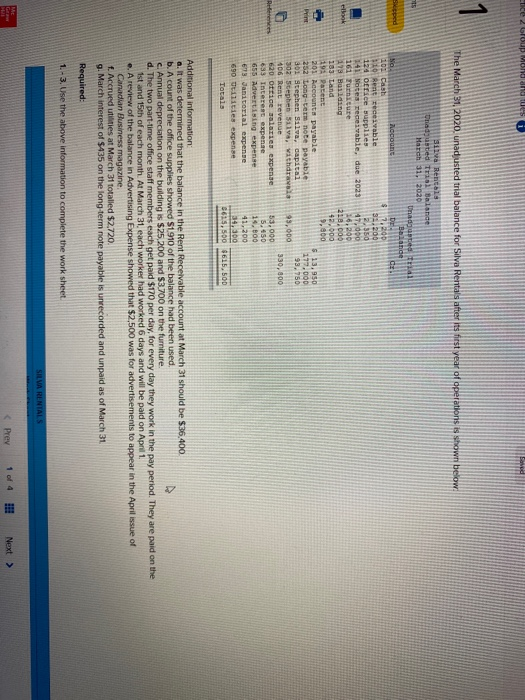

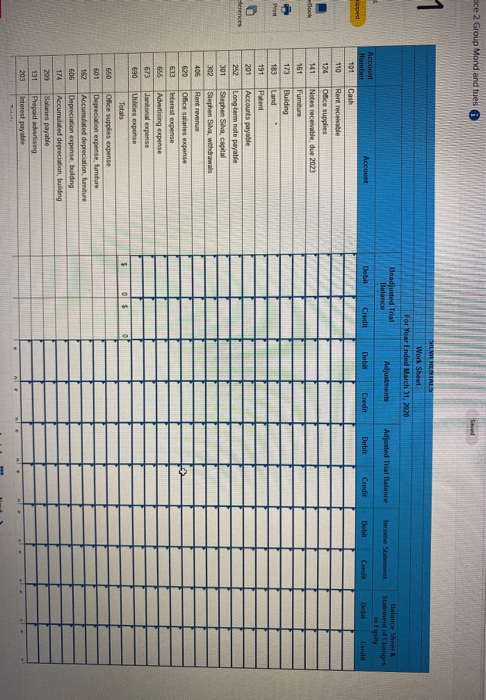

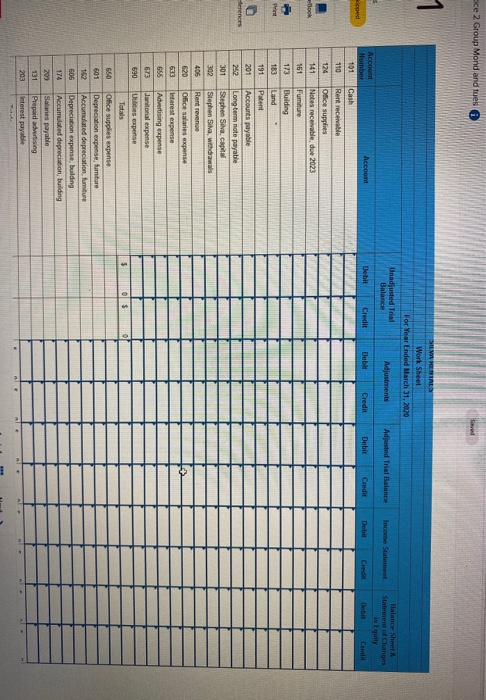

Etice 2 Group Onda i The March 31, 2020, unad usted trial balance for Silva Rentals after its first year of operations is shown below: Silva Rentals Oradjusted trial Balance March 31, 2020 Unada 4 5 cil Foco 100 Cash No Rent receivable 124 orice supplies 141 Notes receivable, due 2023 161 Turniture 179 Basiding 183 Land 19 Patent 201 Accounts payable 252 Long-term note payable 201 Stephen Silva, capital 302 Stephen Silva, withdrawal 106 Rent revenue 620 Ottice salaries expense 693 Interest expense 655 Advertising expense 6 Janitorial expense 690 ilities expense Totals $112.00 31.200 2.350 17.000 26.200 218.000 42.000 9.00 $ 13,950 177.000 93.750 99,000 330,000 53,000 5.450 19. too 41,200 34,100 61,500 615,500 Additional information: Q. It was determined that the balance in the Rent Receivable account at March 31 should be $36.400 b. A count of the office supplies showed 51910 of the balance had been used c. Annual depreciation on the building is $25,200 and $3.700 on the furniture d. The two part-time office staff members each get paid $170 per day, for every day they work in the pay period. They are paid on the 1st and 15th of each month. At March 31, each worker had worked 6 days and will be paid on April 1. e. A review of the balance in Advertising Expense showed that $2,500 was for advertisements to appear in the April issue of Canadian Business magazine f. Accrued utilities at March 31 totalled $2,720. 9. March interest of $135 on the long term note payable is unrecorded and unpaid as of March 31 Required: 1.-3. Use the above information to complete the work sheet SILVA RENTALS Me SEL ice 2 Group Mond and tues VAPORIALS Work Sheet For Year Ended March 31, 2020 Unadjusted Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Statement of Changes Debit Credit Debit Credit Debit Credit Debit Credit Debit Condit apped Peint erences Account Number Account 101 Cash 110 Rent recevable 124 Ofice supplies 141 Notes receivable, due 2023 161 Fumiture 173 Building 183 Land 191 Patent 201 Accounts payable 262 Long term note payable 301 Stephen Silva, capital 302 Stephen Silva, withdrawals 406 Rent revenue 620 Ofice salaries expense 633 Interest expense GSS Advertising expense 673 Janitoral expense 690 Utilis expense Totals 650 Office supplies expense 601 Depreciation expense, furniture 162 Accumulated depreciation, furniture 605 Depreciation expense, building 174 Accumulated depreciation, building 209 Salaries payable 131 Prepaid advertising 203 Interest payable $ o $ ice 2 Group Mond and tues VAPORIALS Work Sheet For Year Ended March 31, 2020 Unadjusted Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Statement of Changes Debit Credit Debit Credit Debit Credit Debit Credit Debit Condit apped Peint erences Account Number Account 101 Cash 110 Rent recevable 124 Ofice supplies 141 Notes receivable, due 2023 161 Fumiture 173 Building 183 Land 191 Patent 201 Accounts payable 262 Long term note payable 301 Stephen Silva, capital 302 Stephen Silva, withdrawals 406 Rent revenue 620 Ofice salaries expense 633 Interest expense GSS Advertising expense 673 Janitoral expense 690 Utilis expense Totals 650 Office supplies expense 601 Depreciation expense, furniture 162 Accumulated depreciation, furniture 605 Depreciation expense, building 174 Accumulated depreciation, building 209 Salaries payable 131 Prepaid advertising 203 Interest payable $ o $