Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Estimating Share Value Using the DCF Model Following are forecasted sales, NOPAT, and NOA for AT&T for 2019 through 2022 Note: Complete the entire

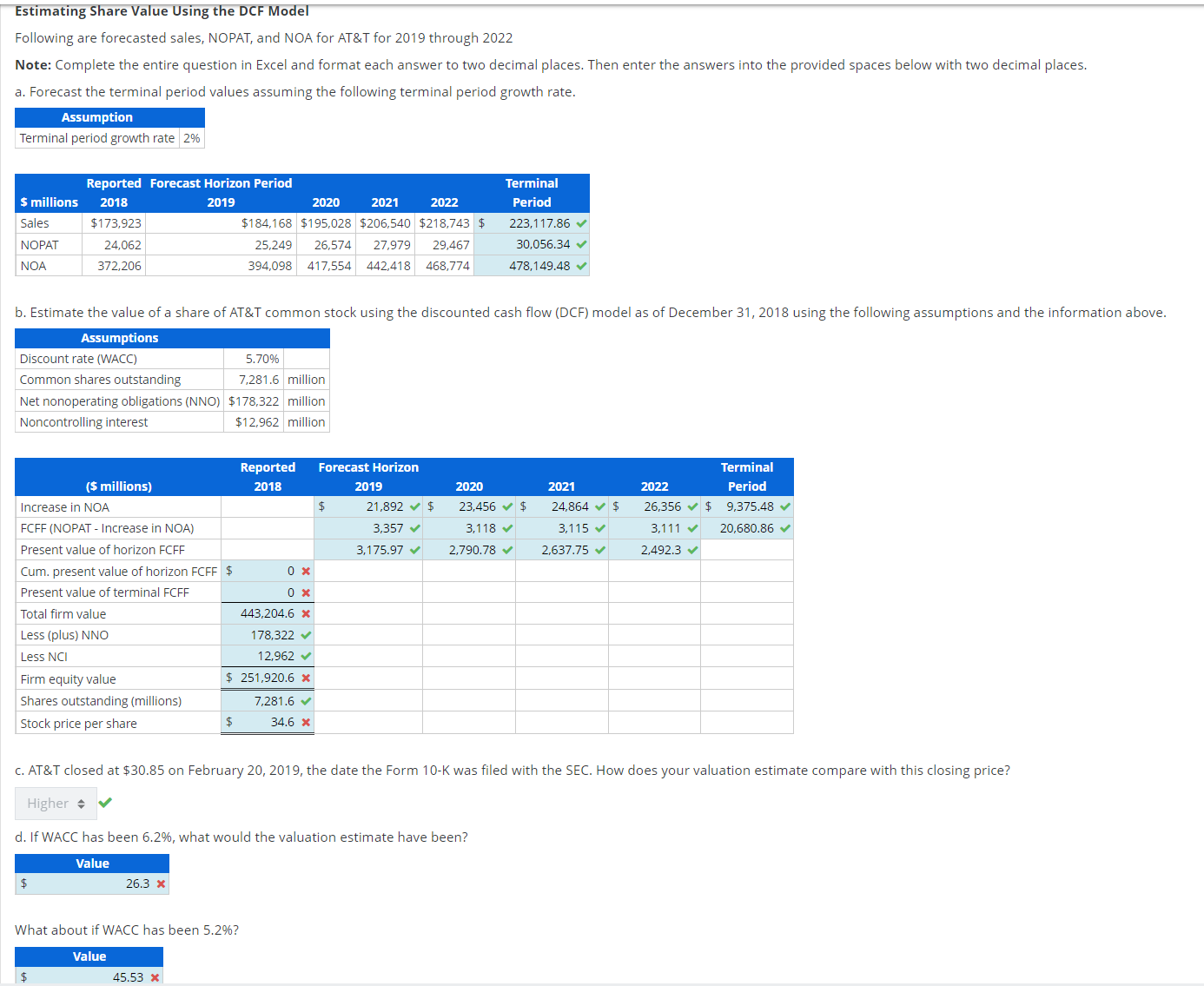

Estimating Share Value Using the DCF Model Following are forecasted sales, NOPAT, and NOA for AT&T for 2019 through 2022 Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. a. Forecast the terminal period values assuming the following terminal period growth rate. Assumption Terminal period growth rate 2% Reported Forecast Horizon Period $ millions 2018 Sales NOPAT NOA 2019 $173,923 24,062 372,206 2020 2021 $184,168 $195,028 $206,540 $218,743 $ 25,249 26,574 27,979 29,467 394,098 417,554 442,418 468,774 2022 Terminal Period 223,117.86 30,056.34 478,149.48 b. Estimate the value of a share of AT&T common stock using the discounted cash flow (DCF) model as of December 31, 2018 using the following assumptions and the information above. Assumptions Discount rate (WACC) 5.70% 7,281.6 million Common shares outstanding Net nonoperating obligations (NNO) $178,322 million Noncontrolling interest $12,962 million Reported Forecast Horizon Increase in NOA ($ millions) FCFF (NOPAT - Increase in NOA) 2018 $ 2019 21,892 $ 3,357 Present value of horizon FCFF 2020 23,456 $ 3,118 3,175.97 2,790.78 2021 24,864 $ 3,115 2,637.75 2022 26,356 $ 3,111 2,492.3 Terminal Period 9,375.48 20,680.86 Cum. present value of horizon FCFF $ 0 x Present value of terminal FCFF 0 x Total firm value Less (plus) NNO Less NCI 443,204.6 x 178,322 12,962 Firm equity value $ 251,920.6 x Shares outstanding (millions) Stock price per share $ 7,281.6 34.6 x c. AT&T closed at $30.85 on February 20, 2019, the date the Form 10-K was filed with the SEC. How does your valuation estimate compare with this closing price? Higher d. If WACC has been 6.2%, what would the valuation estimate have been? Value $ 26.3 x What about if WACC has been 5.2%? Value $ 45.53 x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started