Answered step by step

Verified Expert Solution

Question

1 Approved Answer

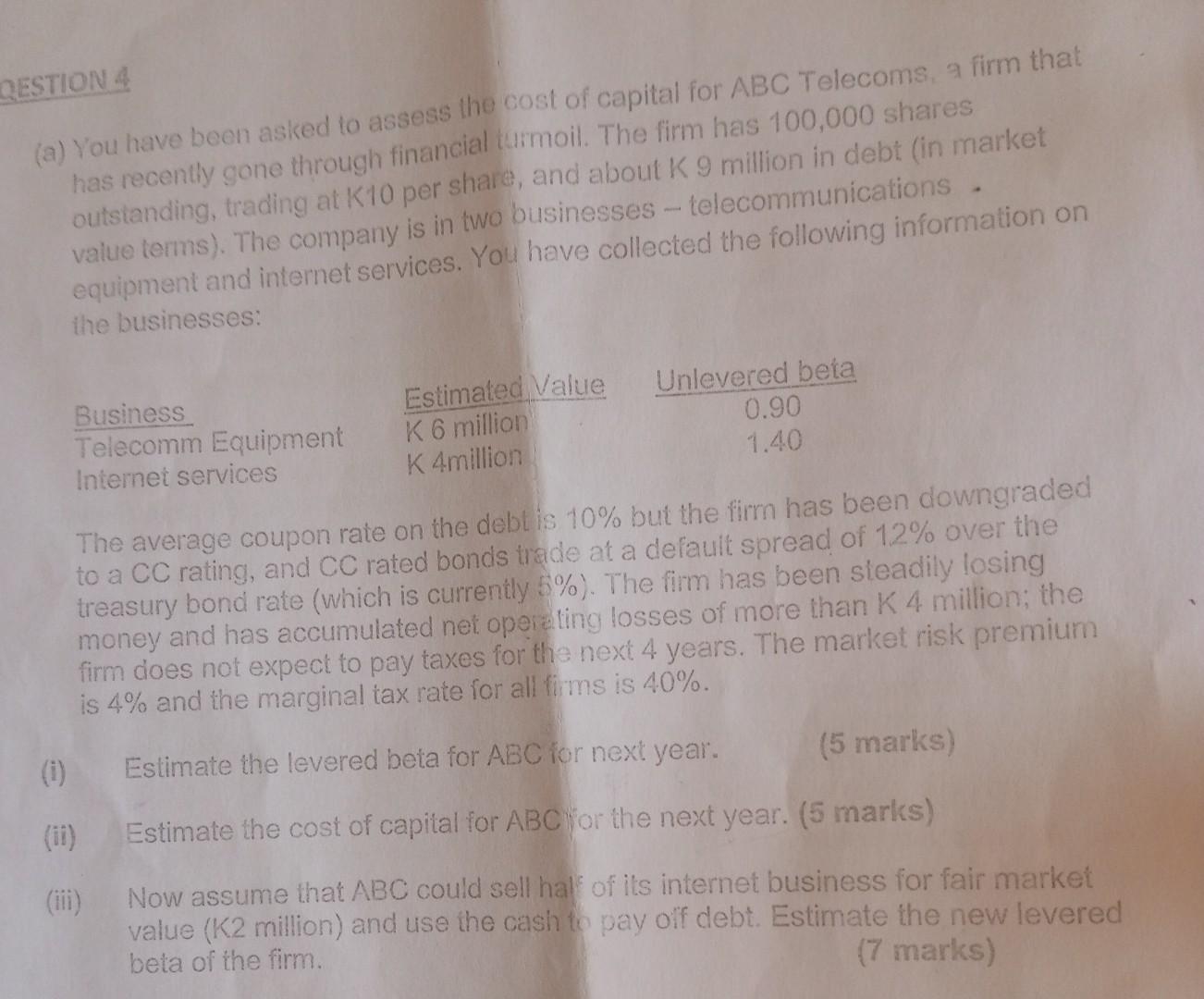

ESTION 4 (a) You have been asked to assess the cost of capital for ABC Telecoms, 7 firm that has recently gone through financial turmoil.

ESTION 4 (a) You have been asked to assess the cost of capital for ABC Telecoms, 7 firm that has recently gone through financial turmoil. The firm has 100,000 shares outstanding, trading at K10 per share, and about K9 million in debt (in market value terms). The company is in two businesses - telecommunications. equipment and internet services. You have collected the following information on the businesses: The average coupon rate on the debt is 10% but the firm nas veer downgraded to a CC rating, and CC rated bonds trade at a default spread of 12% over the treasury bond rate (which is currently 5% ). The firm has been sieadily losing money and has accumulated net opereting losses of more than K4 million; the firm does not expect to pay taxes for the next 4 years. The market risk premium is 4% and the marginal tax rate for all fims is 40%. (i) Estimate the levered beta for ABC ior next year. (5 marks) (ii) Estimate the cost of capital for ABC yor the next year. (5 marks) (iii) Now assume that ABC could sell hal of its internet business for fair market value ( K2 million) and use the cash to pay off debt. Estimate the new levered beta of the firm. (7 marks) ESTION 4 (a) You have been asked to assess the cost of capital for ABC Telecoms, 7 firm that has recently gone through financial turmoil. The firm has 100,000 shares outstanding, trading at K10 per share, and about K9 million in debt (in market value terms). The company is in two businesses - telecommunications. equipment and internet services. You have collected the following information on the businesses: The average coupon rate on the debt is 10% but the firm nas veer downgraded to a CC rating, and CC rated bonds trade at a default spread of 12% over the treasury bond rate (which is currently 5% ). The firm has been sieadily losing money and has accumulated net opereting losses of more than K4 million; the firm does not expect to pay taxes for the next 4 years. The market risk premium is 4% and the marginal tax rate for all fims is 40%. (i) Estimate the levered beta for ABC ior next year. (5 marks) (ii) Estimate the cost of capital for ABC yor the next year. (5 marks) (iii) Now assume that ABC could sell hal of its internet business for fair market value ( K2 million) and use the cash to pay off debt. Estimate the new levered beta of the firm. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started