Answered step by step

Verified Expert Solution

Question

1 Approved Answer

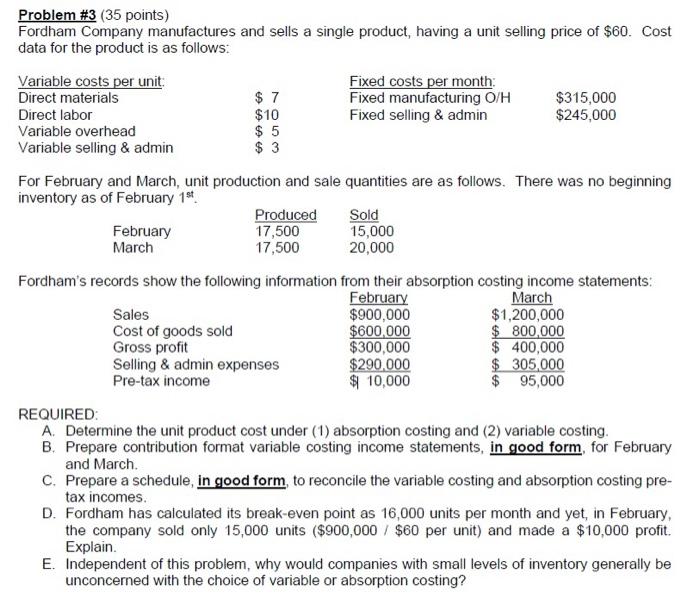

Problem #3 (35 points) Fordham Company manufactures and sells a single product, having a unit selling price of $60. Cost data for the product

Problem #3 (35 points) Fordham Company manufactures and sells a single product, having a unit selling price of $60. Cost data for the product is as follows: Variable costs per unit: Direct materials Direct labor Variable overhead Variable selling & admin February March $7 $10 $5 $3 For February and March, unit production and sale quantities are as follows. There was no beginning inventory as of February 1st Sales Cost of goods sold Produced 17,500 17,500 Fixed costs per month: Fixed manufacturing O/H Fixed selling & admin Gross profit Selling & admin expenses Pre-tax income $315,000 $245,000 Sold 15,000 20,000 Fordham's records show the following information from their absorption costing income statements: February $900,000 $600,000 $300,000 $290,000 $10,000 March $1,200,000 $800,000 $ 400,000 $ 305,000 $ 95,000 REQUIRED: A. Determine the unit product cost under (1) absorption costing and (2) variable costing. B. Prepare contribution format variable costing income statements, in good form, for February and March. C. Prepare a schedule, in good form, to reconcile the variable costing and absorption costing pre- tax incomes. D. Fordham has calculated its break-even point as 16,000 units per month and yet, in February, the company sold only 15,000 units ($900,000 $60 per unit) and made a $10,000 profit. Explain. E. Independent of this problem, why would companies with small levels of inventory generally be unconcerned with the choice of variable or absorption costing?

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

A Absorption Costing Product cost Direct materials Direct labor Variable manufacturing Overhead Fixed manufacturing Overhead 7105 31500017500 7 10 5 18 40 Variable Costing Product cost Direct material...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started