Question

Bulldog Electronics Corporation finances its operations with P75 million in stock with a required return of 12 percent and P45 million in bonds with

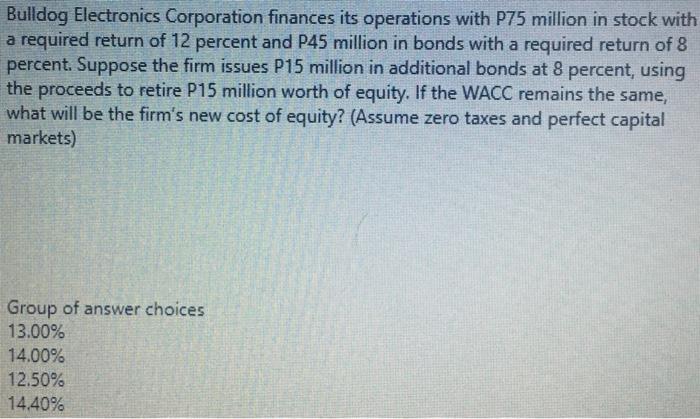

Bulldog Electronics Corporation finances its operations with P75 million in stock with a required return of 12 percent and P45 million in bonds with a required return of 8 percent. Suppose the firm issues P15 million in additional bonds at 8 percent, using the proceeds to retire P15 million worth of equity. If the WACC remains the same, what will be the firm's new cost of equity? (Assume zero taxes and perfect capital markets) Group of answer choices 13.00% 14.00% 12.50% 14.40%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Step 1 Modigliani Miller Theorem It express that the market value of a company is correctly ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting A Focus on Ethical Decision Making

Authors: Steve Jackson, Roby Sawyers, Greg Jenkins

5th edition

324663854, 978-0324663853

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App