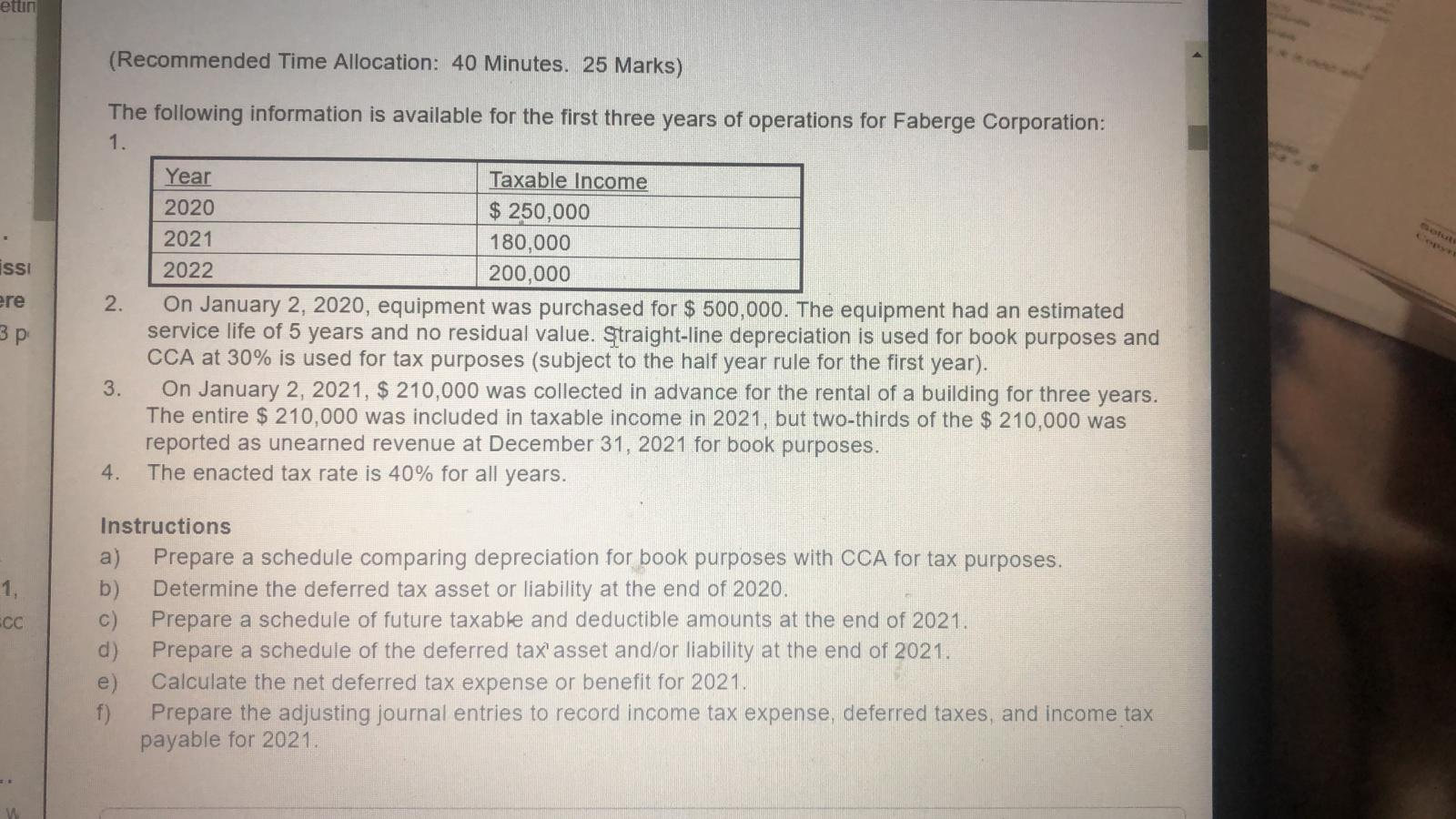

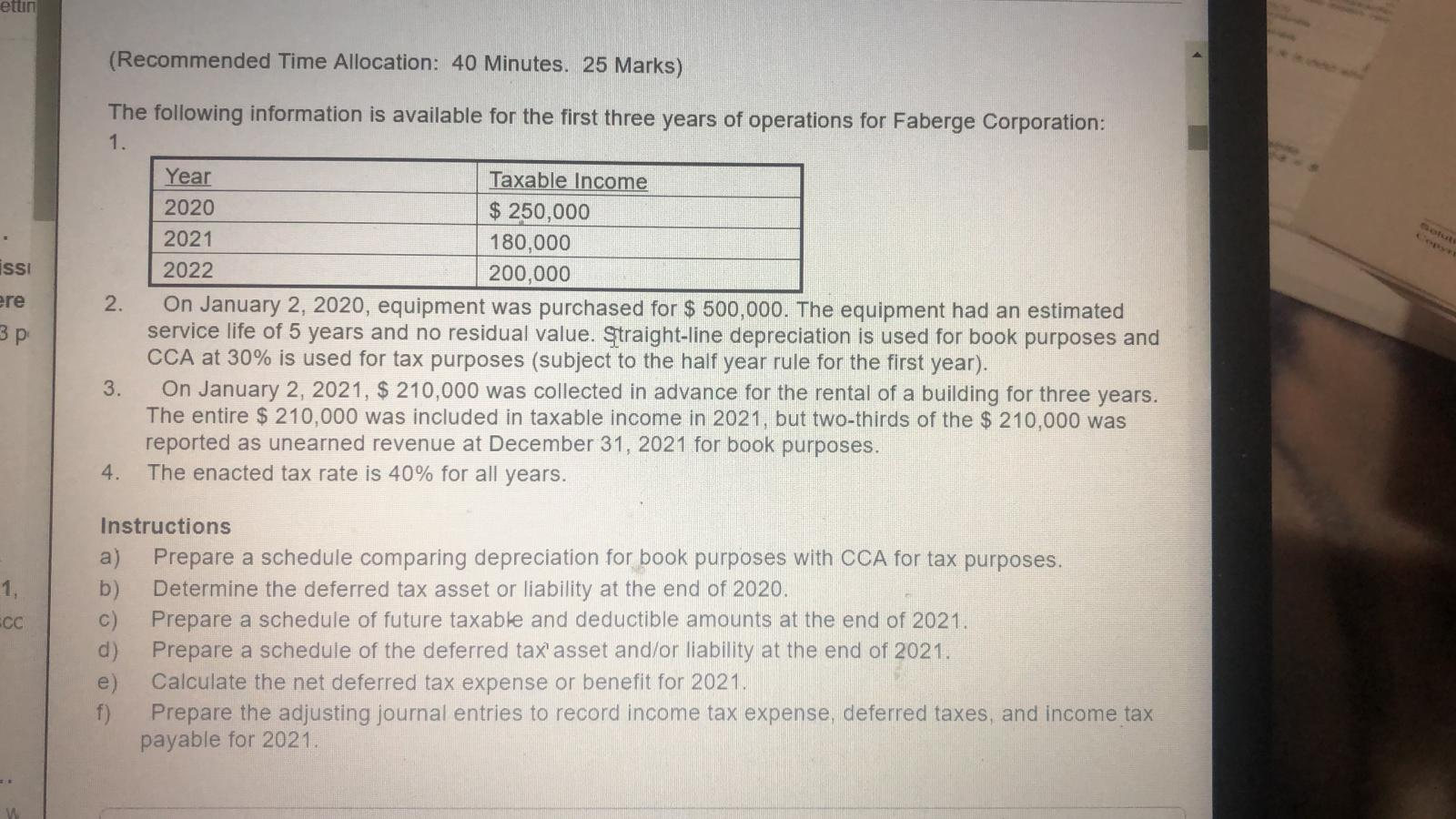

ettin (Recommended Time Allocation: 40 Minutes. 25 Marks) The following information is available for the first three years of operations for Faberge Corporation: 1. issi ere 2. Year Taxable Income 2020 $ 250,000 2021 180,000 2022 200,000 On January 2, 2020, equipment was purchased for $ 500,000. The equipment had an estimated service life of 5 years and no residual value. Straight-line depreciation is used for book purposes and CCA at 30% is used for tax purposes (subject to the half year rule for the first year). On January 2, 2021, $ 210,000 was collected in advance for the rental of a building for three years. The entire $ 210,000 was included in taxable income in 2021, but two-thirds of the $ 210,000 was reported as unearned revenue at December 31, 2021 for book purposes. The enacted tax rate is 40% for all years. 3. 4. ECC Instructions a) Prepare a schedule comparing depreciation for book purposes with CCA for tax purposes. b Determine the deferred tax asset or liability at the end of 2020. c) Prepare a schedule of future taxable and deductible amounts at the end of 2021. d) Prepare a schedule of the deferred tax'asset and/or liability at the end of 2021. e) Calculate the net deferred tax expense or benefit for 2021. f) Prepare the adjusting journal entries to record income tax expense, deferred taxes, and income tax payable for 2021. ettin (Recommended Time Allocation: 40 Minutes. 25 Marks) The following information is available for the first three years of operations for Faberge Corporation: 1. issi ere 2. Year Taxable Income 2020 $ 250,000 2021 180,000 2022 200,000 On January 2, 2020, equipment was purchased for $ 500,000. The equipment had an estimated service life of 5 years and no residual value. Straight-line depreciation is used for book purposes and CCA at 30% is used for tax purposes (subject to the half year rule for the first year). On January 2, 2021, $ 210,000 was collected in advance for the rental of a building for three years. The entire $ 210,000 was included in taxable income in 2021, but two-thirds of the $ 210,000 was reported as unearned revenue at December 31, 2021 for book purposes. The enacted tax rate is 40% for all years. 3. 4. ECC Instructions a) Prepare a schedule comparing depreciation for book purposes with CCA for tax purposes. b Determine the deferred tax asset or liability at the end of 2020. c) Prepare a schedule of future taxable and deductible amounts at the end of 2021. d) Prepare a schedule of the deferred tax'asset and/or liability at the end of 2021. e) Calculate the net deferred tax expense or benefit for 2021. f) Prepare the adjusting journal entries to record income tax expense, deferred taxes, and income tax payable for 2021