Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Evaluate the financial health of the company using financial ratio analysis; get financial data (time period of the case) if the case does not

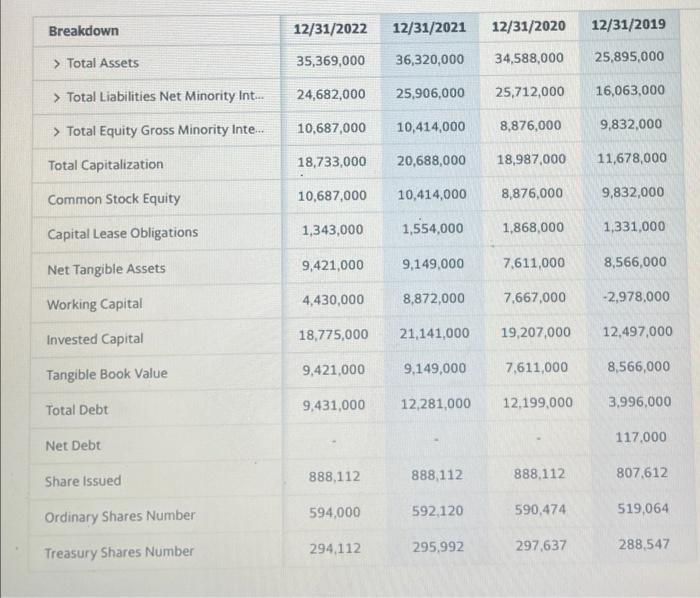

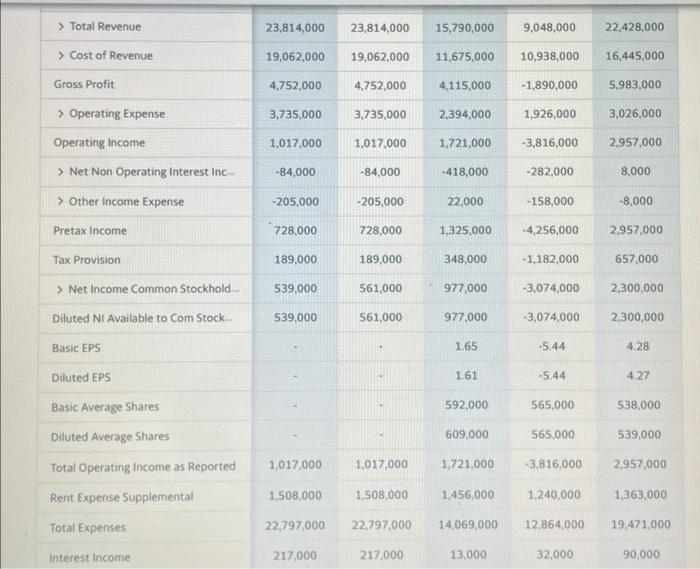

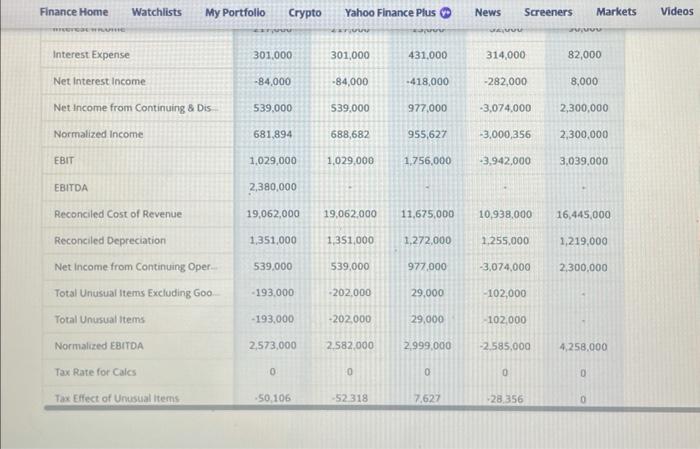

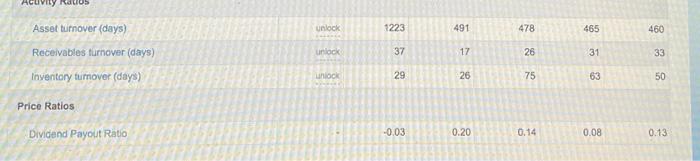

Evaluate the financial health of the company using financial ratio analysis; get financial data (time period of the case) if the case does not provide it (http:finance.yahoo.com/) Make sure you benchmark it against rivals or industry average. Breakdown > Total Assets > Total Liabilities Net Minority Int..... > Total Equity Gross Minority Inte... Total Capitalization Common Stock Equity Capital Lease Obligations Net Tangible Assets Working Capital Invested Capital Tangible Book Value Total Debt Net Debt Share Issued Ordinary Shares Number Treasury Shares Number 12/31/2022 12/31/2021 35,369,000 24,682,000 25,906,000 10,687,000 10,687,000 18,733,000 20,688,000 1,343,000 9,421,000 4,430,000 18,775,000 9,421,000 9,431,000 12/31/2020 12/31/2019 36,320,000 34,588,000 25,895,000 16,063,000 9,832,000 11,678,000 9,832,000 1,331,000 8,566,000 -2,978,000 888,112 594,000 294,112 10,414,000 10,414,000 1,554,000 9,149,000 8,872,000 21,141,000 9,149,000 12,281,000 888,112 592,120 295,992 25,712,000 8,876,000 18,987,000 8,876,000 1,868,000 7,611,000 7,667,000 19,207,000 7,611,000 12,199,000 888,112 590,474 297,637 12,497,000 8,566,000 3,996,000 117.000 807,612 519,064 288,547 > Total Revenue > Cost of Revenue Gross Profit > Operating Expense Operating Income > Net Non Operating Interest Inc... > Other Income Expense Pretax Income Tax Provision > Net Income Common Stockhold.... Diluted NI Available to Com Stock... Basic EPS Diluted EPS Basic Average Shares Diluted Average Shares Total Operating Income as Reported Rent Expense Supplemental Total Expenses Interest Income 23,814,000 23,814,000 15,790,000 9,048,000 19,062,000 19,062,000 11,675,000 10,938,000 4,752,000 3,735,000 1,017,000 -84,000 -205,000 728,000 189,000 539,000 539,000 1,017,000 1,508,000 22,797,000 217,000 4,752,000 3,735,000 1,017,000 -84,000 -205,000 728,000 189,000 561,000 561,000 1,017,000 1,508,000 4,115,000 217,000 2,394,000 1,721,000 -418,000 22,000 1,325,000 348,000 977,000 977,000 1.65 1.61 592,000 609,000 1,721,000 1.456,000 22,797,000 14,069,000 13,000 -1,890,000 1,926,000 -3,816,000 -282,000 -158,000 -4,256,000 -1,182,000 -3,074,000 -3,074,000 -5.44 -5.44 565,000 565,000 -3,816,000 1,240,000 12,864,000 32,000 22,428,000 16,445,000 5,983,000 3,026,000 2,957,000 8,000 -8,000 2,957,000 657,000 2,300,000 2,300,000 4.28 4.27 538,000 539,000 2,957,000 1,363,000 19,471,000 90,000 Finance Home BRETCH WRATIC Interest Expense Watchlists My Portfolio Net Interest Income Net Income from Continuing & Dis Normalized Income EBIT EBITDA Reconciled Cost of Revenue Reconciled Depreciation Net Income from Continuing Oper.... Total Unusual Items Excluding Go..... Total Unusual Items Normalized EBITDA Tax Rate for Calcs Tax Effect of Unusual Items Crypto 301,000 -84,000 539,000 681,894 1,029,000 2,380,000 19,062,000 1,351,000 539,000 -193,000 -193,000 2,573,000 0 -50,106 Yahoo Finance Plus 301,000 -84,000 $39.000 688,682 1,029,000 19,062.000 1,351,000 539,000 -202,000 -202,000 2.582,000 0 -52.318 Pov 431,000 -418,000 11,675,000 1,272,000 977,000 977,000 955,627 -3,000,356 1,756,000 -3,942,000 29,000 29,000 2,999,000 0 News Screeners Markets Videos 7,627 vvvv 314,000 -282,000 -3,074,000 10,938,000 1,255,000 -3,074,000 -102,000 -102,000 -2.585,000 0 -28,356 82,000 8,000 2,300,000 2,300,000 3,039,000 16,445,000 1,219,000 2,300,000 4,258,000 0 0 Transportation By Air: average industry financial ratios for U.S. listed companies Industry: 45- Transportation By Air Financial ratio Solvency Ratios Debt ratio Debt-to-equity ratio Interest coverage ratio Liquidity Ratios Current Ratio Quick Ratio Cash Ratio Profitability Ratios Profit margin ROE (Return on equity), after tax ROA (Return on assets) Gross margin Operating margin (Return on salos) 2021 unlock unbok unlock Unlock unlock unlock wrock unlock selok 2020 0.71 2:45 -37.23 1.14 1.00 0.82 -28.8% -30.9% -98% 27.6% -41.7% Measure of center: median (recommended) Year 2019 0,69 2.03 20.04 0.82 0.58 0.39 7% 16.2% 5.8% 34,5% 9.4% 2018 0.68 1.91 4.04 0.96 0.62 0.37 5.3% 14% 4,8% 52.7% 8.2% 2017 0.65 1.77 5.84 1.21 0.88 0.42 4.7% 21.6% 5.6% 66.5% 9.3% 2016 0.67 1.84 9.15 1.31 0.76 0.45 4.2% 15.6% 5.5% 72.7% 9.4% Asset turnover (days) Receivables turnover (days) Inventory turnover (days) Price Ratios Dividend Payout Ratio unlock unlock unlock 1223 37 29 -0.03 491 17 26 0.20 478 26 75 0.14 465 31 63 0.08 460 33 50 0.13

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the screenshots youve provided which include various financial figures from balance sheets and income statements as well as some industry average ratios we can perform a financial ratio analy...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started