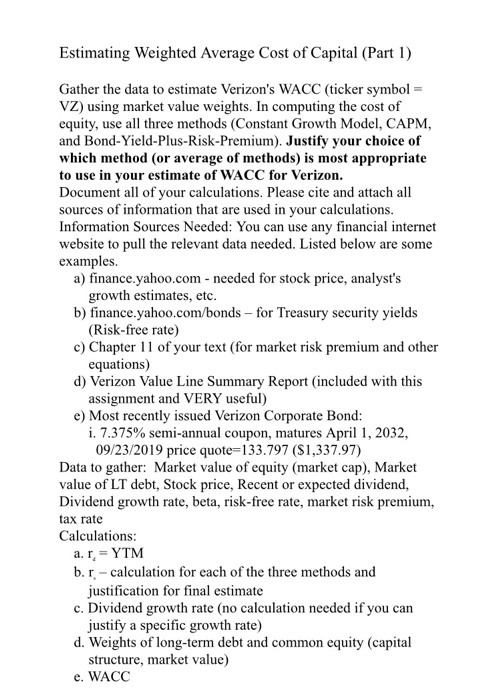

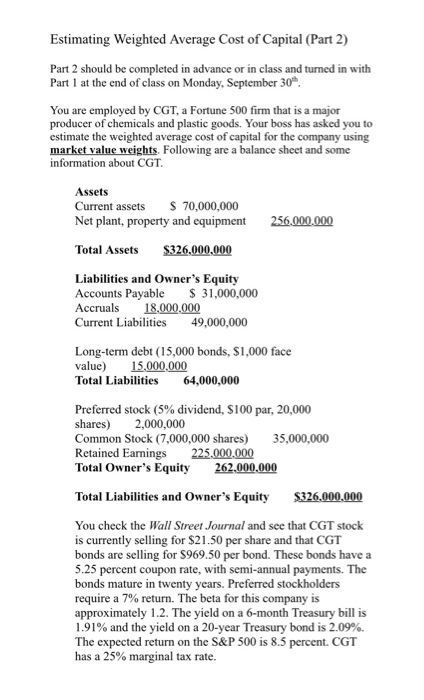

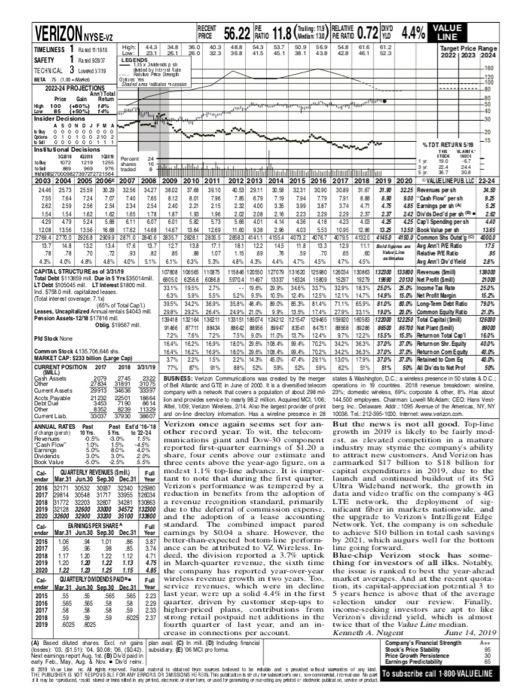

Estimating Weighted Average Cost of Capital (Part 1) Gather the data to estimate Verizon's WACC (ticker symbol = VZ) using market value weights. In computing the cost of equity, use all three methods (Constant Growth Model, CAPM, and Bond-Yield-Plus-Risk-Premium). Justify your choice of which method (or average of methods) is most appropriate to use in your estimate of WACC for Verizon. Document all of your calculations. Please cite and attach all sources of information that are used in your calculations. Information Sources Needed: You can use any financial internet website to pull the relevant data needed. Listed below are some examples. a) finance.yahoo.com - needed for stock price, analyst's growth estimates, etc. b) finance.yahoo.com/bonds - for Treasury security yields (Risk-free rate) c) Chapter 11 of your text (for market risk premium and other equations) d) Verizon Value Line Summary Report (included with this assignment and VERY useful) e) Most recently issued Verizon Corporate Bond: i. 7.375% semi-annual coupon, matures April 1, 2032, 09/23/2019 price quote=133.797 (S1,337.97) Data to gather: Market value of equity (market cap), Market value of LT debt, Stock price, Recent or expected dividend, Dividend growth rate, beta, risk-free rate, market risk premium, tax rate Calculations: a. r,YTM b. r. - calculation for each of the three methods and justification for final estimate c. Dividend growth rate (no calculation needed if you can justify a specific growth rate) d. Weights of long-term debt and common equity (capital structure, market value) e. WACC Estimating Weighted Average Cost of Capital (Part 2) Part 2 should be completed in advance or in class and turned in with Part 1 at the end of class on Monday, September 30" You are employed by CGT, a Fortune 500 firm that is a major producer of chemicals and plastic goods. Your boss has asked you to estimate the weighted average cost of capital for the company using market value weights. Following are a balance sheet and some information about CGT. Assets Current assets $ 70,000,000 Net plant, property and equipment 256.000.000 Total Assets $326,000,000 Liabilities and Owner's Equity Accounts Payable $ 31,000,000 Accruals 18,000,000 Current Liabilities 49,000,000 Long-term debt (15,000 bonds, $1,000 face value) 15,000,000 Total Liabilities 64,000,000 Preferred stock (5% dividend, $100 par, 20,000 shares) 2,000,000 Common Stock (7,000,000 shares) 35,000,000 Retained Earnings 225,000,000 Total Owner's Equity 262,000,000 Total Liabilities and Owner's Equity S326,000,000 You check the Wall Street Journal and see that CGT stock is currently selling for $21.50 per share and that CGT bonds are selling for $969.50 per bond. These bonds have a 5.25 percent coupon rate, with semi-annual payments. The bonds mature in twenty years. Preferred stockholders require a 7% return. The beta for this company is approximately 1.2. The yield on a 6-month Treasury bill is 1.91% and the yield on a 20-year Treasury bond is 2.09%. The expected return on the S&P 500 is 8.5 percent. CGT has a 25% marginal tax rate. VERIZON NYSE:42 PRE 56.22. 11.8(M ) 0.7244% VALUE TEUNESS 1 WETY 1 TENA 3 2005 3 32:50 179 10 90 94 24 20 250 251 24 258 0241 Eet 031350 12 2 6 225 226 2 GEBEE 25 3 13 Bow MONTGOTTO COM MER 404 440 SE 635 444 445 AD CAPITAL STRUCTURE 19 TO S OTTO TOUR Toll Duins 100 ESBOER 4 MET310015052921200 NP LTD LT100 5220 Ind. 5720p 21254214PM 3153429388636 8 4780 Long Det La 2222 2 977422Tony Poster 13481632211 2010 21212 12150 1920 1921 U TC Og 3 e 14 DNP PNS 72 73 72 1 272 Ton Cul 1 162916% 1 2 10 70253424334 35 36 Common S 413700646 A s com ON MARKETCAP 1233 Large Capi 1992215 225 NENG 2015130417 370 F Ped to come CURRENT POSITION 2017 2018 31/08 e 9 SANDY BUSNESS: Verizon Communication was red by the mergers & Veston DC a s price in DC of Art and GT June 2000 sadded come s in 2018 company with anothatcovers a population of bout 20 home o pathe ion and provide service for 2 million Aquired MCL 106 144.500 op e n CEV A V on Www 2014 the west price of bergine de 10 of the NY, NY wdonin drectory information M arine price 100. Tel: 2125-1000 erne www .cn Verizon once again seems set for an But the news is not all good.Top-line other record year. To win the telecom growth in 2019 is likely to be fairly mod manications giant and Dow-30 componentes elevated competition in a mature reported first quarter earnings of S120 industry styme the many bility share for cent above our estimate and to attract new cu r s. And Verizona three cents above the year ago figuron marked 517 M et SIN Blon for C U ATRU REVENUES 1.15 top-line advance. It is in capital expenditures in 2019, due to the www. 1 0 0 Dec 31 tant to note that during the first quarter launch and continued huidout of its SG Vers performance was tempered by a Ultra Wideband work, the growth in redaction in benefits from the adoption of data and wideo traffic on the company's T 301 303 even region standard primarily he nificant her in markets a n d 700 30 and the adoption of a la coming the upgrade V e t Edge standard. The combined impact pared Network Yet, the company is on schedule 30 Dec camins by S004 share. However the achieve SiO h on in tal cash savings the-than expected hottom-lime perform by 2021. which a s well for the ho 10 ance can be anbuted Z Wireless in line forward deed, the division reported a pi h e-chip Ver s teckhus 4 in Manchquarter the time thing for investors of all ks. No 1545 the company has reported year-e-year the is ranked to host the year ahead C UTER DOO Pawless reverthin two yen Tomake . And at the recent qua ve m e which were in decline to its capital appreciate pe to 30 last year, wer up a solid 4.45 in the first years hence is above that of the average 2 quarter driven by customer step-ups o election under review. Finally 2 hacer produsenbutro seckan som are to Me 2:37 grail postpaidata in the Ver d e widwich orth quarter of last year and an int e that the Line median crease in connects per account Kenneth Nur June 1 A bil i ndungan SUSTE 14 SEB E MOL LEEE To subscribe call 1-800 VALUELINE Estimating Weighted Average Cost of Capital (Part 1) Gather the data to estimate Verizon's WACC (ticker symbol = VZ) using market value weights. In computing the cost of equity, use all three methods (Constant Growth Model, CAPM, and Bond-Yield-Plus-Risk-Premium). Justify your choice of which method (or average of methods) is most appropriate to use in your estimate of WACC for Verizon. Document all of your calculations. Please cite and attach all sources of information that are used in your calculations. Information Sources Needed: You can use any financial internet website to pull the relevant data needed. Listed below are some examples. a) finance.yahoo.com - needed for stock price, analyst's growth estimates, etc. b) finance.yahoo.com/bonds - for Treasury security yields (Risk-free rate) c) Chapter 11 of your text (for market risk premium and other equations) d) Verizon Value Line Summary Report (included with this assignment and VERY useful) e) Most recently issued Verizon Corporate Bond: i. 7.375% semi-annual coupon, matures April 1, 2032, 09/23/2019 price quote=133.797 (S1,337.97) Data to gather: Market value of equity (market cap), Market value of LT debt, Stock price, Recent or expected dividend, Dividend growth rate, beta, risk-free rate, market risk premium, tax rate Calculations: a. r,YTM b. r. - calculation for each of the three methods and justification for final estimate c. Dividend growth rate (no calculation needed if you can justify a specific growth rate) d. Weights of long-term debt and common equity (capital structure, market value) e. WACC Estimating Weighted Average Cost of Capital (Part 2) Part 2 should be completed in advance or in class and turned in with Part 1 at the end of class on Monday, September 30" You are employed by CGT, a Fortune 500 firm that is a major producer of chemicals and plastic goods. Your boss has asked you to estimate the weighted average cost of capital for the company using market value weights. Following are a balance sheet and some information about CGT. Assets Current assets $ 70,000,000 Net plant, property and equipment 256.000.000 Total Assets $326,000,000 Liabilities and Owner's Equity Accounts Payable $ 31,000,000 Accruals 18,000,000 Current Liabilities 49,000,000 Long-term debt (15,000 bonds, $1,000 face value) 15,000,000 Total Liabilities 64,000,000 Preferred stock (5% dividend, $100 par, 20,000 shares) 2,000,000 Common Stock (7,000,000 shares) 35,000,000 Retained Earnings 225,000,000 Total Owner's Equity 262,000,000 Total Liabilities and Owner's Equity S326,000,000 You check the Wall Street Journal and see that CGT stock is currently selling for $21.50 per share and that CGT bonds are selling for $969.50 per bond. These bonds have a 5.25 percent coupon rate, with semi-annual payments. The bonds mature in twenty years. Preferred stockholders require a 7% return. The beta for this company is approximately 1.2. The yield on a 6-month Treasury bill is 1.91% and the yield on a 20-year Treasury bond is 2.09%. The expected return on the S&P 500 is 8.5 percent. CGT has a 25% marginal tax rate. VERIZON NYSE:42 PRE 56.22. 11.8(M ) 0.7244% VALUE TEUNESS 1 WETY 1 TENA 3 2005 3 32:50 179 10 90 94 24 20 250 251 24 258 0241 Eet 031350 12 2 6 225 226 2 GEBEE 25 3 13 Bow MONTGOTTO COM MER 404 440 SE 635 444 445 AD CAPITAL STRUCTURE 19 TO S OTTO TOUR Toll Duins 100 ESBOER 4 MET310015052921200 NP LTD LT100 5220 Ind. 5720p 21254214PM 3153429388636 8 4780 Long Det La 2222 2 977422Tony Poster 13481632211 2010 21212 12150 1920 1921 U TC Og 3 e 14 DNP PNS 72 73 72 1 272 Ton Cul 1 162916% 1 2 10 70253424334 35 36 Common S 413700646 A s com ON MARKETCAP 1233 Large Capi 1992215 225 NENG 2015130417 370 F Ped to come CURRENT POSITION 2017 2018 31/08 e 9 SANDY BUSNESS: Verizon Communication was red by the mergers & Veston DC a s price in DC of Art and GT June 2000 sadded come s in 2018 company with anothatcovers a population of bout 20 home o pathe ion and provide service for 2 million Aquired MCL 106 144.500 op e n CEV A V on Www 2014 the west price of bergine de 10 of the NY, NY wdonin drectory information M arine price 100. Tel: 2125-1000 erne www .cn Verizon once again seems set for an But the news is not all good.Top-line other record year. To win the telecom growth in 2019 is likely to be fairly mod manications giant and Dow-30 componentes elevated competition in a mature reported first quarter earnings of S120 industry styme the many bility share for cent above our estimate and to attract new cu r s. And Verizona three cents above the year ago figuron marked 517 M et SIN Blon for C U ATRU REVENUES 1.15 top-line advance. It is in capital expenditures in 2019, due to the www. 1 0 0 Dec 31 tant to note that during the first quarter launch and continued huidout of its SG Vers performance was tempered by a Ultra Wideband work, the growth in redaction in benefits from the adoption of data and wideo traffic on the company's T 301 303 even region standard primarily he nificant her in markets a n d 700 30 and the adoption of a la coming the upgrade V e t Edge standard. The combined impact pared Network Yet, the company is on schedule 30 Dec camins by S004 share. However the achieve SiO h on in tal cash savings the-than expected hottom-lime perform by 2021. which a s well for the ho 10 ance can be anbuted Z Wireless in line forward deed, the division reported a pi h e-chip Ver s teckhus 4 in Manchquarter the time thing for investors of all ks. No 1545 the company has reported year-e-year the is ranked to host the year ahead C UTER DOO Pawless reverthin two yen Tomake . And at the recent qua ve m e which were in decline to its capital appreciate pe to 30 last year, wer up a solid 4.45 in the first years hence is above that of the average 2 quarter driven by customer step-ups o election under review. Finally 2 hacer produsenbutro seckan som are to Me 2:37 grail postpaidata in the Ver d e widwich orth quarter of last year and an int e that the Line median crease in connects per account Kenneth Nur June 1 A bil i ndungan SUSTE 14 SEB E MOL LEEE To subscribe call 1-800 VALUELINE