Answered step by step

Verified Expert Solution

Question

1 Approved Answer

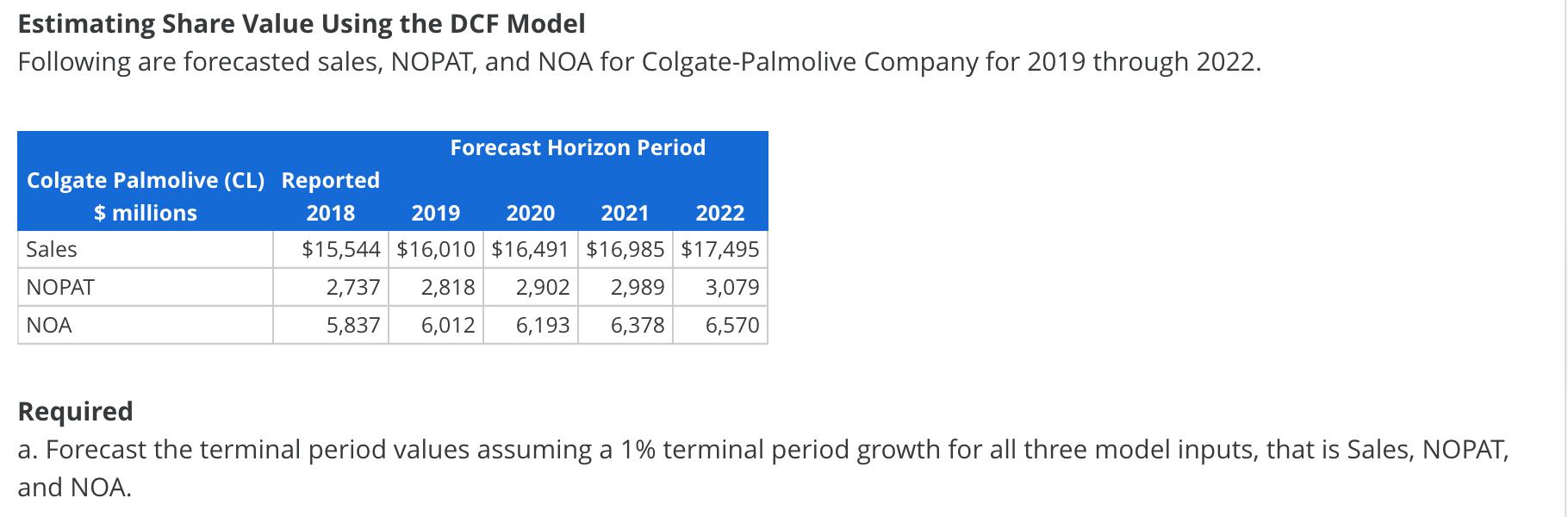

Estimating Share Value Using the DCF Model Following are forecasted sales, NOPAT, and NOA for Colgate-Palmolive Company for 2019 through 2022. Colgate Palmolive (CL)

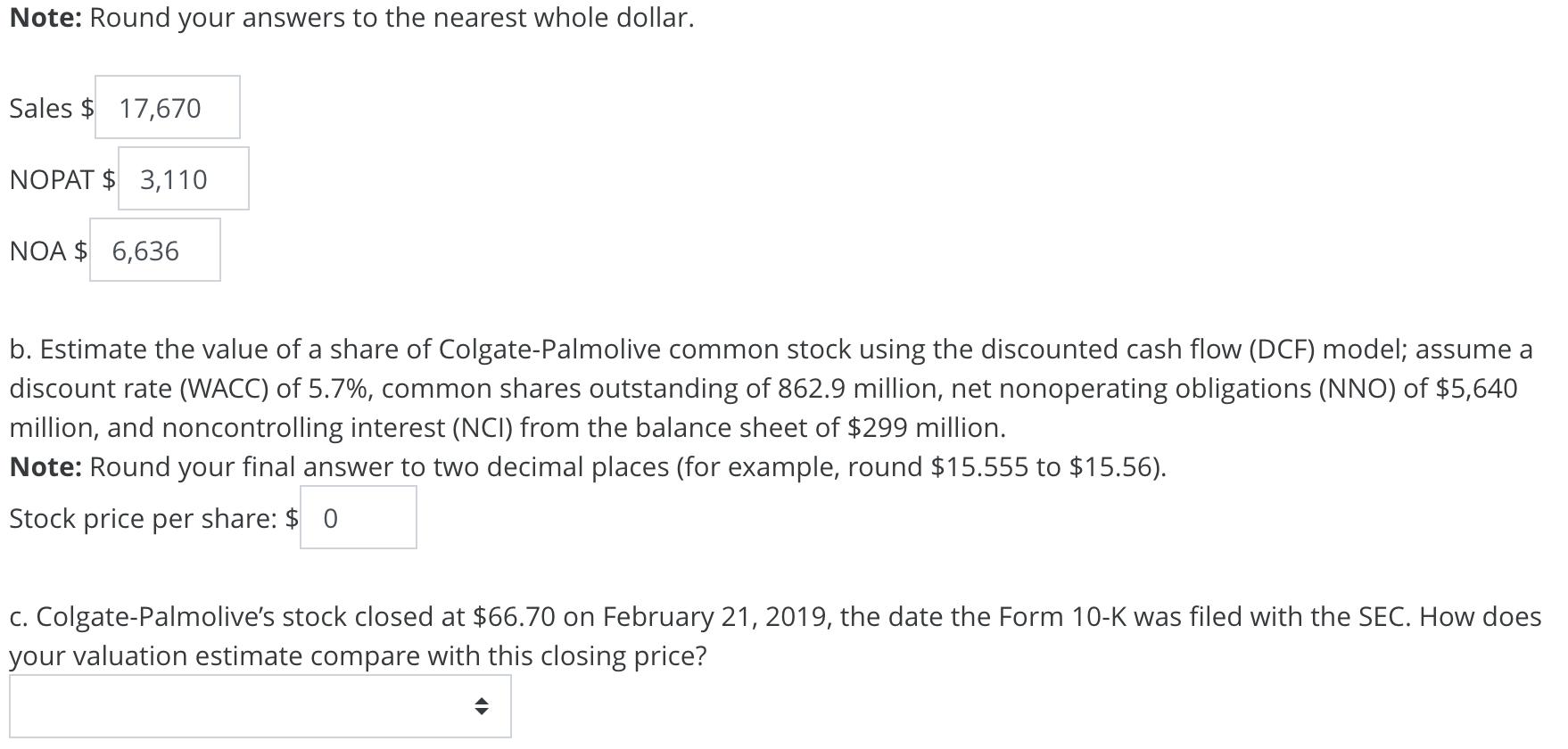

Estimating Share Value Using the DCF Model Following are forecasted sales, NOPAT, and NOA for Colgate-Palmolive Company for 2019 through 2022. Colgate Palmolive (CL) Reported $ millions Sales NOPAT NOA Forecast Horizon Period 2018 2019 2020 2021 2022 $15,544 $16,010 $16,491 $16,985 $17,495 2,737 2,818 2,902 2,989 3,079 5,837 6,012 6,193 6,378 6,570 Required a. Forecast the terminal period values assuming a 1% terminal period growth for all three model inputs, that is Sales, NOPAT, and NOA. Note: Round your answers to the nearest whole dollar. Sales $ 17,670 NOPAT $ 3,110 NOA $ 6,636 b. Estimate the value of a share of Colgate-Palmolive common stock using the discounted cash flow (DCF) model; assume a discount rate (WACC) of 5.7%, common shares outstanding of 862.9 million, net nonoperating obligations (NNO) of $5,640 million, and noncontrolling interest (NCI) from the balance sheet of $299 million. Note: Round your final answer to two decimal places (for example, round $15.555 to $15.56). Stock price per share: $ 0 c. Colgate-Palmolive's stock closed at $66.70 on February 21, 2019, the date the Form 10-K was filed with the SEC. How does your valuation estimate compare with this closing price? d. The forecasts you completed assumed a terminal growth rate of 1%. What if the terminal rate had been 2%. What would your estimated stock price have been? Note: Round your final answer to two decimal places (for example, round $15.555 to $15.56). Stock price per share: $ 0 e. What would WACC have to be to warrant the actual stock price on February 21, 2019? Note: Round percentage to two decimal places (for example, round 15.555% to 15.56%). WACC 0 %

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started