Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Evaluate the audit work done by the audit junior on the accounts receivable and property plant and equipment and outline additional procedures that should be

-

Evaluate the audit work done by the audit junior on the accounts receivable and property plant and equipment and outline additional procedures that should be performed by the audit team on future work in this area, clearly identifying why more procedures are needed. Make use of headings, sub-headings and bullets points

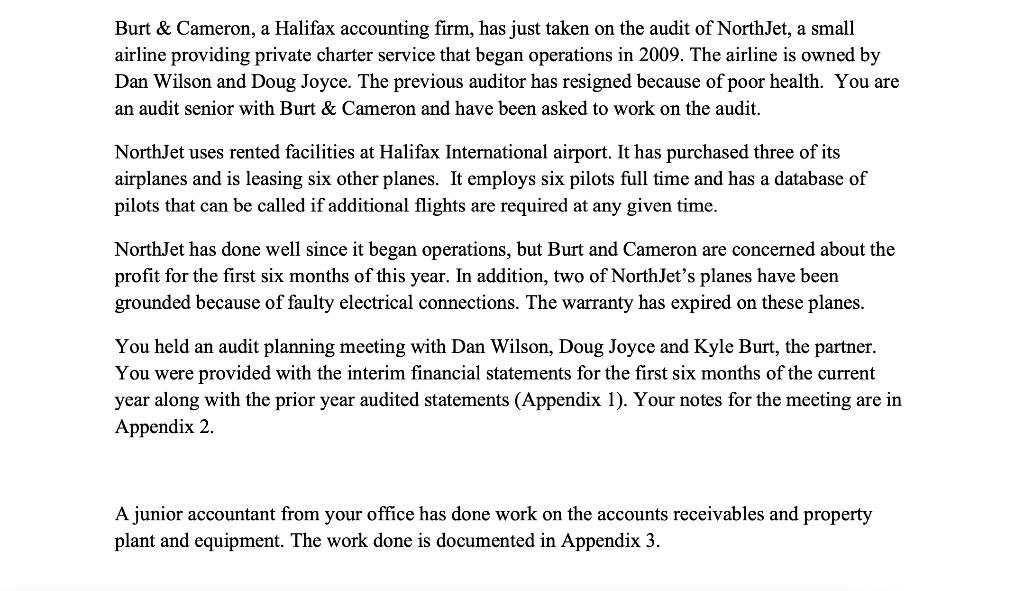

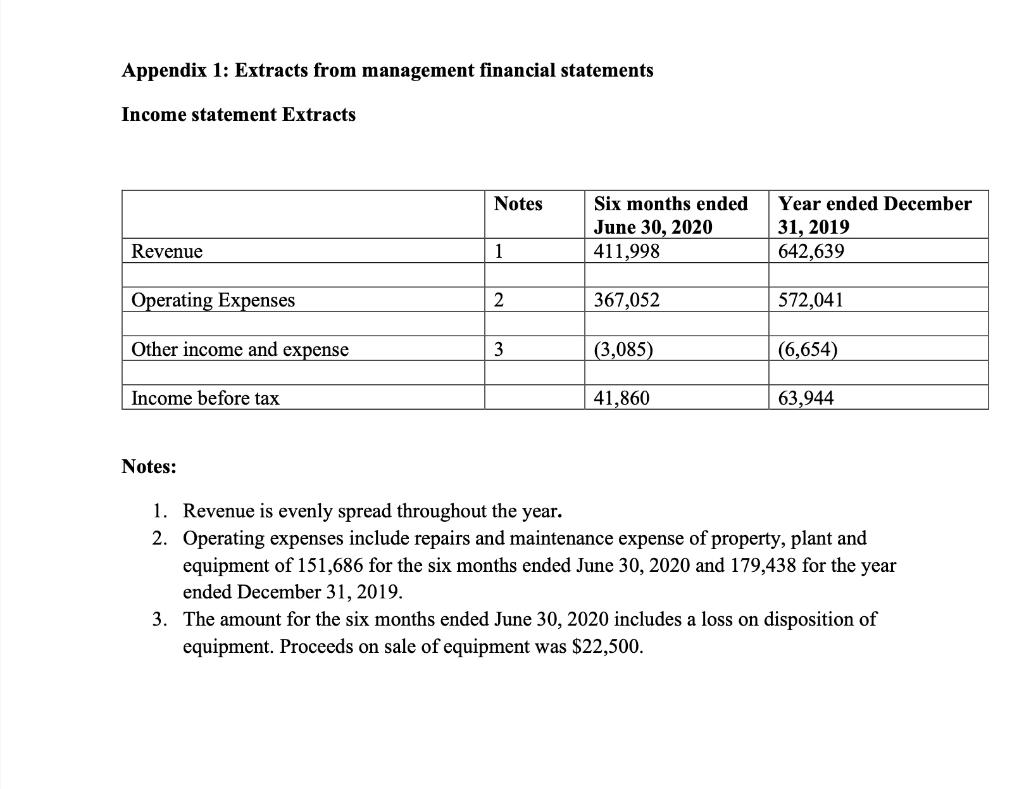

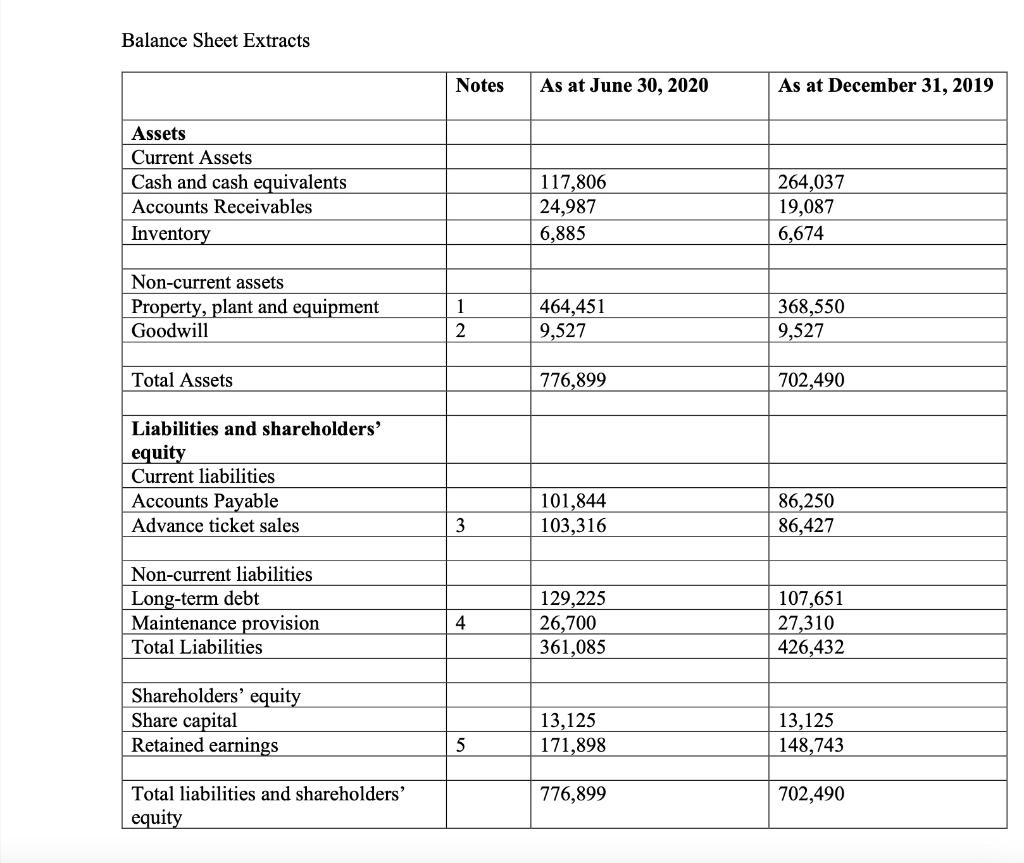

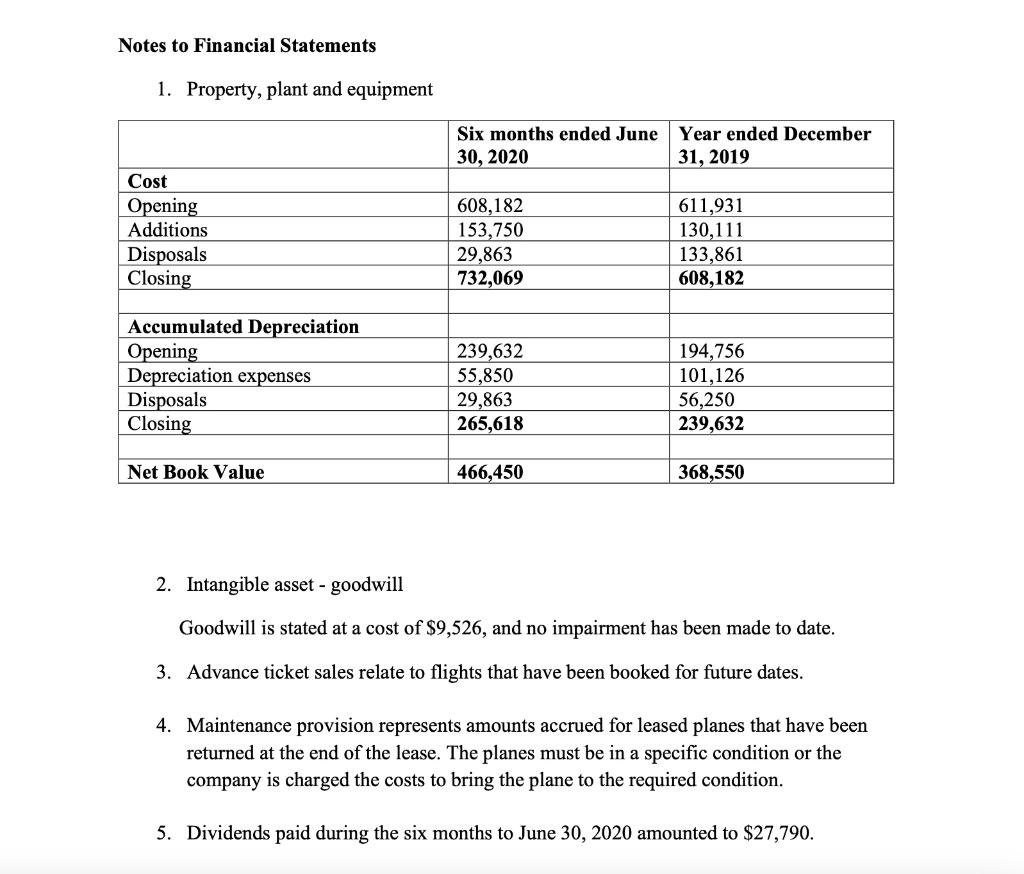

*3 appendix are attached above along with notes to the financial statements

Burt & Cameron, a Halifax accounting firm, has just taken on the audit of North Jet, a small airline providing private charter service that began operations in 2009. The airline is owned by Dan Wilson and Doug Joyce. The previous auditor has resigned because of poor health. You are an audit senior with Burt & Cameron and have been asked to work on the audit. NorthJet uses rented facilities at Halifax International airport. It has purchased three of its airplanes and is leasing six other planes. It employs six pilots full time and has a database of pilots that can be called if additional flights are required at any given time. NorthJet has done well since it began operations, but Burt and Cameron are concerned about the profit for the first six months of this year. In addition, two of North Jet's planes have been grounded because of faulty electrical connections. The warranty has expired on these planes. You held an audit planning meeting with Dan Wilson, Doug Joyce and Kyle Burt, the partner. You were provided with the interim financial statements for the first six months of the current year along with the prior year audited statements (Appendix 1). Your notes for the meeting are in Appendix 2. A junior accountant from your office has done work on the accounts receivables and property plant and equipment. The work done is documented in Appendix 3. Appendix 1: Extracts from management financial statements Income statement Extracts Notes Six months ended June 30, 2020 411,998 Year ended December 31, 2019 642,639 Revenue 1 Operating Expenses 2 367,052 572,041 Other income and expense 3 (3,085) (6,654) Income before tax 41,860 63,944 Notes: 1. Revenue is evenly spread throughout the year. 2. Operating expenses include repairs and maintenance expense of property, plant and equipment of 151,686 for the six months ended June 30, 2020 and 179,438 for the year ended December 31, 2019. 3. The amount for the six months ended June 30, 2020 includes a loss on disposition of equipment. Proceeds on sale of equipment was $22,500. Balance Sheet Extracts Notes As at June 30, 2020 As at December 31, 2019 Assets Current Assets Cash and cash equivalents Accounts Receivables Inventory 117,806 24,987 6,885 264,037 19,087 6,674 Non-current assets Property, plant and equipment Goodwill 1 2 464,451 9,527 368,550 9,527 Total Assets 776,899 702,490 Liabilities and shareholders' equity Current liabilities Accounts Payable Advance ticket sales 101,844 103,316 86,250 86,427 3 Non-current liabilities Long-term debt Maintenance provision Total Liabilities 4 129,225 26,700 361,085 107,651 27,310 426,432 Shareholders' equity Share capital Retained earnings 13,125 171,898 13,125 148,743 5 776,899 Total liabilities and shareholders' equity 702,490 Notes to Financial Statements 1. Property, plant and equipment Six months ended June 30, 2020 Year ended December 31, 2019 Cost Opening Additions Disposals Closing 608,182 153,750 29,863 732,069 611,931 130,111 133,861 608,182 Accumulated Depreciation Opening Depreciation expenses Disposals Closing 239,632 55,850 29,863 265,618 194,756 101,126 56,250 239,632 Net Book Value 466,450 368,550 2. Intangible asset - goodwill Goodwill is stated at a cost of $9,526, and no impairment has been made to date. 3. Advance ticket sales relate to flights that have been booked for future dates. 4. Maintenance provision represents amounts accrued for leased planes that have been returned at the end of the lease. The planes must be in a specific condition or the company is charged the costs to bring the plane to the required condition. 5. Dividends paid during the six months to June 30, 2020 amounted to $27,790. Appendix 2: Notes from meeting Dan Wilson and Doug Joyce explained that NorthJet operates in a very competitive environment. The economic downturn has resulted in fewer charter flights and airlines have been offering reduced rates to remain competitive. NorthJet has been paying strict attention to cost controls and have introduced a bonus for management that is based on the company's profitability. Recently two of NorthJet's major customers have gone into bankruptcy. There is $41,250 in advanced ticket sales related to these customers. NorthJet held a manager's retreat last month to think of ways to boost the business. The company intends on offering an exclusive business class service for business customers such that they can fly to and from a major city in the same day. This service will begin in the new year. North Jet is optimistic that there will be an 80% uptake of seats on these flights that will be offered from Monday through Friday. One of NorthJet's planes was damaged because of a fire in the cockpit. Although the plane was insured the insurance company is disputing the claim because the company did not meet safety standards that were required in the industry. The cost of the damage is estimated at $105,000. Because North Jet is anticipating additional flights in the new year, it will need to lease or purchase additional planes. NorthJet has begun discussions with a leasing company regarding leasing the planes. They expect the leasing agreements to be in place by year end. Appendix 3: Notes regarding the accounts receivable and property, plant and equipment work performed by the junior auditor. Accounts Receivables / Unearned Revenue When clients book charter flights, the flight is prepaid, and the amounts are recorded in unearned revenue. Once the service has been provided (the client takes the flight) the unearned revenue related to the flight is transferred to revenue. Large well-established clients do not have to prepay and are invoiced for the amounts of the flights. These represent the accounts receivable amounts on the balance sheet. The prior year audit file indicates there were issues with accounts receivables in prior years - NorthJet had accounted for unearned revenue as accounts receivable. The junior accountant performed analytical review on the accounts receivable noting that percentage of accounts receivable as a percentage of total assets was consistent with the prior year. There were several credit balances in accounts receivable which the junior ignored. No confirmations of accounts receivable were performed. The junior auditor concluded the accounts receivable were fairly stated for the interim period. Property Plant and Equipment Property plant and equipment represents the largest item on the balance sheet and represents the planes that Northjet owns as well as leased planes. They are separated in the general ledger accounts. The junior auditor traced each item on the subsidiary ledger to the original invoice, added the subsidiary ledger and agreed the total to the general ledger. Then the junior auditor signed the working paper concluding that property plant and equipment was fairly stated for the interim period. Burt & Cameron, a Halifax accounting firm, has just taken on the audit of North Jet, a small airline providing private charter service that began operations in 2009. The airline is owned by Dan Wilson and Doug Joyce. The previous auditor has resigned because of poor health. You are an audit senior with Burt & Cameron and have been asked to work on the audit. NorthJet uses rented facilities at Halifax International airport. It has purchased three of its airplanes and is leasing six other planes. It employs six pilots full time and has a database of pilots that can be called if additional flights are required at any given time. NorthJet has done well since it began operations, but Burt and Cameron are concerned about the profit for the first six months of this year. In addition, two of North Jet's planes have been grounded because of faulty electrical connections. The warranty has expired on these planes. You held an audit planning meeting with Dan Wilson, Doug Joyce and Kyle Burt, the partner. You were provided with the interim financial statements for the first six months of the current year along with the prior year audited statements (Appendix 1). Your notes for the meeting are in Appendix 2. A junior accountant from your office has done work on the accounts receivables and property plant and equipment. The work done is documented in Appendix 3. Appendix 1: Extracts from management financial statements Income statement Extracts Notes Six months ended June 30, 2020 411,998 Year ended December 31, 2019 642,639 Revenue 1 Operating Expenses 2 367,052 572,041 Other income and expense 3 (3,085) (6,654) Income before tax 41,860 63,944 Notes: 1. Revenue is evenly spread throughout the year. 2. Operating expenses include repairs and maintenance expense of property, plant and equipment of 151,686 for the six months ended June 30, 2020 and 179,438 for the year ended December 31, 2019. 3. The amount for the six months ended June 30, 2020 includes a loss on disposition of equipment. Proceeds on sale of equipment was $22,500. Balance Sheet Extracts Notes As at June 30, 2020 As at December 31, 2019 Assets Current Assets Cash and cash equivalents Accounts Receivables Inventory 117,806 24,987 6,885 264,037 19,087 6,674 Non-current assets Property, plant and equipment Goodwill 1 2 464,451 9,527 368,550 9,527 Total Assets 776,899 702,490 Liabilities and shareholders' equity Current liabilities Accounts Payable Advance ticket sales 101,844 103,316 86,250 86,427 3 Non-current liabilities Long-term debt Maintenance provision Total Liabilities 4 129,225 26,700 361,085 107,651 27,310 426,432 Shareholders' equity Share capital Retained earnings 13,125 171,898 13,125 148,743 5 776,899 Total liabilities and shareholders' equity 702,490 Notes to Financial Statements 1. Property, plant and equipment Six months ended June 30, 2020 Year ended December 31, 2019 Cost Opening Additions Disposals Closing 608,182 153,750 29,863 732,069 611,931 130,111 133,861 608,182 Accumulated Depreciation Opening Depreciation expenses Disposals Closing 239,632 55,850 29,863 265,618 194,756 101,126 56,250 239,632 Net Book Value 466,450 368,550 2. Intangible asset - goodwill Goodwill is stated at a cost of $9,526, and no impairment has been made to date. 3. Advance ticket sales relate to flights that have been booked for future dates. 4. Maintenance provision represents amounts accrued for leased planes that have been returned at the end of the lease. The planes must be in a specific condition or the company is charged the costs to bring the plane to the required condition. 5. Dividends paid during the six months to June 30, 2020 amounted to $27,790. Appendix 2: Notes from meeting Dan Wilson and Doug Joyce explained that NorthJet operates in a very competitive environment. The economic downturn has resulted in fewer charter flights and airlines have been offering reduced rates to remain competitive. NorthJet has been paying strict attention to cost controls and have introduced a bonus for management that is based on the company's profitability. Recently two of NorthJet's major customers have gone into bankruptcy. There is $41,250 in advanced ticket sales related to these customers. NorthJet held a manager's retreat last month to think of ways to boost the business. The company intends on offering an exclusive business class service for business customers such that they can fly to and from a major city in the same day. This service will begin in the new year. North Jet is optimistic that there will be an 80% uptake of seats on these flights that will be offered from Monday through Friday. One of NorthJet's planes was damaged because of a fire in the cockpit. Although the plane was insured the insurance company is disputing the claim because the company did not meet safety standards that were required in the industry. The cost of the damage is estimated at $105,000. Because North Jet is anticipating additional flights in the new year, it will need to lease or purchase additional planes. NorthJet has begun discussions with a leasing company regarding leasing the planes. They expect the leasing agreements to be in place by year end. Appendix 3: Notes regarding the accounts receivable and property, plant and equipment work performed by the junior auditor. Accounts Receivables / Unearned Revenue When clients book charter flights, the flight is prepaid, and the amounts are recorded in unearned revenue. Once the service has been provided (the client takes the flight) the unearned revenue related to the flight is transferred to revenue. Large well-established clients do not have to prepay and are invoiced for the amounts of the flights. These represent the accounts receivable amounts on the balance sheet. The prior year audit file indicates there were issues with accounts receivables in prior years - NorthJet had accounted for unearned revenue as accounts receivable. The junior accountant performed analytical review on the accounts receivable noting that percentage of accounts receivable as a percentage of total assets was consistent with the prior year. There were several credit balances in accounts receivable which the junior ignored. No confirmations of accounts receivable were performed. The junior auditor concluded the accounts receivable were fairly stated for the interim period. Property Plant and Equipment Property plant and equipment represents the largest item on the balance sheet and represents the planes that Northjet owns as well as leased planes. They are separated in the general ledger accounts. The junior auditor traced each item on the subsidiary ledger to the original invoice, added the subsidiary ledger and agreed the total to the general ledger. Then the junior auditor signed the working paper concluding that property plant and equipment was fairly stated for the interim periodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started