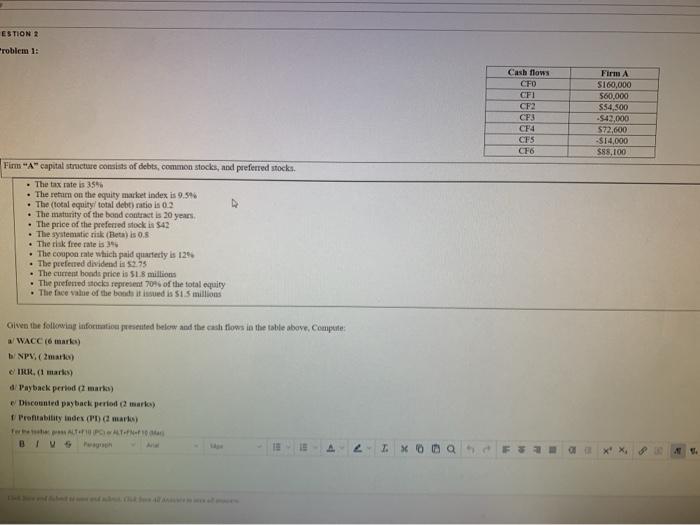

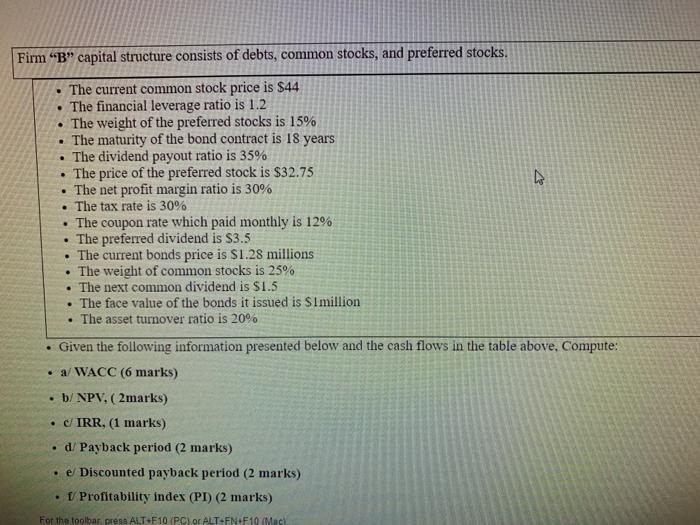

ESTION Problem 1: Cash flows CFO CFI CF2 CP3 CH CFS CF6 Firm S160,000 560,000 $54,500 -$42.000 572,600 $14,000 $83,100 Fimm "A" capital structure consists of debts, common stocks, and preferred stocks. The tax rate is 35% The retam on the equity market index is 9.546 The (total equity total debt) ratio is 0.2 The maturity of the band contract is 20 years The price of the preferred stock is $42 The systematic risk (Beta) is 0.5 The thik free rate is 39 The coupon cate which paid quartetty is 129 The preferred dividend is $275 The current bonds price in 518 millions The preferred stocks represent 70% of the total equity The face value of the boods it sed is 515 millions Olven the following information presented below and the cash flows in the table above. Compte a/ WACC (6 man) NP. (mark) CIRK, (1 mark) di Payback period marks) Discounted payback period (maria) Profitability Index (Pn marks) TATO AT XX 1 Firm "B" capital structure consists of debts, common stocks, and preferred stocks. . . . . . The current common stock price is $44 The financial leverage ratio is 1.2 The weight of the preferred stocks is 15% The maturity of the bond contract is 18 years The dividend payout ratio is 35% The price of the preferred stock is $32.75 The net profit margin ratio is 30% The tax rate is 30% The coupon rate which paid monthly is 12% . The preferred dividend is $3.5 The current bonds price is $1.28 millions The weight of common stocks is 25% The next common dividend is $1.5 The face value of the bonds it issued is Simillion The asset turnover ratio is 20% . Given the following information presented below and the cash flows in the table above, Compute: a/WACC (6 marks) b/NPV. (2 marks) IRR, (1 marks) . d/ Payback period (2 marks) e Discounted payback period (2 marks) f Profitability index (PI) (2 marks) For the toolbar press ALT-F10 (PC) or ALT-FN:F10 (Mack ESTION Problem 1: Cash flows CFO CFI CF2 CP3 CH CFS CF6 Firm S160,000 560,000 $54,500 -$42.000 572,600 $14,000 $83,100 Fimm "A" capital structure consists of debts, common stocks, and preferred stocks. The tax rate is 35% The retam on the equity market index is 9.546 The (total equity total debt) ratio is 0.2 The maturity of the band contract is 20 years The price of the preferred stock is $42 The systematic risk (Beta) is 0.5 The thik free rate is 39 The coupon cate which paid quartetty is 129 The preferred dividend is $275 The current bonds price in 518 millions The preferred stocks represent 70% of the total equity The face value of the boods it sed is 515 millions Olven the following information presented below and the cash flows in the table above. Compte a/ WACC (6 man) NP. (mark) CIRK, (1 mark) di Payback period marks) Discounted payback period (maria) Profitability Index (Pn marks) TATO AT XX 1 Firm "B" capital structure consists of debts, common stocks, and preferred stocks. . . . . . The current common stock price is $44 The financial leverage ratio is 1.2 The weight of the preferred stocks is 15% The maturity of the bond contract is 18 years The dividend payout ratio is 35% The price of the preferred stock is $32.75 The net profit margin ratio is 30% The tax rate is 30% The coupon rate which paid monthly is 12% . The preferred dividend is $3.5 The current bonds price is $1.28 millions The weight of common stocks is 25% The next common dividend is $1.5 The face value of the bonds it issued is Simillion The asset turnover ratio is 20% . Given the following information presented below and the cash flows in the table above, Compute: a/WACC (6 marks) b/NPV. (2 marks) IRR, (1 marks) . d/ Payback period (2 marks) e Discounted payback period (2 marks) f Profitability index (PI) (2 marks) For the toolbar press ALT-F10 (PC) or ALT-FN:F10 (Mack