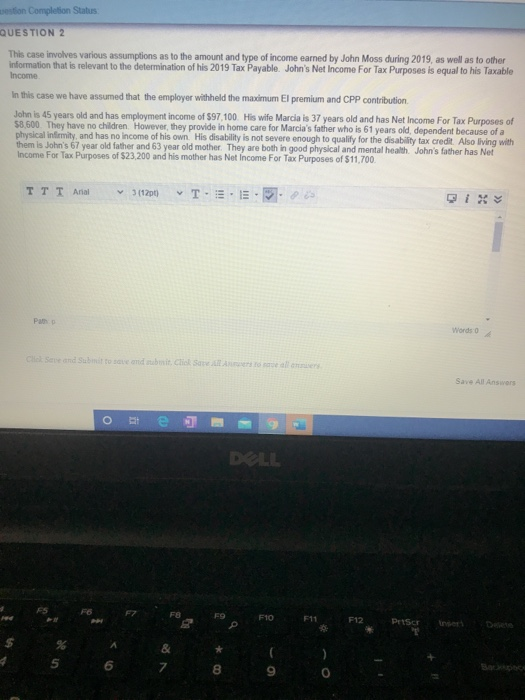

estion Completion Status: QUESTION 2 This case involves various assumptions as to the amount and type of income earned by John Moss during 2019, as well as to other information that is relevant to the determination of his 2019 Tax Payable. John's Net Income For Tax Purposes is equal to his Taxable Income In this case we have assumed that the employer withheld the maximum El premium and CPP contribution John is 45 years old and has employment income of $97,100. His wife Marcia is 37 years old and has Net Income For Tax Purposes of $8.500 They have no children. However, they provide in home care for Marcia's father who is 61 years old, dependent because of a physical Infinity, and has no income of his own. His disability is not severe enough to qualify for the disability tax credit. Also living with them is John's 67 year old father and 63 year old mother. They are both in good physical and mental health. John's father has Net Income For Tax Purposes of $23,200 and his mother has Net Income For Tax Purposes of $11,700 TTT Anal 3 (120) T.EE PE Words o Save All Answers O e DLL FS FO F7 F10 F11 F12 Priser 8 9 0 estion Completion Status: QUESTION 2 This case involves various assumptions as to the amount and type of income earned by John Moss during 2019, as well as to other information that is relevant to the determination of his 2019 Tax Payable. John's Net Income For Tax Purposes is equal to his Taxable Income In this case we have assumed that the employer withheld the maximum El premium and CPP contribution John is 45 years old and has employment income of $97,100. His wife Marcia is 37 years old and has Net Income For Tax Purposes of $8.500 They have no children. However, they provide in home care for Marcia's father who is 61 years old, dependent because of a physical Infinity, and has no income of his own. His disability is not severe enough to qualify for the disability tax credit. Also living with them is John's 67 year old father and 63 year old mother. They are both in good physical and mental health. John's father has Net Income For Tax Purposes of $23,200 and his mother has Net Income For Tax Purposes of $11,700 TTT Anal 3 (120) T.EE PE Words o Save All Answers O e DLL FS FO F7 F10 F11 F12 Priser 8 9 0