Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Evaluate ROIC measure compares to traditional ratios like ROE and ROA. What are the similarities and what are the differences? Why do you think Nike

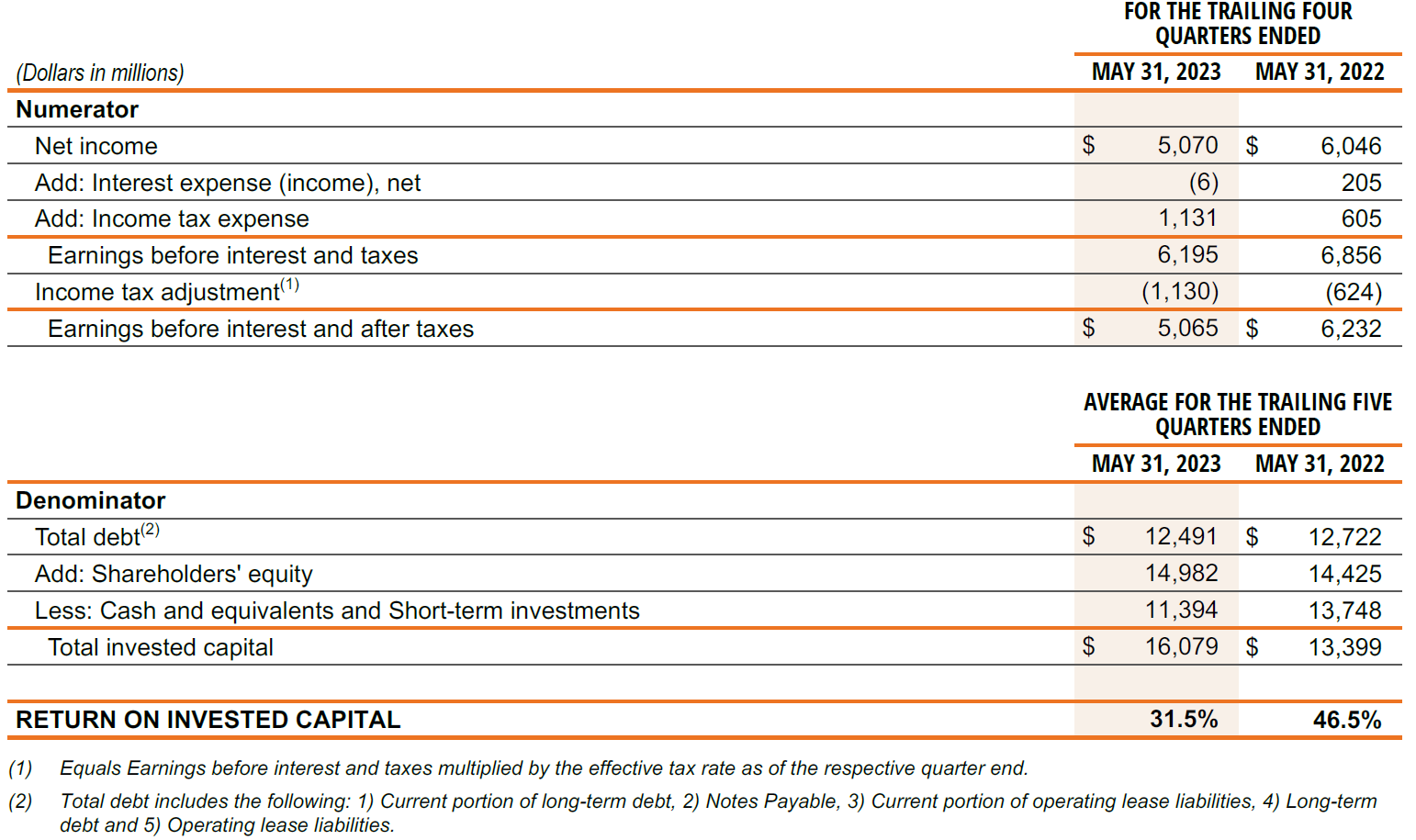

Evaluate ROIC measure compares to traditional ratios like ROE and ROA. What are the similarities and what are the differences? Why do you think Nike presents the "return on invested capital" in this way?

(Dollars in millions) Numerator Net income Add: Interest expense (income), net Add: Income tax expense Earnings before interest and taxes Income tax adjustment () Earnings before interest and after taxes Denominator Total debt (2) Add: Shareholders' equity Less: Cash and equivalents and Short-term investments Total invested capital FOR THE TRAILING FOUR QUARTERS ENDED MAY 31, 2023 MAY 31, 2022 $ 5,070 $ 6,046 (6) 205 1,131 605 6,195 6,856 (1,130) (624) 5,065 $ 6,232 AVERAGE FOR THE TRAILING FIVE QUARTERS ENDED MAY 31, 2023 MAY 31, 2022 $ 12,491 12,722 14,982 14,425 11,394 13,748 $ 16,079 $ 13,399 RETURN ON INVESTED CAPITAL 31.5% 46.5% (1) Equals Earnings before interest and taxes multiplied by the effective tax rate as of the respective quarter end. (2) Total debt includes the following: 1) Current portion of long-term debt, 2) Notes Payable, 3) Current portion of operating lease liabilities, 4) Long-term debt and 5) Operating lease liabilities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started