hline 7 & \\ \hline & \\ \hline & \\ \hline$ & 0 \\ \hline$ & 0 \\ \hline$ & 0 \\ \hline \end{tabular} Estimated tax (based on 2018 tax rates) Less tax credits Plus other taxes Equals total tax liability Less estimated withholding and payments Equals tax due (or refund)

Estimated Income Tax Gross income (wages, salary, investment income, and other ordinary income) Less adjustments to income (see current tax regulations) Equals adjusted gross income Less standard deduction (use 2018 amounts) or Itemized deductions (whichever total is larger) Medical expenses (exceeding 10% of AGI) State/local income and property taxes Mortgage, home equity loan interest Contributions Casualty and theft losses Moving, job-related, and miscellaneaous expenses (exceeding 2\% of AGI) Total itemized deductions Larger of standard or itemized deductions Equals taxable income \begin{tabular}{|c|c|} \hline 7 & \\ \hline & \\ \hline & \\ \hline 7 & \\ \hline & \\ \hline & \\ \hline$ & 0 \\ \hline$ & 0 \\ \hline$ & 0 \\ \hline \end{tabular} Estimated tax (based on 2018 tax rates) Less tax credits Plus other taxes Equals total tax liability Less estimated withholding and payments Equals tax due (or refund) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started