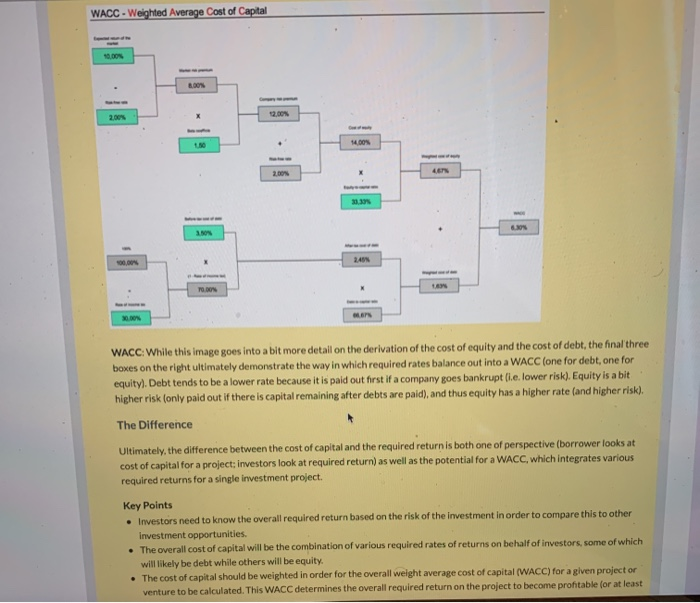

Evaluate the information below. Upon completion, Discuss the weighted average cost of capital (WACC)by analyzing the required rate of various investors and submit in the drop box named "WACC". Why Require Return Rates When making investments on the business level, it is critical to create a required amount of return on the project. A required return is exactly what it sounds like the amount of profit as a percentage of the investment that will be created over a given time period. As an investor, this required rate is a practical concept. Investors have options, and each of those options will offer a rate of return. The risk attached to those rates will fluctuate, as higher risk projects require a higher rate of return. Through establishing this required rate, the investor is stipulating their expectations on repayment of this invested capital, which the borrower will confirm and agree to repay over a set time period (usually via timed installments) So What's Cost of Capital? This required amount of return will ultimately equal the cost of capital, as the required rate from the investor is now a cost being put on the borrower. Now, cost of capital for a given investor will always equate to the required return. However, things get a bit more complicated when organizations fund new projects via a wide variety of stakeholders. Weighted Average Cost of Capital (WACC) This is where the concept of weighted average cost of capital (WACC) enters the equation, as there may be more than one investor with varying rates of return. Intuitively, the WACC will then be a calculation which takes into account the percentage of the overall borrowed capital that each form of investment contributed, and the respective required rates. To make this a bit clearer, let's look at the equation of WACC that takes into account one rate for equity and another rate for debt: WACC-DD+EKd+CD+EKEWACC-DD+EKd+ED+Eke In the above equation, you have Das total debt, E as total equity, Kd as the required return on debt, and Ke as the required return on equity. If various investors require different rates of return, the equation can be altered accordingly (ie. Kd and Ke will each be averaged based on their respective inputs). For the sake of simplicity, this WACC equation will suffice for the majority of calculations WACC - Weighted Average Cost of Capital 2.00% 14.00 2.00 . 240 TO DO WACC: While this image goes into a bit more detail on the derivation of the cost of equity and the cost of debt, the final three boxes on the right ultimately demonstrate the way in which required rates balance out into a WACC (one for debt, one for equity). Debt tends to be a lower rate because it is paid out first if a company goes bankrupt (e. lower risk). Equity is a bit higher risk (only paid out if there is capital remaining after debts are paid), and thus equity has a higher rate (and higher risk). The Difference Ultimately, the difference between the cost of capital and the required return is both one of perspective (borrower looks at cost of capital for a project; investors look at required return) as well as the potential for a WACC, which integrates various required returns for a single investment project. Key Points Investors need to know the overall required return based on the risk of the investment in order to compare this to other investment opportunities. The overall cost of capital will be the combination of various required rates of returns on behalf of investors, some of which will likely be debt while others will be equity. The cost of capital should be weighted in order for the overall weight average cost of capital (WACC)for a given projector venture to be calculated. This WACC determines the overall required return on the project to become profitable (or at least