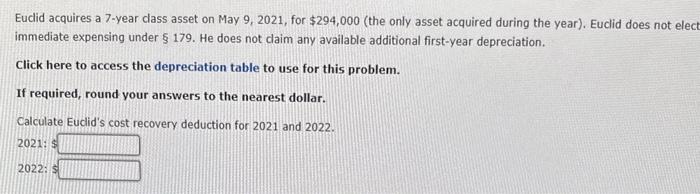

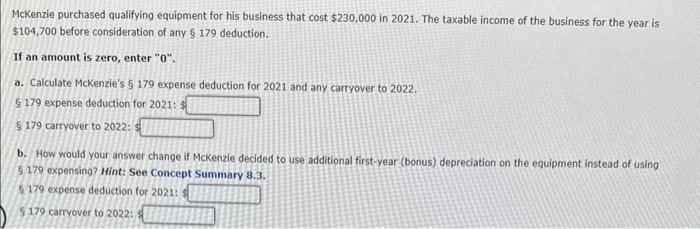

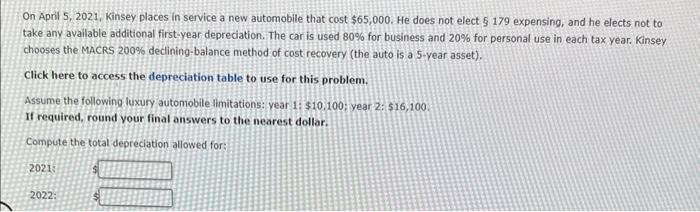

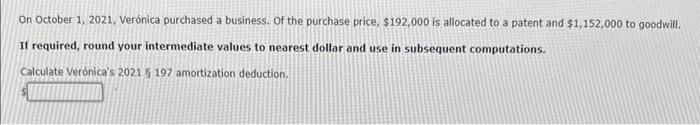

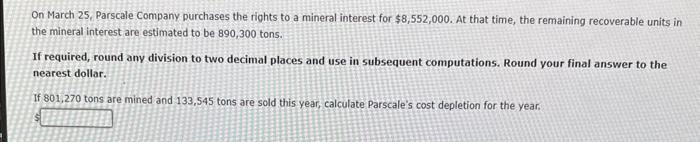

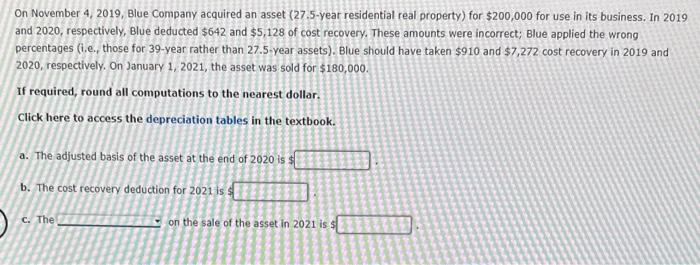

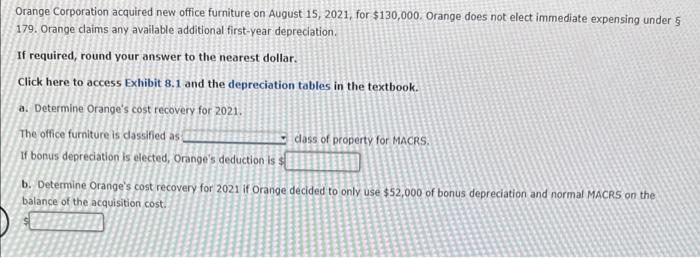

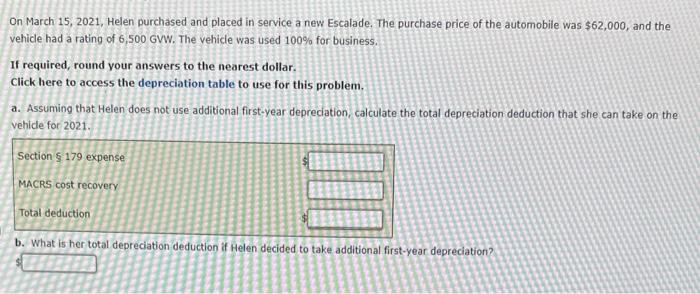

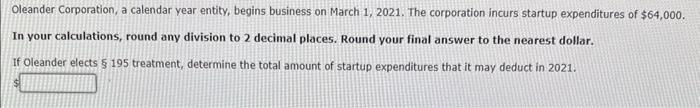

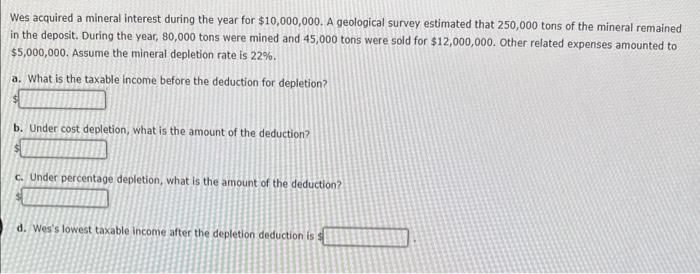

Euclid acquires a 7-year dass asset on May 9, 2021, for $294,000 (the only asset acquired during the year). Euclid does not elec immediate expensing under $179. He does not daim any available additional first-year depreciation. Click here to access the depreciation table to use for this problem. If required, round your answers to the nearest dollar. Calculate Euclid's cost recovery deduction for 2021 and 2022. 2021: $ 2022: McKenzie purchased qualifying equipment for his business that cost $230,000 in 2021 . The taxable income of the business for the year is $104,700 before consideration of any 5179 deduction. If an amount is zero, enter " 0 ". a. Calculate Mckenzie's $179 expense deduction for 2021 and any carryover to 2022 . 5179 expense deduction for 2021: $ 179 carryover to 2022: 9 b. How would your answer change if Mckenzie decided to use additional first-year (bonus) depreciation on the equipment instead of using \$. 179 expensing? Hint: See Concept Summary 8.3. 5179 expense deduction for 2021: \$ 5179 caryover to 2022: On April 5, 2021, Kinsey places in service a new automobile that cost \$65,000. He does not elect $179 expensing, and he elects not to take any available additional first-year depreciation. The car is used 80% for business and 20% for personal use in each tax year. Kinsey chooses the MACRS 200% declining-balance method of cost recovery (the auto is a 5 -year asset). Click here to access the depreciation table to use for this problem. Assume the following luxury automobile limitations: year 1:$10,100; year 2:$16,100 : If required, round your final answers to the nearest dollar. Compute the total depreciation allowed for: 2021 19 2022: On October 1, 2021, Vernica purchased a business. Of the purchase price, $192,000 is allocated to a patent and $1,152,000 to goodwill. If required, round your intermediate values to nearest dollar and use in subsequent computations. Calculate Vernica's 20215.197 amortization deduction. On March 25. Parscale Company purchases the rights to a mineral interest for $8,552,000. At that time, the remaining recoverable units in the mineral interest are estimated to be 890,300 tons. If required, round any division to two decimal places and use in subsequent computations. Round your final answer to the nearest dollar. If 801,270 tons are mined and 133,545 tons are sold this year, calculate Parscale's cost depletion for the year. On November 4,2019 , Blue Company acquired an asset (27.5-year residential real property) for $200,000 for use in its business, in 2019 and 2020 , respectively, Blue deducted $642 and $5,128 of cost recovery. These amounts were incorrect; Blue applied the wrong percentages (i.e., those for 39-year rather than 27.5-year assets). Blue should have taken $910 and $7,272 cost recovery in 2019 and 2020 , respectively. On January 1,2021 , the asset was sold for $180,000. If required, round all computations to the nearest dollar. Click here to access the depreciation tables in the textbook. a. The adjusted basis of the asset at the end of 2020 is $ b. The cost recovery deduction for 2021 is $ c. The on the sale of the asset in 2021 is 4 Orange Corporation acquired new office fumiture on August 15, 2021, for $130,000. Orange does not elect immediate expensing under 179. Orange claims any available additional first-year depreciation. If required, round your answer to the nearest dollar. Click here to access Exhibit 8.1 and the depreciation tables in the textbook. a. Determine Orange's cost recovery for 2021 . The office furniture is dassified as dass of property for MACRS. If bonus depreciation is elected, Orange's deduction is $ b. Determine orange's cost recovery for 2021 if Orange decided to only use $52,000 of bonus depreciation and normal MACRS on the balance of the acquisition cost. On March 15, 2021, Helen purchased and placed in service a new Escalade. The purchase price of the automobile was $62,000, and the vehide had a rating of 6,500GVW. The vehicle was used 100% for business. If required, round your answers to the nearest dollar. Click here to access the depreciation table to use for this problem. a. Assuming that Helen does not use additional first-year depreciation, calculate the total depreciation deduction that she can take on the vehide for 2021. b. What is her total depreciation deduction if Helen decided to take additional first-year depreciation? Oleander Corporation, a calendar year entity, begins business on March 1,2021 . The corporation incurs startup expenditures of $64,000. In your calculations, round any division to 2 decimal places. Round your final answer to the nearest dollar. If Oleander elects 195 treatment, determine the total amount of startup expenditures that it may deduct in 2021. Wes acquired a mineral interest during the year for $10,000,000. A geological survey estimated that 250,000 tons of the mineral remained in the deposit. During the year, 80,000 tons were mined and 45,000 tons were sold for $12,000,000. Other related expenses amounted to $5,000,000. Assume the mineral depletion rate is 22%. a. What is the taxable income before the deduction for depletion? b. Under cost depletion, what is the amount of the deduction? c. Under percentage depletion, what is the amount of the deduction? d. Wes's lowest taxable income after the depletion deduction is