Answered step by step

Verified Expert Solution

Question

1 Approved Answer

estion 3 t yet swered arked out of 10 Flag question estion yet swered rked out of 10 Flag question Ax P 2 W

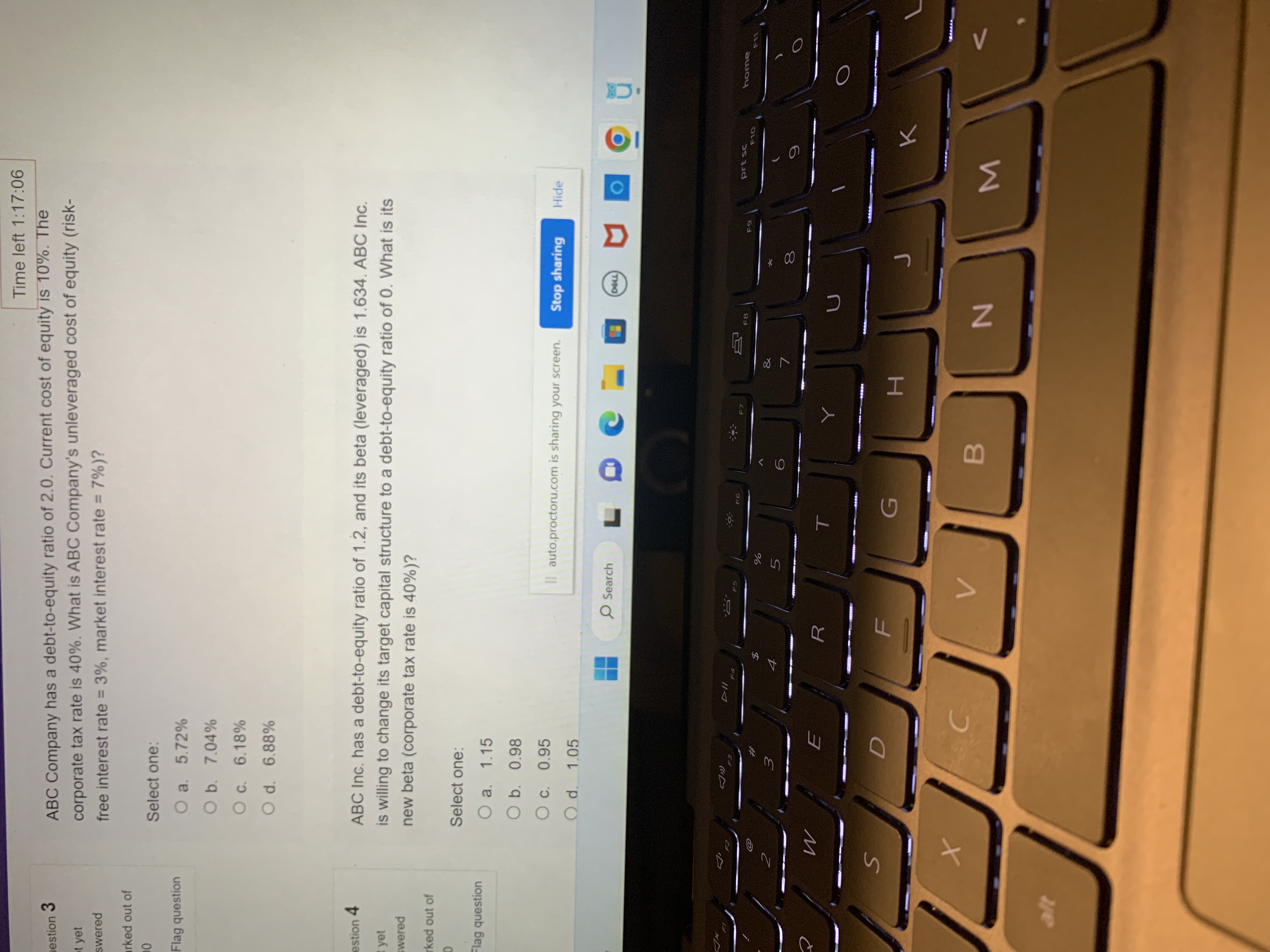

estion 3 t yet swered arked out of 10 Flag question estion yet swered rked out of 10 Flag question Ax P 2 W S x Time left 1:17:06 ABC Company has a debt-to-equity ratio of 2.0. Current cost of equity is 10%. The corporate tax rate is 40%. What is ABC Company's unleveraged cost of equity (risk- free interest rate = 3%, market interest rate = 7%)? Select one: O a. 5.72% O b. 7.04% 6.18% O c. O d. 6.88% ABC Inc. has a debt-to-equity ratio of 1.2, and its beta (leveraged) is 1.634. ABC Inc. is willing to change its target capital structure to a debt-to-equity ratio of 0. What is its new beta (corporate tax rate is 40%)? Select one: O a. 1.15 O b. 0.98 O c. 0.95 O d. 1.05 F3 # 3 E D C F4 $ 4 R O Search LO C F II auto.proctoru.com is sharing your screen. 8 F5 V Un d % 5 20: T F6 G B F7 Y H 7 F8 Stop sharing Hide N DELL 8 J F9 1 prt sc M F10 K home

Step by Step Solution

★★★★★

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Okay lets solve this step by step 1 ABCs debttoequity ratio is 2 The formula is DE ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started