Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Evaluate the outcomes of each hedging strategy for hedging the exposure to Malaysia Ringgit. Then, compare the two hedging alternatives with a scenario under which

Evaluate the outcomes of each hedging strategy for hedging the exposure to Malaysia Ringgit. Then, compare the two hedging alternatives with a scenario under which SSI remains unhedged. Would you recommend a hedge or no hedge for the exposure to MYR? If you recommend a hedge, which hedging strategy is most appropriate?

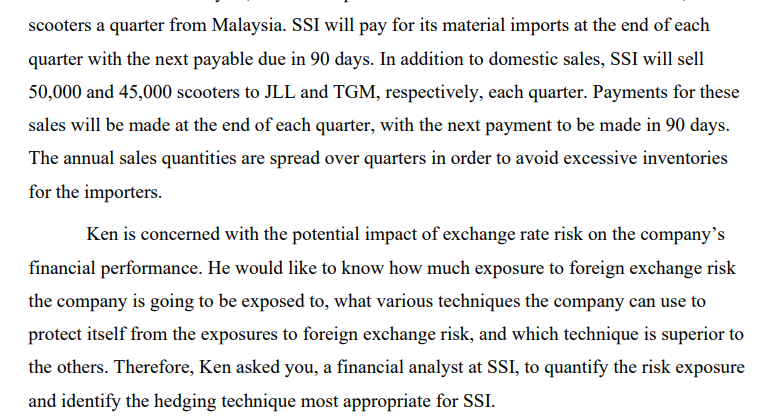

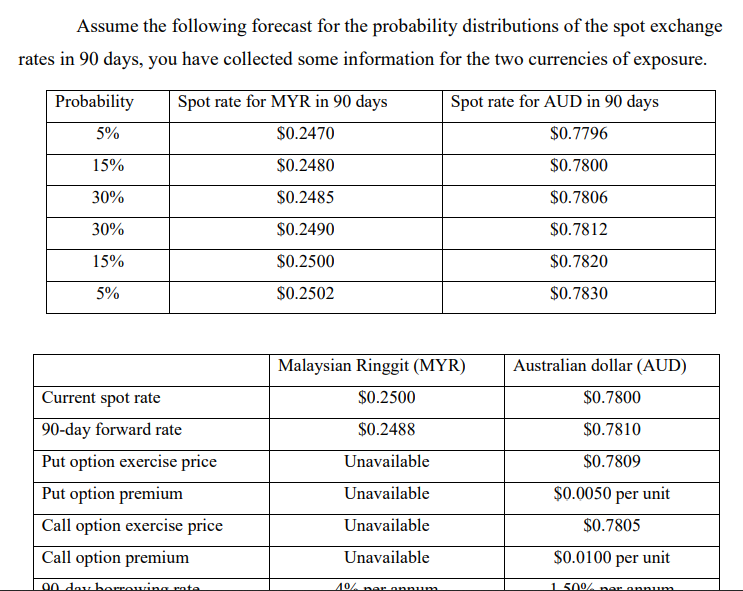

Topic: International Expansion and Exposure to Foreign Exchange Risk States Scooters Incorporation (SSI) is a manufacturer of electric scooters based in the United States. The company imports raw materials from Malaysia, therefore, incurs costs of goods sold denominated in Malaysian Ringgit (currency code: MYR). Its supplier in Malaysia agrees to supply sufficient material to manufacture 600,000 scooters a year at a fixed price of 1,000 Malaysian Ringgit per unit of production. In addition to satisfying the domestic demand for its products, SSI also sells its primary product Primooter" in Australia through an agreement with JLL, an Australian retailer. Under the agreement, JLL commits itself to an annual purchase of 200,000 units of SSI's Primooter scooters for a price of A$800 per unit. Ken Krause, the CEO of SSI, is considering an international expansion strategy to initiate exporting and selling its new product Skater to Malaysia through an exporting agreement with a Malaysian retailer named Top Gear Malaysia (TGM). If the new export agreement is signed, TGM will commit itself to an annual purchase of 180,000 Skater scooters at a fixed price of 2,200 Malaysian Ringgit per unit. In the scenario of exporting to both Australia and Malaysia, SSI will import materials sufficient to manufacture 150,000 scooters a quarter from Malaysia. SSI will pay for its material imports at the end of each andere AL11.11 scooters a quarter from Malaysia. SSI will pay for its material imports at the end of each quarter with the next payable due in 90 days. In addition to domestic sales, SSI will sell 50,000 and 45,000 scooters to JLL and TGM, respectively, each quarter. Payments for these sales will be made at the end of each quarter, with the next payment to be made in 90 days. The annual sales quantities are spread over quarters in order to avoid excessive inventories for the importers. Ken is concerned with the potential impact of exchange rate risk on the company's financial performance. He would like to know how much exposure to foreign exchange risk the company is going to be exposed to, what various techniques the company can use to protect itself from the exposures to foreign exchange risk, and which technique is superior to the others. Therefore, Ken asked you, a financial analyst at SSI, to quantify the risk exposure and identify the hedging technique most appropriate for SSI. Assume the following forecast for the probability distributions of the spot exchange rates in 90 days, you have collected some information for the two currencies of exposure. Probability Spot rate for MYR in 90 days $0.2470 Spot rate for AUD in 90 days $0.7796 5% 15% $0.2480 $0.7800 30% $0.2485 $0.7806 30% $0.2490 $0.7812 15% $0.2500 $0.7820 5% $0.2502 $0.7830 Malaysian Ringgit (MYR) Australian dollar (AUD) $0.7800 $0.2500 $0.2488 $0.7810 Unavailable Current spot rate 90-day forward rate Put option exercise price Put option premium Call option exercise price Call option premium Unavailable Unavailable $0.7809 $0.0050 per unit $0.7805 $0.0100 per unit Unavailable on du bare at 40arannum 1_500/bannum Call option premium 90-day borrowing rate 90-day lending rate Unavailable 4% per annum 3.6% per annum $0.0100 per unit 1.50% per annum 1.20% per annum US 90-day borrowing rate 2.0% US 90-day lending rate 1.8% Note: the Australian options are available for A$100,000 per option contract. Unfortunately, no options are available for Malaysian Ringgit. SSI's next international receipts and payments will occur 90 days from now. You are asked to calculate the size of net exposure to each foreign currency and give advice on the detailed steps of: i) the forward hedge; ii) the money market hedge; iii) the options hedge. If the company decides to hedge, Ken would like to hedge the entire amount subject to exchange rate fluctuation in each currency. Prepare a report to present your analytical results and make recommendations for the desirability of expansion to the Malaysian market and the best approach to managing the exposure to foreign exchange rate risk. Topic: International Expansion and Exposure to Foreign Exchange Risk States Scooters Incorporation (SSI) is a manufacturer of electric scooters based in the United States. The company imports raw materials from Malaysia, therefore, incurs costs of goods sold denominated in Malaysian Ringgit (currency code: MYR). Its supplier in Malaysia agrees to supply sufficient material to manufacture 600,000 scooters a year at a fixed price of 1,000 Malaysian Ringgit per unit of production. In addition to satisfying the domestic demand for its products, SSI also sells its primary product Primooter" in Australia through an agreement with JLL, an Australian retailer. Under the agreement, JLL commits itself to an annual purchase of 200,000 units of SSI's Primooter scooters for a price of A$800 per unit. Ken Krause, the CEO of SSI, is considering an international expansion strategy to initiate exporting and selling its new product Skater to Malaysia through an exporting agreement with a Malaysian retailer named Top Gear Malaysia (TGM). If the new export agreement is signed, TGM will commit itself to an annual purchase of 180,000 Skater scooters at a fixed price of 2,200 Malaysian Ringgit per unit. In the scenario of exporting to both Australia and Malaysia, SSI will import materials sufficient to manufacture 150,000 scooters a quarter from Malaysia. SSI will pay for its material imports at the end of each andere AL11.11 scooters a quarter from Malaysia. SSI will pay for its material imports at the end of each quarter with the next payable due in 90 days. In addition to domestic sales, SSI will sell 50,000 and 45,000 scooters to JLL and TGM, respectively, each quarter. Payments for these sales will be made at the end of each quarter, with the next payment to be made in 90 days. The annual sales quantities are spread over quarters in order to avoid excessive inventories for the importers. Ken is concerned with the potential impact of exchange rate risk on the company's financial performance. He would like to know how much exposure to foreign exchange risk the company is going to be exposed to, what various techniques the company can use to protect itself from the exposures to foreign exchange risk, and which technique is superior to the others. Therefore, Ken asked you, a financial analyst at SSI, to quantify the risk exposure and identify the hedging technique most appropriate for SSI. Assume the following forecast for the probability distributions of the spot exchange rates in 90 days, you have collected some information for the two currencies of exposure. Probability Spot rate for MYR in 90 days $0.2470 Spot rate for AUD in 90 days $0.7796 5% 15% $0.2480 $0.7800 30% $0.2485 $0.7806 30% $0.2490 $0.7812 15% $0.2500 $0.7820 5% $0.2502 $0.7830 Malaysian Ringgit (MYR) Australian dollar (AUD) $0.7800 $0.2500 $0.2488 $0.7810 Unavailable Current spot rate 90-day forward rate Put option exercise price Put option premium Call option exercise price Call option premium Unavailable Unavailable $0.7809 $0.0050 per unit $0.7805 $0.0100 per unit Unavailable on du bare at 40arannum 1_500/bannum Call option premium 90-day borrowing rate 90-day lending rate Unavailable 4% per annum 3.6% per annum $0.0100 per unit 1.50% per annum 1.20% per annum US 90-day borrowing rate 2.0% US 90-day lending rate 1.8% Note: the Australian options are available for A$100,000 per option contract. Unfortunately, no options are available for Malaysian Ringgit. SSI's next international receipts and payments will occur 90 days from now. You are asked to calculate the size of net exposure to each foreign currency and give advice on the detailed steps of: i) the forward hedge; ii) the money market hedge; iii) the options hedge. If the company decides to hedge, Ken would like to hedge the entire amount subject to exchange rate fluctuation in each currency. Prepare a report to present your analytical results and make recommendations for the desirability of expansion to the Malaysian market and the best approach to managing the exposure to foreign exchange rate riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started