Question

Etsy and the Long-Haul Consider your assigned role in the situation, and let that guide your perspective. Look deeper at the details: facts, problems, organizational

Etsy and the Long-Haul

Consider your assigned role in the situation, and let that guide your perspective. Look deeper at the details: facts, problems, organizational goals, objectives, policies, strategies. Next, consider the concepts, theories, tools and research you need to use to address the issues presented. Then, complete any research, analysis, calculations, or graphing to support your decisions and make recommendations.

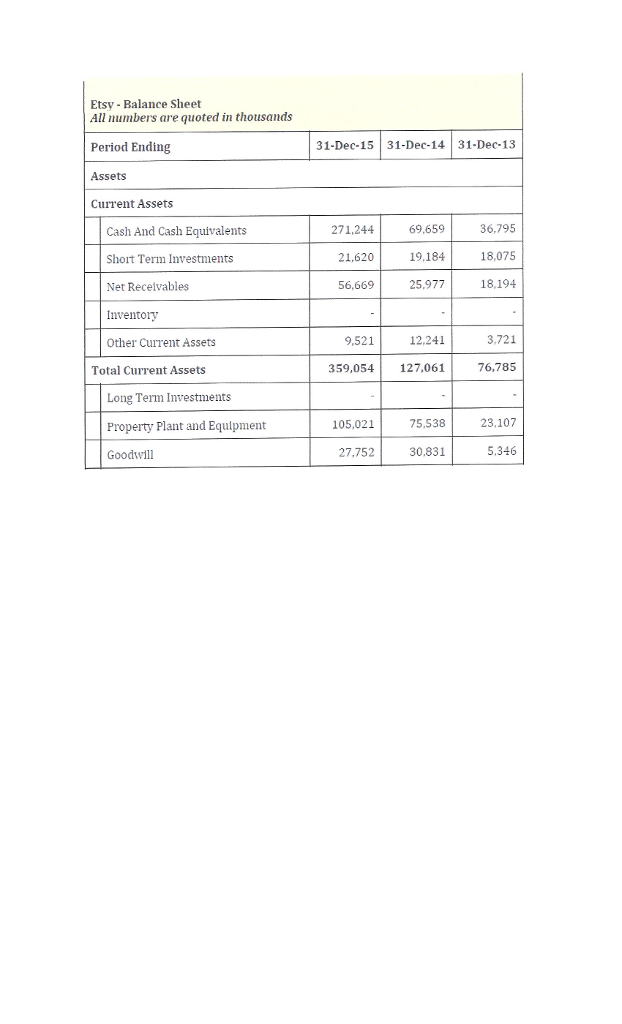

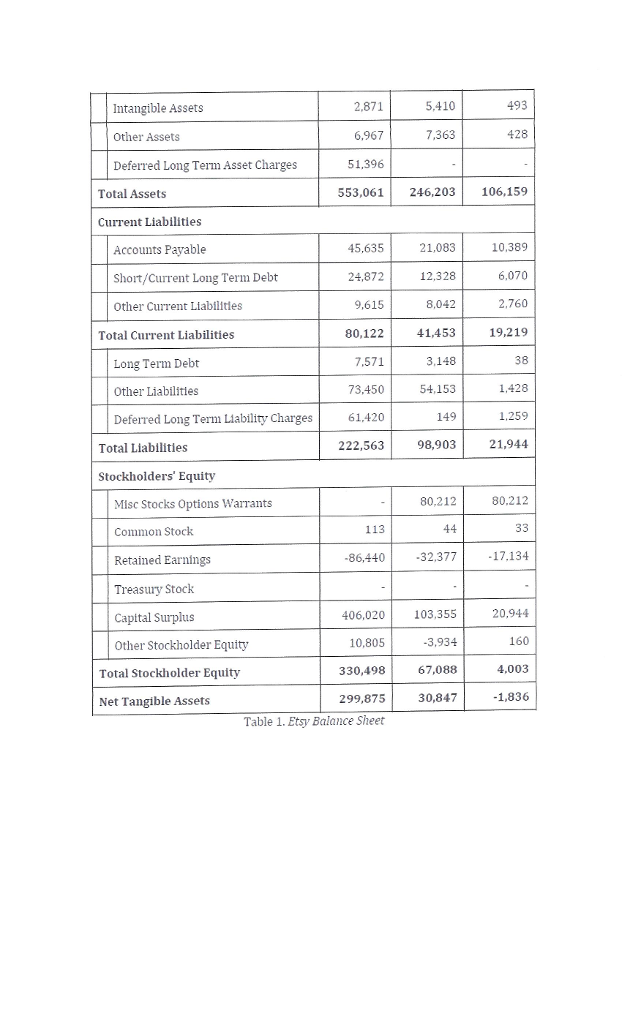

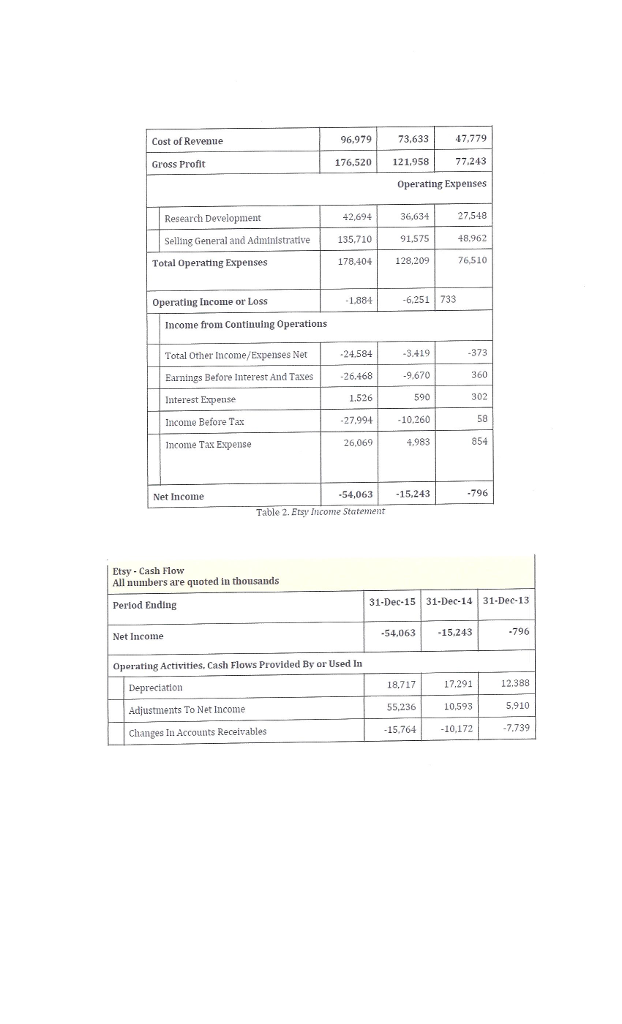

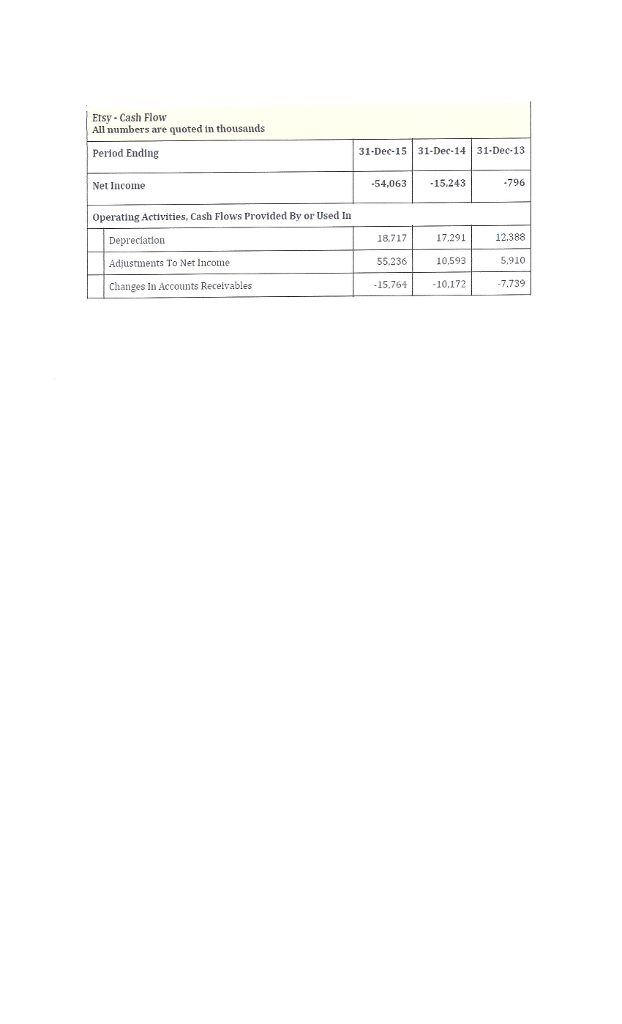

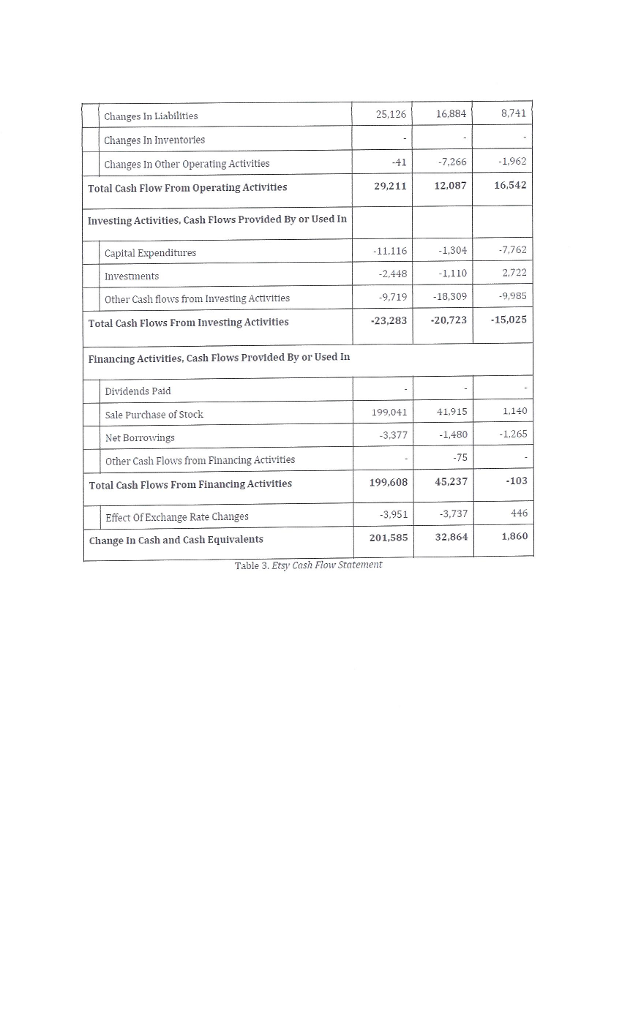

Scenario Investigate the areas of corporate finance as you examine basic financial statements for Etsy (ETSY), an online retailing e-commerce platform. Etsy, which was formed in 2005, held its initial public offering in 2015, and we can thus think of Etsy as a new, publicly traded firm. Etsy has experienced rapid growth (Egan, 2015; Securities and Exchange Commission, n.d.). It is also the largest certified socially-responsible company, or B Corporation, to go public in the United States (Schweiger & Marcus, 2015; Sweeney, 2013). Benefit corporations expand the obligations of boards legally, requiring them to consider environmental and social factors, as well as the financial interests of shareholders. This gives directors and officers the legal protection to pursue a mission and consider the impact their business has on society and the environment. An enacting state's benefit corporation statutes are placed within existing state incorporation codes so that existing code applies to benefit corporations in every respect, except where explicit provisions unique to the benefit corporation form have been included. Directors are required to balance stockholders' interests, interests of those materially affected by the corporation's conduct, and a specific public benefit(s) identified in the firms certificate of incorporation. Prior to engaging in this discussion, please review the Management Discussion and Analysis (MD&A) section of Etsys Annual Report to Shareholders, and other research or materials of your choosing to become familiar with Etsy. Etsys financial statements are provided, for your convenience. You may also visit Yahoo Finance, and type Estys ticker symbol (ETSY) into the search box, to investigate more recent activity, however your answers here should address financial statements that are provided for your use.

QUESTION:

With the case and graph below, "does Etsy have many fixed costs"? Explain with formula and calculation.

Note:

Usually, companies in more capital intensive, automated fields tend to have relatively high fixed costs. In addition, companies that need to have very highly-skilled workers who are to be paid during both good economic times and poor economic times have relatively high fixed costs. Additionally, firms with high product development costs have relatively high fixed costs. When reviewing operating leverage issues, its important to compute an operating breakeven number; this breakeven happens when a firms earnings before interest and taxes equal zero. Typically, the more operating leverage a firm has, the more business risk it faces.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started