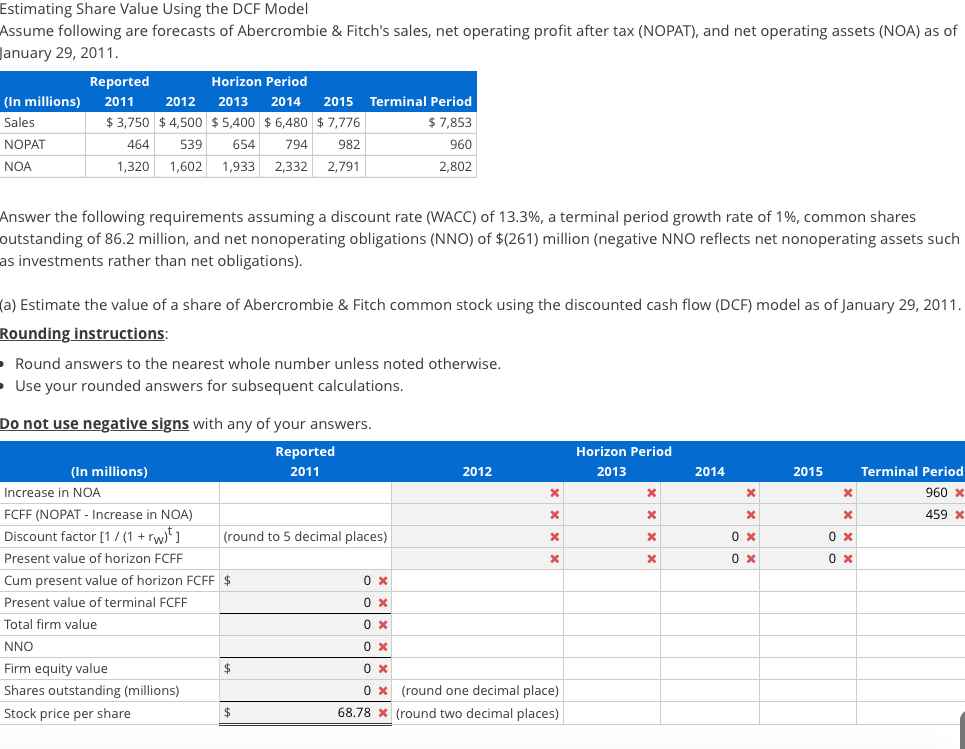

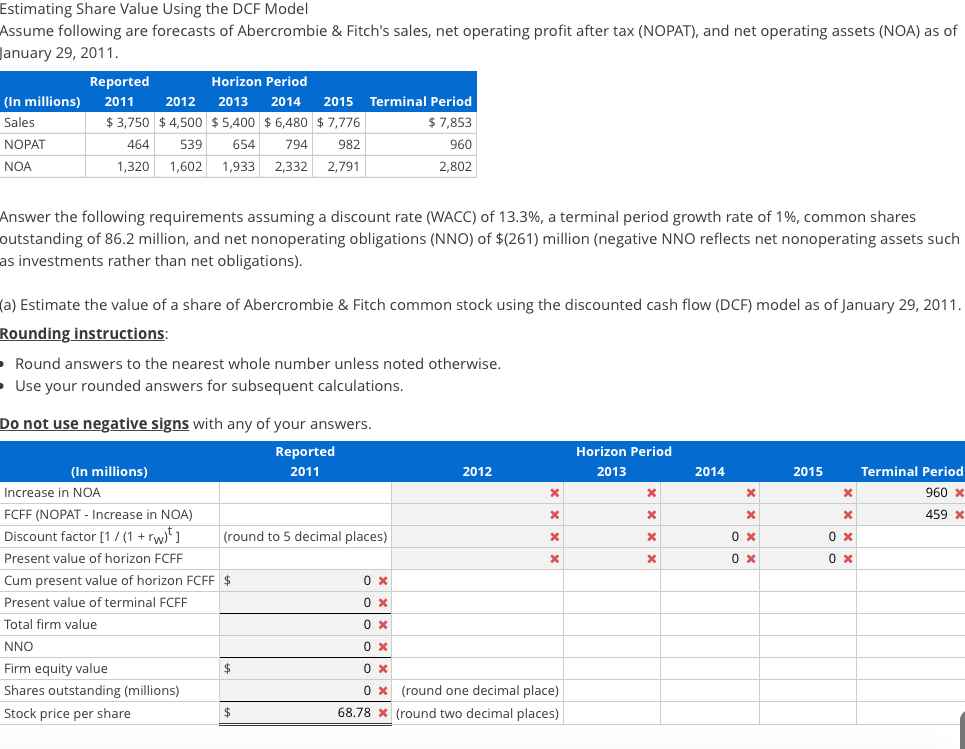

Estimating Share Value Using the DCF Model Assume following are forecasts of Abercrombie & Fitch's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of January 29, 2011. (In millions) Sales NOPAT Reported Horizon Period 2011 2012 2013 2014 2015 $3,750 $4,500 $5,400 $ 6,480 $ 7,776 464 539 654 794 982 1,320 1,602 1,933 2,332 2,791 Terminal Period $7,853 960 2,802 NOA Answer the following requirements assuming a discount rate (WACC) of 13.3%, a terminal period growth rate of 1%, common shares outstanding of 86.2 million, and net nonoperating obligations (NNO) of $(261) million (negative NNO reflects net nonoperating assets such as investments rather than net obligations). (a) Estimate the value of a share of Abercrombie & Fitch common stock using the discounted cash flow (DCF) model as of January 29, 2011. Rounding instructions: Round answers to the nearest whole number unless noted otherwise. - Use your rounded answers for subsequent calculations. Horizon Period 2013 2014 2015 Terminal Period 960 x 459 x 0 x 0 X 0 X Do not use negative signs with any of your answers. Reported (In millions) 2011 2012 Increase in NOA FCFF (NOPAT - Increase in NOA) Discount factor [1/(1 +rw ] (round to 5 decimal places) Present value of horizon FCFF Cum present value of horizon FCFF $ OX Present value of terminal FCFF OX Total firm value OX NNO OX Firm equity value Ox Shares outstanding (millions) 0x (round one decimal place) Stock price per share $ 68.78 x (round two decimal places) Estimating Share Value Using the DCF Model Assume following are forecasts of Abercrombie & Fitch's sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of January 29, 2011. (In millions) Sales NOPAT Reported Horizon Period 2011 2012 2013 2014 2015 $3,750 $4,500 $5,400 $ 6,480 $ 7,776 464 539 654 794 982 1,320 1,602 1,933 2,332 2,791 Terminal Period $7,853 960 2,802 NOA Answer the following requirements assuming a discount rate (WACC) of 13.3%, a terminal period growth rate of 1%, common shares outstanding of 86.2 million, and net nonoperating obligations (NNO) of $(261) million (negative NNO reflects net nonoperating assets such as investments rather than net obligations). (a) Estimate the value of a share of Abercrombie & Fitch common stock using the discounted cash flow (DCF) model as of January 29, 2011. Rounding instructions: Round answers to the nearest whole number unless noted otherwise. - Use your rounded answers for subsequent calculations. Horizon Period 2013 2014 2015 Terminal Period 960 x 459 x 0 x 0 X 0 X Do not use negative signs with any of your answers. Reported (In millions) 2011 2012 Increase in NOA FCFF (NOPAT - Increase in NOA) Discount factor [1/(1 +rw ] (round to 5 decimal places) Present value of horizon FCFF Cum present value of horizon FCFF $ OX Present value of terminal FCFF OX Total firm value OX NNO OX Firm equity value Ox Shares outstanding (millions) 0x (round one decimal place) Stock price per share $ 68.78 x (round two decimal places)