Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ethical Decision-Making Field Manual #2: The Research Report The Case Page, Case: The Research Report Kate: Hi George, do you have a second? I've been

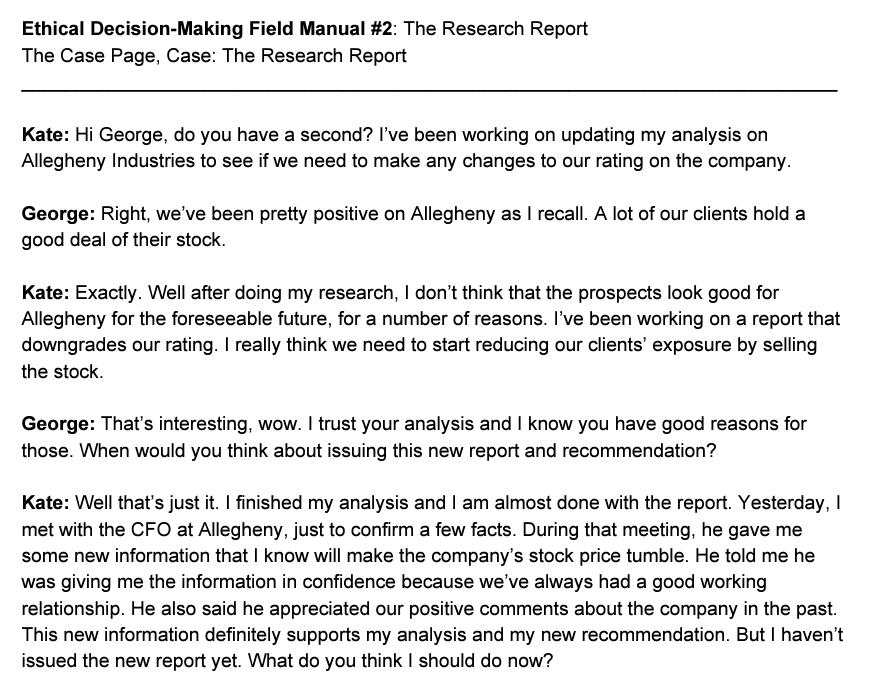

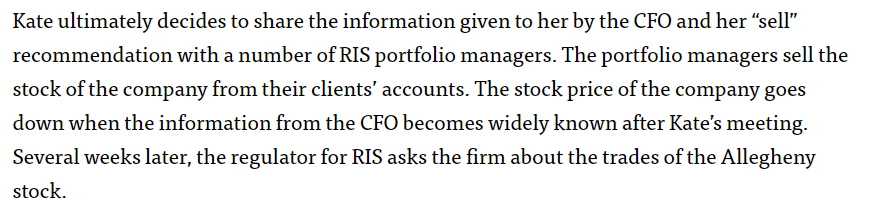

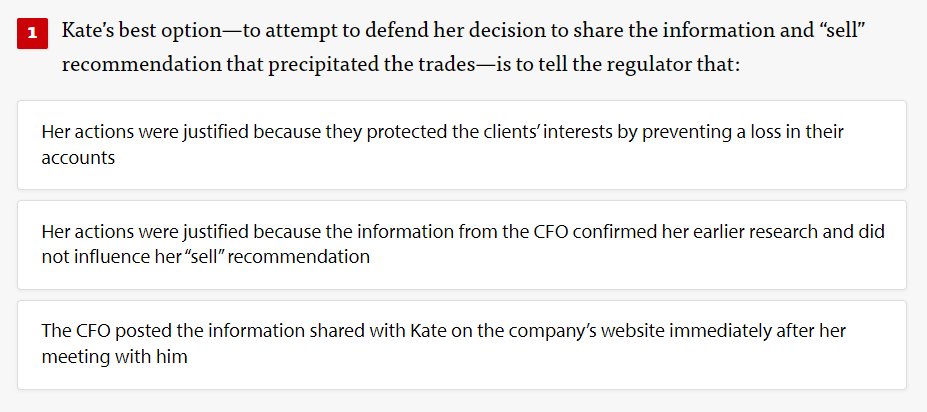

Ethical Decision-Making Field Manual \#2: The Research Report The Case Page, Case: The Research Report Kate: Hi George, do you have a second? I've been working on updating my analysis on Allegheny Industries to see if we need to make any changes to our rating on the company. George: Right, we've been pretty positive on Allegheny as I recall. A lot of our clients hold a good deal of their stock. Kate: Exactly. Well after doing my research, I don't think that the prospects look good for Allegheny for the foreseeable future, for a number of reasons. I've been working on a report that downgrades our rating. I really think we need to start reducing our clients' exposure by selling the stock. George: That's interesting, wow. I trust your analysis and I know you have good reasons for those. When would you think about issuing this new report and recommendation? Kate: Well that's just it. I finished my analysis and I am almost done with the report. Yesterday, I met with the CFO at Allegheny, just to confirm a few facts. During that meeting, he gave me some new information that I know will make the company's stock price tumble. He told me he was giving me the information in confidence because we've always had a good working relationship. He also said he appreciated our positive comments about the company in the past. This new information definitely supports my analysis and my new recommendation. But I haven't issued the new report yet. What do you think I should do now? Kate ultimately decides to share the information given to her by the CFO and her "sell" recommendation with a number of RIS portfolio managers. The portfolio managers sell the stock of the company from their clients' accounts. The stock price of the company goes down when the information from the CFO becomes widely known after Kate's meeting. Several weeks later, the regulator for RIS asks the firm about the trades of the Allegheny stock. Kate's best option-to attempt to defend her decision to share the information and "sell" recommendation that precipitated the trades-is to tell the regulator that: Her actions were justified because they protected the clients' interests by preventing a loss in their accounts Her actions were justified because the information from the CFO confirmed her earlier research and did not influence her "sell" recommendation The CFO posted the information shared with Kate on the company's website immediately after her meeting with him

Ethical Decision-Making Field Manual \#2: The Research Report The Case Page, Case: The Research Report Kate: Hi George, do you have a second? I've been working on updating my analysis on Allegheny Industries to see if we need to make any changes to our rating on the company. George: Right, we've been pretty positive on Allegheny as I recall. A lot of our clients hold a good deal of their stock. Kate: Exactly. Well after doing my research, I don't think that the prospects look good for Allegheny for the foreseeable future, for a number of reasons. I've been working on a report that downgrades our rating. I really think we need to start reducing our clients' exposure by selling the stock. George: That's interesting, wow. I trust your analysis and I know you have good reasons for those. When would you think about issuing this new report and recommendation? Kate: Well that's just it. I finished my analysis and I am almost done with the report. Yesterday, I met with the CFO at Allegheny, just to confirm a few facts. During that meeting, he gave me some new information that I know will make the company's stock price tumble. He told me he was giving me the information in confidence because we've always had a good working relationship. He also said he appreciated our positive comments about the company in the past. This new information definitely supports my analysis and my new recommendation. But I haven't issued the new report yet. What do you think I should do now? Kate ultimately decides to share the information given to her by the CFO and her "sell" recommendation with a number of RIS portfolio managers. The portfolio managers sell the stock of the company from their clients' accounts. The stock price of the company goes down when the information from the CFO becomes widely known after Kate's meeting. Several weeks later, the regulator for RIS asks the firm about the trades of the Allegheny stock. Kate's best option-to attempt to defend her decision to share the information and "sell" recommendation that precipitated the trades-is to tell the regulator that: Her actions were justified because they protected the clients' interests by preventing a loss in their accounts Her actions were justified because the information from the CFO confirmed her earlier research and did not influence her "sell" recommendation The CFO posted the information shared with Kate on the company's website immediately after her meeting with him Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started