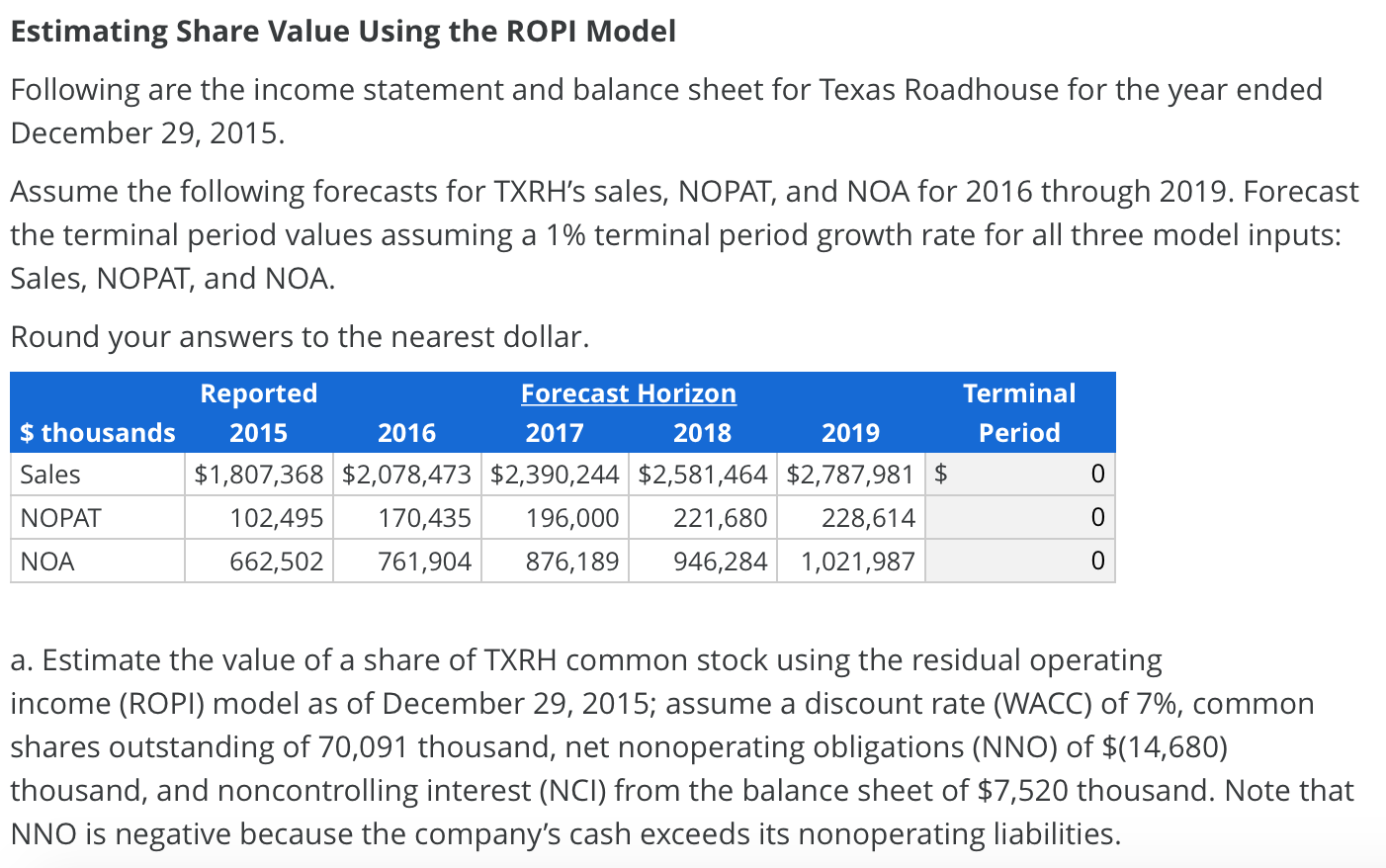

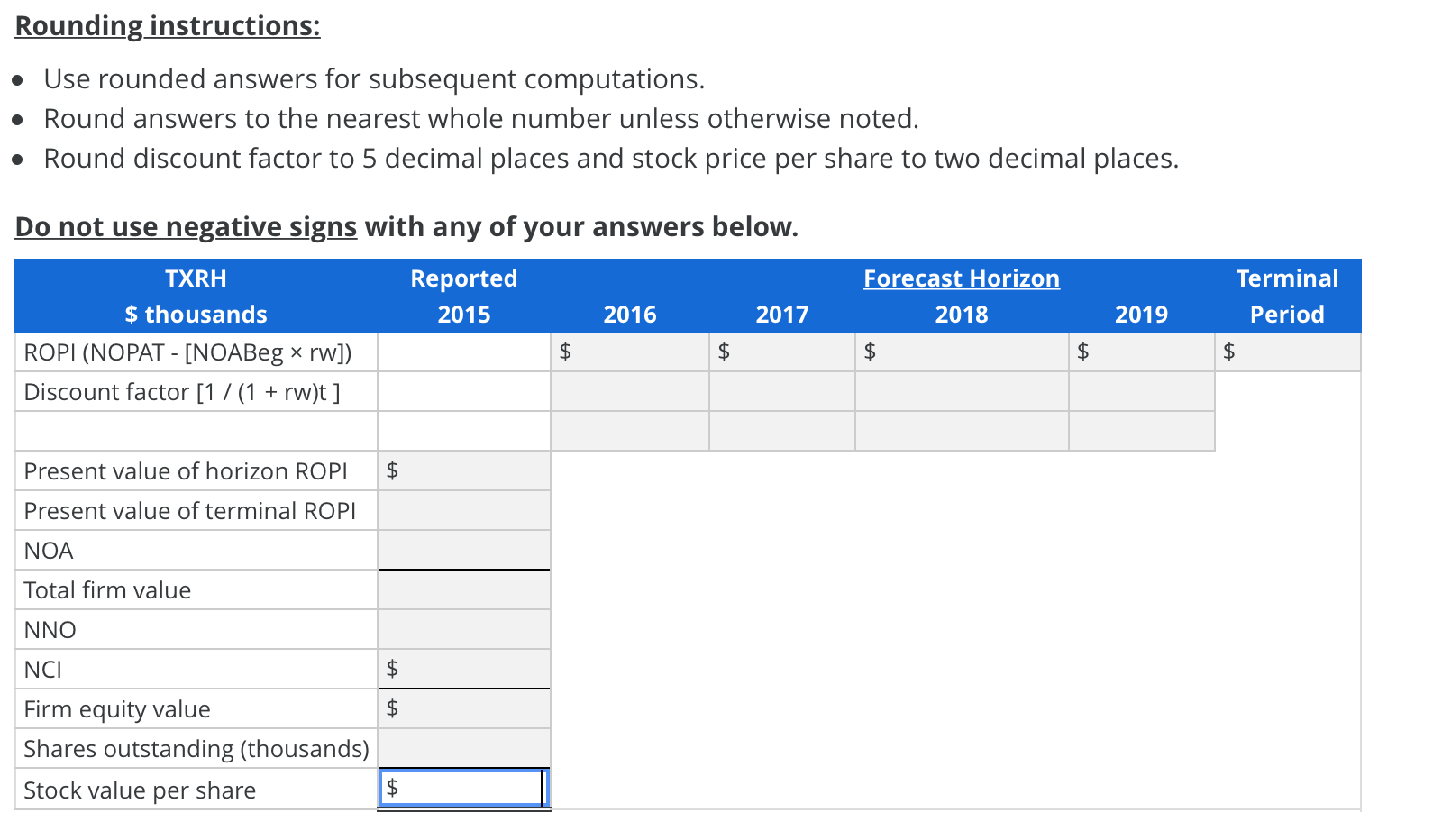

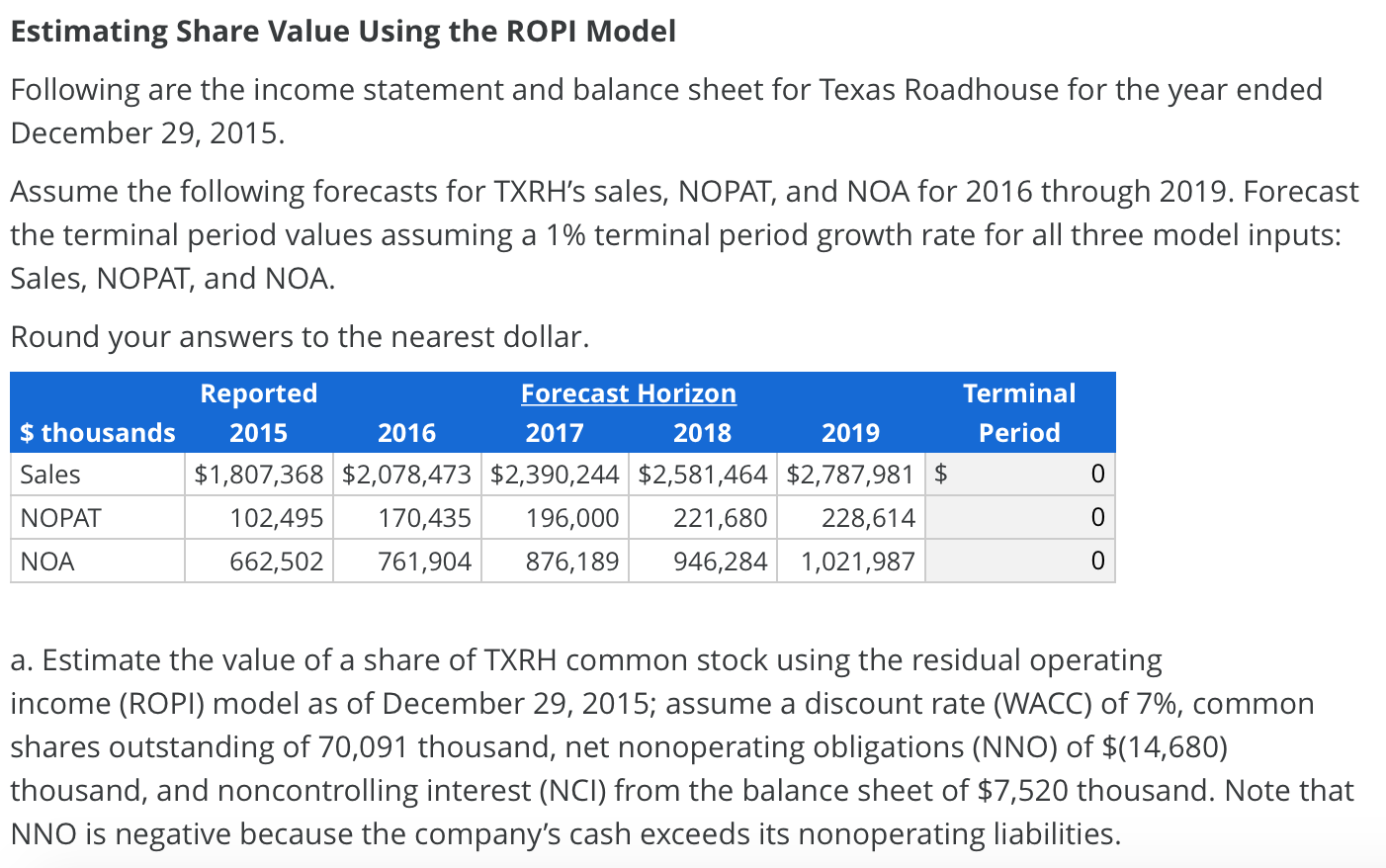

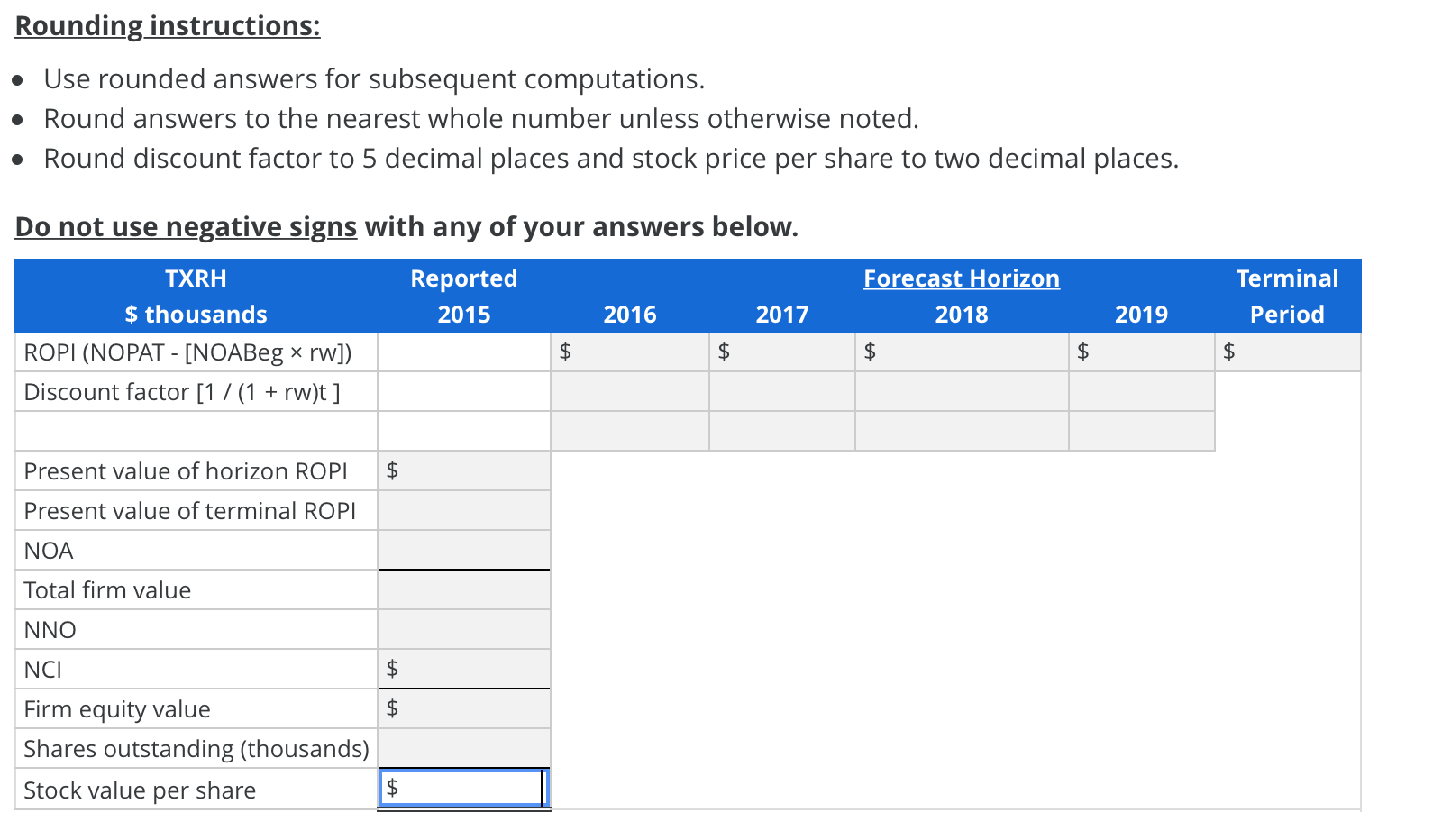

Estimating Share Value Using the ROPI Model Following are the income statement and balance sheet for Texas Roadhouse for the year ended December 29, 2015. Assume the following forecasts for TXRH's sales, NOPAT, and NOA for 2016 through 2019. Forecast the terminal period values assuming a 1% terminal period growth rate for all three model inputs: Sales, NOPAT, and NOA. Round your answers to the nearest dollar. Terminal Period $ thousands Sales Reported Forecast Horizon 2015 2016 2017 2018 2019 $1,807,368 $2,078,473 $2,390,244 $2,581,464 $2,787,981 $ 102,495 170,435 196,000 221,680 228,614 662,502 761,904 876,189 946,284 1,021,987 0 NOPAT 0 NOA 0 a. Estimate the value of a share of TXRH common stock using the residual operating income (ROPI) model as of December 29, 2015; assume a discount rate (WACC) of 7%, common shares outstanding of 70,091 thousand, net nonoperating obligations (NNO) of $(14,680) thousand, and noncontrolling interest (NCI) from the balance sheet of $7,520 thousand. Note that NNO is negative because the company's cash exceeds its nonoperating liabilities. Rounding instructions: Use rounded answers for subsequent computations. Round answers to the nearest whole number unless otherwise noted. Round discount factor to 5 decimal places and stock price per share to two decimal places. Do not use negative signs with any of your answers below. Reported 2015 Forecast Horizon 2018 Terminal Period 2016 2017 2019 TXRH $ thousands ROPI (NOPAT - [NOABeg * rw]) Discount factor [1 / (1 + rw)t ] $ $ $ $ $ Present value of horizon ROPI $ Present value of terminal ROPI NOA Total firm value NNO NCI $ $ Firm equity value Shares outstanding (thousands) Stock value per share $ Estimating Share Value Using the ROPI Model Following are the income statement and balance sheet for Texas Roadhouse for the year ended December 29, 2015. Assume the following forecasts for TXRH's sales, NOPAT, and NOA for 2016 through 2019. Forecast the terminal period values assuming a 1% terminal period growth rate for all three model inputs: Sales, NOPAT, and NOA. Round your answers to the nearest dollar. Terminal Period $ thousands Sales Reported Forecast Horizon 2015 2016 2017 2018 2019 $1,807,368 $2,078,473 $2,390,244 $2,581,464 $2,787,981 $ 102,495 170,435 196,000 221,680 228,614 662,502 761,904 876,189 946,284 1,021,987 0 NOPAT 0 NOA 0 a. Estimate the value of a share of TXRH common stock using the residual operating income (ROPI) model as of December 29, 2015; assume a discount rate (WACC) of 7%, common shares outstanding of 70,091 thousand, net nonoperating obligations (NNO) of $(14,680) thousand, and noncontrolling interest (NCI) from the balance sheet of $7,520 thousand. Note that NNO is negative because the company's cash exceeds its nonoperating liabilities. Rounding instructions: Use rounded answers for subsequent computations. Round answers to the nearest whole number unless otherwise noted. Round discount factor to 5 decimal places and stock price per share to two decimal places. Do not use negative signs with any of your answers below. Reported 2015 Forecast Horizon 2018 Terminal Period 2016 2017 2019 TXRH $ thousands ROPI (NOPAT - [NOABeg * rw]) Discount factor [1 / (1 + rw)t ] $ $ $ $ $ Present value of horizon ROPI $ Present value of terminal ROPI NOA Total firm value NNO NCI $ $ Firm equity value Shares outstanding (thousands) Stock value per share $