Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Euodia's Trading prepares its financial statements annually to 30 September. The accountant has estimated the following allowances for doubtful debts based on the past

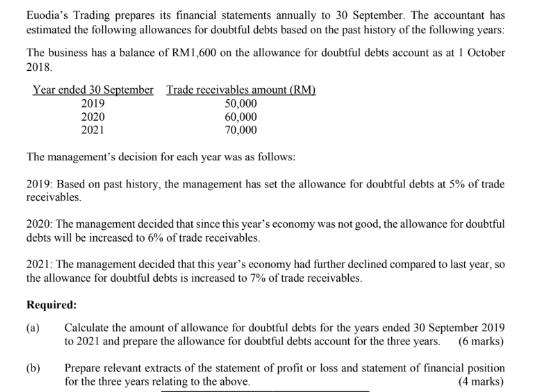

Euodia's Trading prepares its financial statements annually to 30 September. The accountant has estimated the following allowances for doubtful debts based on the past history of the following years: The business has a balance of RM1,600 on the allowance for doubtful debts account as at 1 October 2018. Year ended 30 September Trade receivables amount (RM) 2019 2020 2021 50,000 60,000 70,000 The management's decision for each year was as follows: 2019: Based on past history, the management has set the allowance for doubtful debts at 5% of trade receivables. 2020: The management decided that since this year's economy was not good, the allowance for doubtful debts will be increased to 6% of trade receivables. 2021: The management decided that this year's economy had further declined compared to last year, so the allowance for doubtful debts is increased to 7% of trade receivables. Required: (a) (b) Calculate the amount of allowance for doubtful debts for the years ended 30 September 2019 to 2021 and prepare the allowance for doubtful debts account for the three years. (6 marks) Prepare relevant extracts of the statement of profit or loss and statement of financial position for the three years relating to the above. (4 marks) Euodia's Trading prepares its financial statements annually to 30 September. The accountant has estimated the following allowances for doubtful debts based on the past history of the following years: The business has a balance of RM1,600 on the allowance for doubtful debts account as at 1 October 2018. Year ended 30 September Trade receivables amount (RM) 2019 2020 2021 50,000 60,000 70,000 The management's decision for each year was as follows: 2019: Based on past history, the management has set the allowance for doubtful debts at 5% of trade receivables. 2020: The management decided that since this year's economy was not good, the allowance for doubtful debts will be increased to 6% of trade receivables. 2021: The management decided that this year's economy had further declined compared to last year, so the allowance for doubtful debts is increased to 7% of trade receivables. Required: (a) (b) Calculate the amount of allowance for doubtful debts for the years ended 30 September 2019 to 2021 and prepare the allowance for doubtful debts account for the three years. (6 marks) Prepare relevant extracts of the statement of profit or loss and statement of financial position for the three years relating to the above. (4 marks)

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a Calculation of Allowance for Doubtful Debts Year ended 30 September 2019 Allowance for Doubtful De...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started