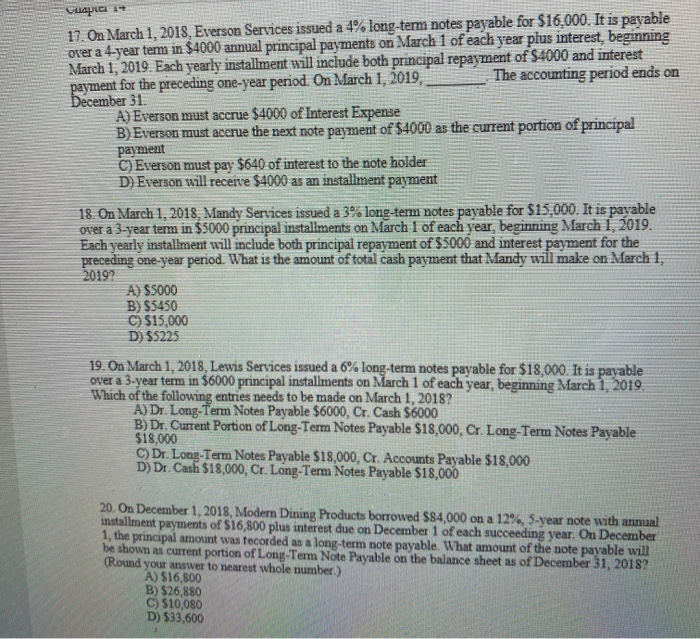

Euro 14 17. On March 1, 2018. Everson Services issued a 4% long-term notes payable for $16.000. It is pavable over a 4-year term in $4000 annual principal payments on March 1 of each year plus interest, beginning March 1, 2019. Each yearly installment will include both principal repayment of $4000 and interest payment for the preceding one-year period. On March 1, 2019, The accounting period ends on December 31 A) Everson must accrue $4000 of Interest Expense B) Everson must accrue the next note payment of $4000 as the current portion of principal payment C) Everson must pay $640 of interest to the note holder D) Everson will receive $4000 as an installment payment 18. On March 1, 2018 Mandy Services issued a 3% long-term notes payable for $15,000. It is pavable over a 3-year term in $5000 principal installments on March 1 of each year, beginning March 1, 2019. Each yearly installment will include both principal repayment of $5000 and interest payment for the preceding one-year period. What is the amount of total cash payment that Mandy will make on March 1, 2019? A) $5000 B) S5450 C) $15,000 D) $5225 19. On March 1, 2018, Lewis Services issued a 6% long-term notes payable for $18,000. It is payable over a 3-year term in $6000 principal installments on March 1 of each year, beginning March 1, 2019 Which of the following entries needs to be made on March 1, 2018? A) Dr. Long-Term Notes Payable $6000, Cr. Cash $6000 B) Dr. Current Portion of Long-Term Notes Payable $18,000. Cr. Long-Term Notes Payable $18,000 C) Dr. Long-Term Notes Payable $18,000. Cr. Accounts Payable $18,000 D) Dr. Cash $18,000, Cr. Long-Term Notes Payable $18,000 20. On December 1, 2018, Modern Dining Products borrowed $84,000 on a 12%, 5-year note with annual installment payments of $16,800 plus interest due on December 1 of each succeeding year. On December 1, the principal amount was tecorded as a long-term note payable. What amount of the note payable will be shown as current portion of Long-Term Note Payable on the balance sheet as of December 31, 2018? (Round your answer to nearest whole number.) A) $16,800 B) $26,880 C) $10,080 D) $33,600