Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Evaluate the firm's 5-year CORPORATE PERFORMANCE using the metrics described in the handout on VBM 1. First review the firm's revenue growth pattern over the

Evaluate the firm's 5-year CORPORATE PERFORMANCE using the metrics described in the handout on VBM

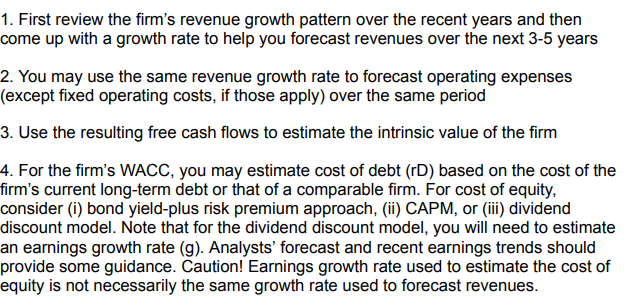

1. First review the firm's revenue growth pattern over the recent years and then come up with a growth rate to help you forecast revenues over the next 3-5 years 2. You may use the same revenue growth rate to forecast operating expenses (except fixed operating costs, if those apply) over the same period 3. Use the resulting free cash flows to estimate the intrinsic value of the firm 4. For the firm's WACC, you may estimate cost of debt (rD) based on the cost of the firm's current long-term debt or that of a comparable firm. For cost of equity, consider (i) bond yield-plus risk premium approach, (ii) CAPM, or (iii) dividend discount model. Note that for the dividend discount model, you will need to estimate an earnings growth rate (g). Analysts' forecast and recent earnings trends should provide some guidance. Caution! Earnings growth rate used to estimate the cost of equity is not necessarily the same growth rate used to forecast revenues.

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Celsius Holdings Inc Corporate Performance Evaluation Introduction Celsius Holdings Inc has demonstrated significant financial growth reflected in rob...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started