Question

75. Bond X is a noncallable corporate bond maturing in ten years. Bond Y is also a corporate bond maturing in ten years, but

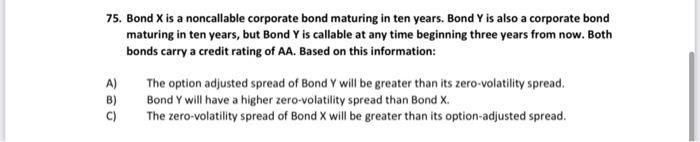

75. Bond X is a noncallable corporate bond maturing in ten years. Bond Y is also a corporate bond maturing in ten years, but Bond Y is callable at any time beginning three years from now. Both bonds carry a credit rating of AA. Based on this information: A) B) C) The option adjusted spread of Bond Y will be greater than its zero-volatility spread. Bond Y will have a higher zero-volatility spread than Bond X. The zero-volatility spread of Bond X will be greater than its option-adjusted spread.

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

A The option adjusted spread of Bond Y will be greater than its zerovolatility spread The option adjusted spread OAS is a measure of the credit spread ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Auditing and Assurance services an integrated approach

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley, Chris E. Hogan

16th edition

978-0134075754, 134075757, 134065824, 978-0134065823

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App