Answered step by step

Verified Expert Solution

Question

1 Approved Answer

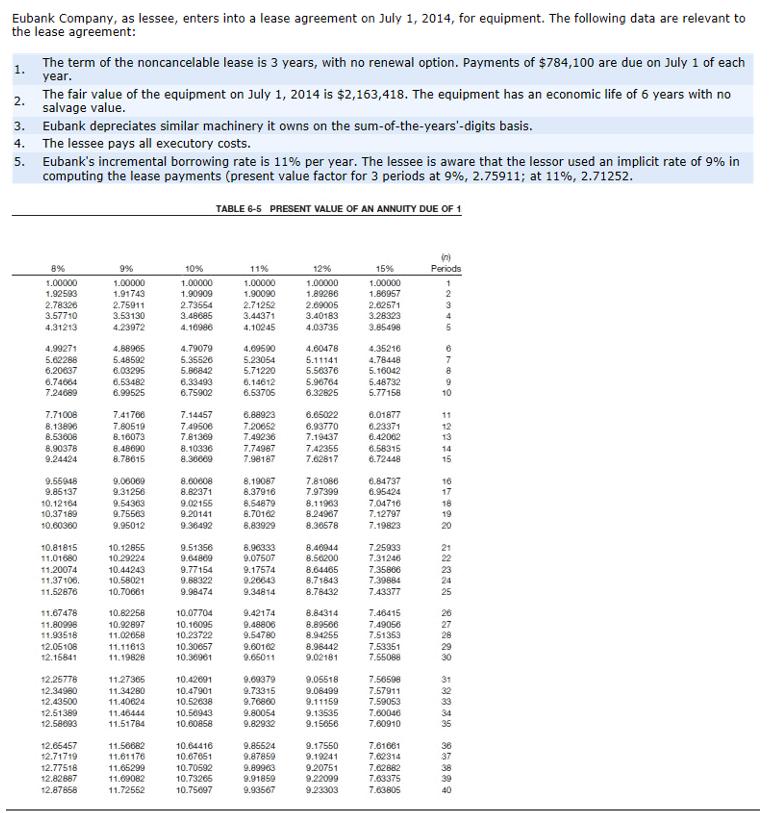

Eubank Company, as lessee, enters into a lease agreement on July 1, 2014, for equipment. The following data are relevant to the lease agreement:

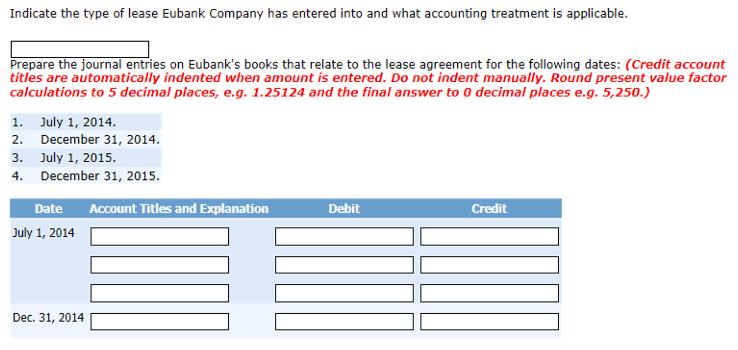

Eubank Company, as lessee, enters into a lease agreement on July 1, 2014, for equipment. The following data are relevant to the lease agreement: The term of the noncancelable lease is 3 years, with no renewal option. Payments of $784,100 are due on July 1 of each 1. year. 2. The fair value of the equipment on July 1, 2014 is $2,163,418. The equipment has an economic life of 6 years with no salvage value. 3. Eubank depreciates similar machinery it owns on the sum-of-the-years'-digits basis. The lessee pays all executory costs. 5. Eubank's incremental borrowing rate is 11% per year. The lessee is aware that the lessor used an implicit rate of 9% in computing the lease payments (present value factor for 3 periods at 9%, 2.75911; at 11%, 2.71252. 4. TABLE 6-5 PRESENT VALUE OF AN ANNUITY DUE OF 1 n) Periods 8% 9% 10% 11% 12% 15% 1.00000 1.00000 1.86957 1.00000 1.00000 1.91743 2.75911 3.53130 4.23972 1.00000 1.90090 1.00000 1.92583 1.90909 1.89286 2 2.78326 3.57710 4,31213 2.73554 3.48685 2.71252 3.44371 4.10245 2.69005 3.40183 2.82571 3.28323 3.85498 3 4 4.10986 4.03735 4.99271 4.88965 4.79079 4.35216 4.69590 5.23054 4.60478 5.82288 5.48592 5.35526 5.86842 5.11141 5.58376 5.96764 4.78448 6.20637 6.74064 7.24689 6.03295 6.53482 5.71220 5.16042 6.33493 6.14612 6.53705 5.48732 9 6.99525 6.75902 6.32825 5.77158 10 6.88923 7.20652 7.49236 7.71008 7.41766 7.14457 6.85022 6.01877 11 8.13896 8.53608 8.90378 9.24424 7.80519 8.16073 7.49506 7.81369 6.23371 6.42002 6.93770 12 13 8.48000 8.78615 7.19437 7.42355 7.62817 8.10336 7.74967 6.58315 6.72448 14 8.30009 7.98187 15 9.0000 9.31258 8.19087 9.55946 9.85137 10.12164 10.37169 8.60008 8.82371 7.81086 6.84737 6.95424 16 17 8.37916 7.97399 9.54363 9.75583 9.02155 9.20141 8.54879 8.70102 8.11963 8.24967 7.04716 7.12797 18 19 10.60300 9.95012 9.36492 6.83929 8.30578 7.19823 20 10.81815 11.01680 10.12655 10.29224 9.51356 9.64809 6.96333 9.07507 7.25933 7.31246 8.40944 21 8.50200 22 8.64465 8.71843 11.20074 10.44243 9.77154 9.17574 7.35868 23 11.37106. 11.52676 10.58021 7.39884 7.43377 9.88322 9.20643 10.70661 9.98474 9.34814 8.78432 25 11.67478 11.80996 11.93518 10.82258 10.07704 9.42174 8.84314 7.46415 26 10.92897 11.02058 9.48806 9.54780 27 28 10.16095 8.89566 8.94255 7.49056 7.51359 10.23722 8.98442 9.02181 7.53351 7.55068 12.05106 11.11613 11.19828 10.30657 9.60162 29 12.16841 10.36901 9.65011 30 12.25778 9.05518 11.27365 11.34280 11.40624 10.42001 9.60379 7.56598 31 12.34960 10.47901 9.73315 9.08499 7.57911 32 7.59053 7.60040 7.60910 12.43500 10.52638 9.76800 9.80054 9.11159 33 9.13535 9.15656 12.51389 11.46444 10.50943 34 12.58093 11.51784 10.60858 9.82932 12.65457 12.71719 12.77518 11.56682 10.64416 9.85524 9.17550 7.61661 11.61176 11.65299 11.09082 11.72552 9.87859 9.89963 7.62314 7.82882 7.63375 10.67051 9.19241 10.70592 9.20751 12.82687 10.73266 9.91859 9.22099 12.87858 10.75097 9.93567 9.23303 7.63805 Indicate the type of lease Eubank Company has entered into and what accounting treatment is applicable. Prepare the journal entries on Eubank's books that relate to the lease agreement for the following dates: (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 5,250.) 1. July 1, 2014. 2. December 31, 2014. 3. July 1, 2015. 4. December 31, 2015. Date Account Titles and Explanation Debit Credit July 1, 2014 Dec. 31, 2014

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Solution 1 Capital Lease Method Note Capitalised Amount Lease Payment PVA113 Capitalised Amount 7841...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started