Answered step by step

Verified Expert Solution

Question

1 Approved Answer

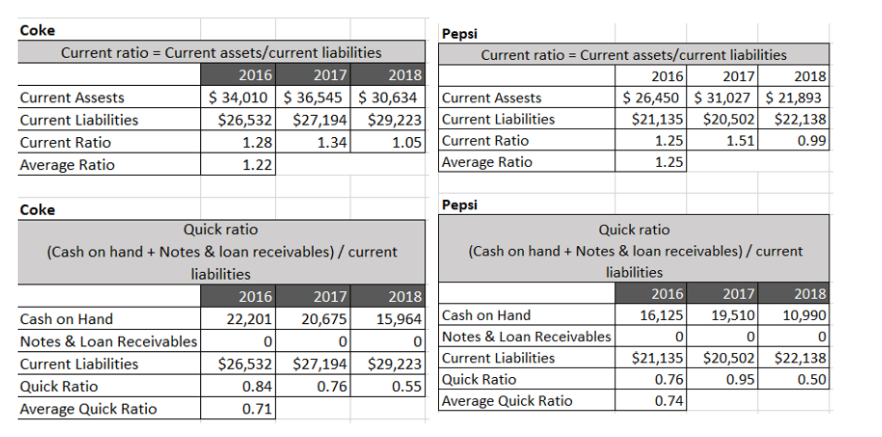

Evaluate the liquidity (ability to meet short-term obligations) of Pepsi & Coke by calculating the current and quick ratios, by averaging their rests over the

Evaluate the liquidity (ability to meet short-term obligations) of Pepsi & Coke by calculating the current and quick ratios, by averaging their rests over the past 3 years. Make your comments from the perspective of a supplier or banker.

*please note I have calculated quick ratio and current ratio, please make comments from the perspective of a supplier or banker

Coke Current ratio = Current assets/current liabilities 2016 2017 2018 Current Assests $ 34,010 $ 36,545 $ 30,634 Current Liabilities $26,532 $27,194 $29,223 Current Ratio 1.28 1.34 1.05 Average Ratio 1.22 Pepsi Current ratio = Current assets/current liabilities 2016 2017 2018 Current Assests $ 26,450 $ 31,027 $ 21,893 Current Liabilities $21,135 $20,502 $22,138 Current Ratio 1.25 1.51 0.99 Average Ratio 1.25 Coke Quick ratio (Cash on hand + Notes & loan receivables)/ current liabilities 2016 2017 2018 Cash on Hand 22,201 20,675 15,964 Notes & Loan Receivables Current Liabilities $26,532 $27,194 $29,223 Quick Ratio 0.84 0.76 0.55 Average Quick Ratio 0.71 Pepsi Quick ratio (Cash on hand + Notes & loan receivables) / current liabilities 2016 2017 2018 Cash on Hand 16,125 19,510 10,990 Notes & Loan Receivables Current Liabilities $21,135 $20,502 $22,138 Quick Ratio Qui 0.76 0.95 0.50 Average Quick Ratio 0.74 OLStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started