Answered step by step

Verified Expert Solution

Question

1 Approved Answer

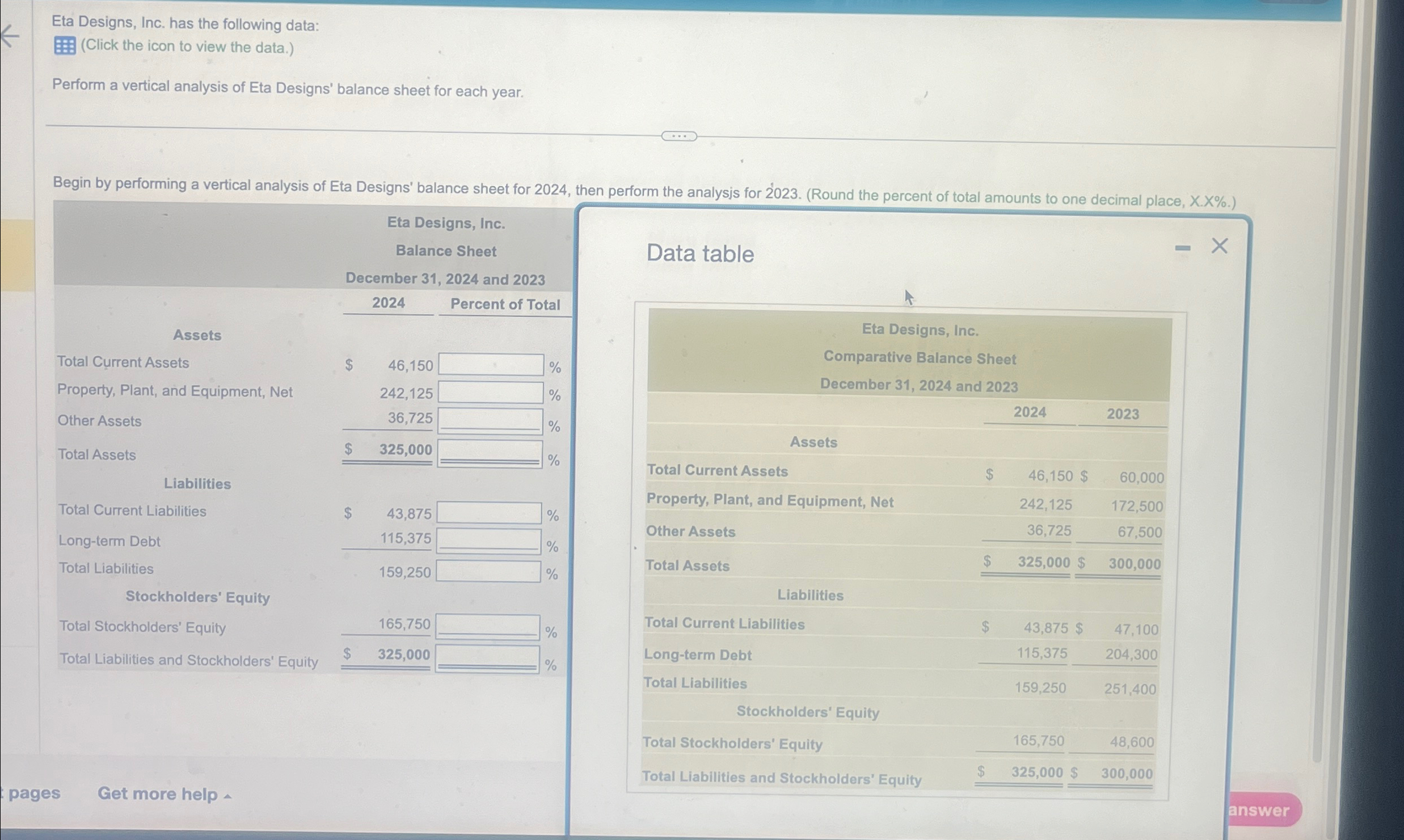

Eta Designs, Inc. has the following data: (Click the icon to view the data.) Perform a vertical analysis of Eta Designs' balance sheet for

Eta Designs, Inc. has the following data: (Click the icon to view the data.) Perform a vertical analysis of Eta Designs' balance sheet for each year. Begin by performing a vertical analysis of Eta Designs' balance sheet for 2024, then perform the analysis for 2023. (Round the percent of total amounts to one decimal place, X.X%.) Eta Designs, Inc. Balance Sheet December 31, 2024 and 2023 Data table 2024 Percent of Total Assets Total Current Assets 46,150 % Property, Plant, and Equipment, Net 242,125 % Eta Designs, Inc. Comparative Balance Sheet December 31, 2024 and 2023 2024 2023 36,725 Other Assets % Assets 325,000 Total Assets % Total Current Assets 46,150 $ Liabilities Property, Plant, and Equipment, Net 242,125 60,000 172,500 Total Current Liabilities $ 43,875 % 36,725 Other Assets 67,500 Long-term Debt 115,375 % 325,000 $ 300,000 Total Assets Total Liabilities Stockholders' Equity 159,250 % Liabilities Total Stockholders' Equity 165,750 Total Current Liabilities % $ 325,000 Long-term Debt Total Liabilities and Stockholders' Equity % Total Liabilities 43,875 $ 47,100 115,375 204,300 159,250 251,400 Stockholders' Equity Total Stockholders' Equity 165,750 48,600 $ 325,000 $ 300,000 Total Liabilities and Stockholders' Equity pages Get more help - answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started