Question

Evaluate the performance of T Rowe Price Blue Chip Growth (Ticker: TRBCX), Goldman Sachs CORE Large Cap Growth (Ticker: GLCGX), Diversified Special Equity Inv (Ticker:

Evaluate the performance of T Rowe Price Blue Chip Growth (Ticker: TRBCX), Goldman Sachs CORE Large Cap Growth (Ticker: GLCGX), Diversified Special Equity Inv (Ticker: DVPEX), and DFA Tax-Managed U.S. Small Cap Value (Ticker: DTMVX) over the period from January 2000 through December 2004. Use the CAPM model. (Exhibit 4 profiles the four funds in December 2004 and Exhibit 5 shows monthly total returns for the period from January 2000 through December 2004.) Which funds show evidence of stock picking skill? Would you recommend buying one of these funds?

Don't copy from chegg and detailed explanation please.

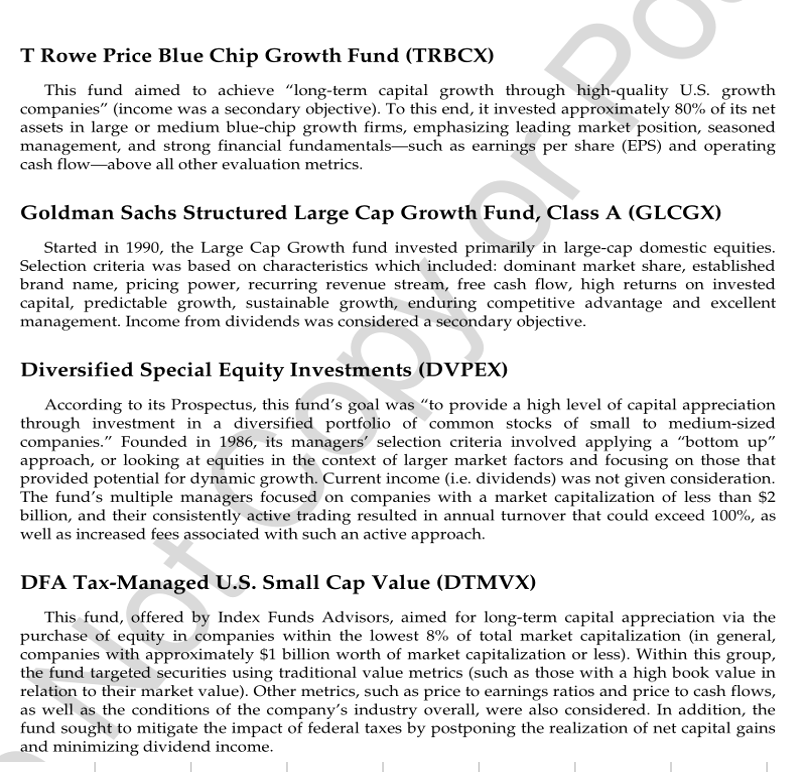

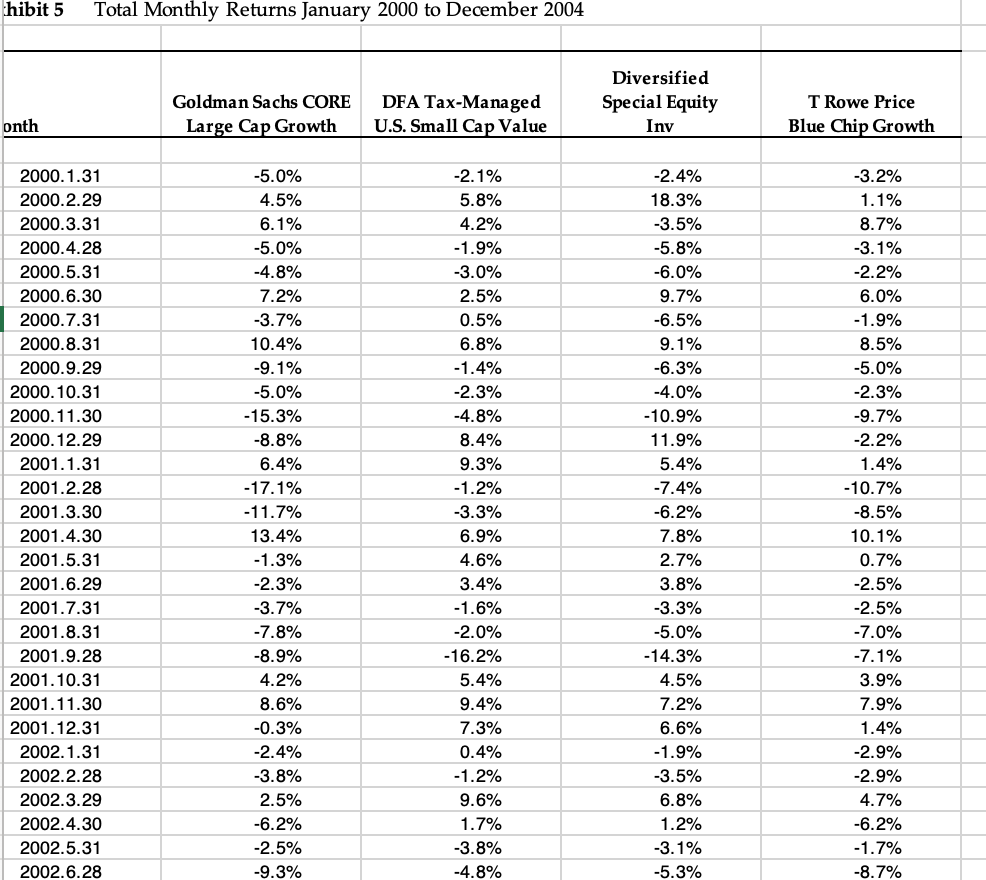

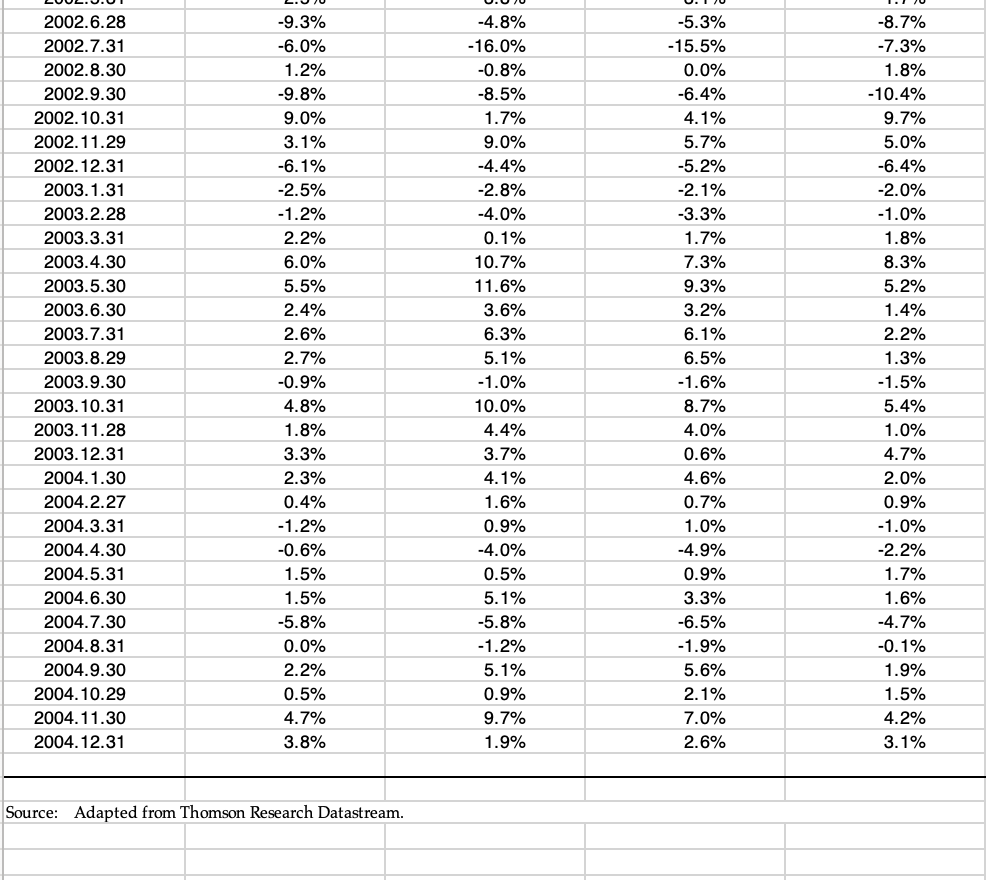

This fund aimed to achieve "long-term capital growth through high-quality U.S. growth companies" (income was a secondary objective). To this end, it invested approximately 80% of its net assets in large or medium blue-chip growth firms, emphasizing leading market position, seasoned management, and strong financial fundamentals-such as earnings per share (EPS) and operating cash flow-above all other evaluation metrics. Goldman Sachs Structured Large Cap Growth Fund, Class A (GLCGX) Started in 1990, the Large Cap Growth fund invested primarily in large-cap domestic equities. Selection criteria was based on characteristics which included: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, enduring competitive advantage and excellent management. Income from dividends was considered a secondary objective. Diversified Special Equity Investments (DVPEX) According to its Prospectus, this fund's goal was "to provide a high level of capital appreciation through investment in a diversified portfolio of common stocks of small to medium-sized companies." Founded in 1986, its managers' selection criteria involved applying a "bottom up" approach, or looking at equities in the context of larger market factors and focusing on those that provided potential for dynamic growth. Current income (i.e. dividends) was not given consideration. The fund's multiple managers focused on companies with a market capitalization of less than $2 billion, and their consistently active trading resulted in annual turnover that could exceed 100%, as well as increased fees associated with such an active approach. DFA Tax-Managed U.S. Small Cap Value (DTMVX) This fund, offered by Index Funds Advisors, aimed for long-term capital appreciation via the purchase of equity in companies within the lowest 8% of total market capitalization (in general, companies with approximately $1 billion worth of market capitalization or less). Within this group, the fund targeted securities using traditional value metrics (such as those with a high book value in relation to their market value). Other metrics, such as price to earnings ratios and price to cash flows, as well as the conditions of the company's industry overall, were also considered. In addition, the fund sought to mitigate the impact of federal taxes by postponing the realization of net capital gains and minimizing dividend income. hibit 5 Total Monthly Returns January 2000 to December 2004 Source: Adapted from Thomson Research Datastream. This fund aimed to achieve "long-term capital growth through high-quality U.S. growth companies" (income was a secondary objective). To this end, it invested approximately 80% of its net assets in large or medium blue-chip growth firms, emphasizing leading market position, seasoned management, and strong financial fundamentals-such as earnings per share (EPS) and operating cash flow-above all other evaluation metrics. Goldman Sachs Structured Large Cap Growth Fund, Class A (GLCGX) Started in 1990, the Large Cap Growth fund invested primarily in large-cap domestic equities. Selection criteria was based on characteristics which included: dominant market share, established brand name, pricing power, recurring revenue stream, free cash flow, high returns on invested capital, predictable growth, sustainable growth, enduring competitive advantage and excellent management. Income from dividends was considered a secondary objective. Diversified Special Equity Investments (DVPEX) According to its Prospectus, this fund's goal was "to provide a high level of capital appreciation through investment in a diversified portfolio of common stocks of small to medium-sized companies." Founded in 1986, its managers' selection criteria involved applying a "bottom up" approach, or looking at equities in the context of larger market factors and focusing on those that provided potential for dynamic growth. Current income (i.e. dividends) was not given consideration. The fund's multiple managers focused on companies with a market capitalization of less than $2 billion, and their consistently active trading resulted in annual turnover that could exceed 100%, as well as increased fees associated with such an active approach. DFA Tax-Managed U.S. Small Cap Value (DTMVX) This fund, offered by Index Funds Advisors, aimed for long-term capital appreciation via the purchase of equity in companies within the lowest 8% of total market capitalization (in general, companies with approximately $1 billion worth of market capitalization or less). Within this group, the fund targeted securities using traditional value metrics (such as those with a high book value in relation to their market value). Other metrics, such as price to earnings ratios and price to cash flows, as well as the conditions of the company's industry overall, were also considered. In addition, the fund sought to mitigate the impact of federal taxes by postponing the realization of net capital gains and minimizing dividend income. hibit 5 Total Monthly Returns January 2000 to December 2004 Source: Adapted from Thomson Research DatastreamStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started