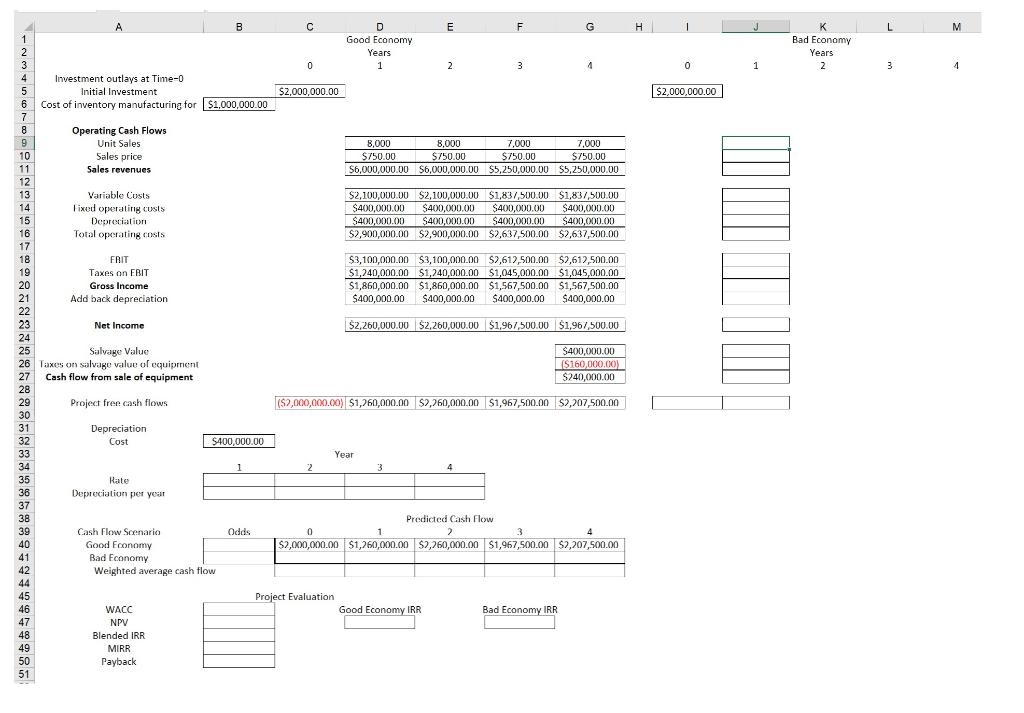

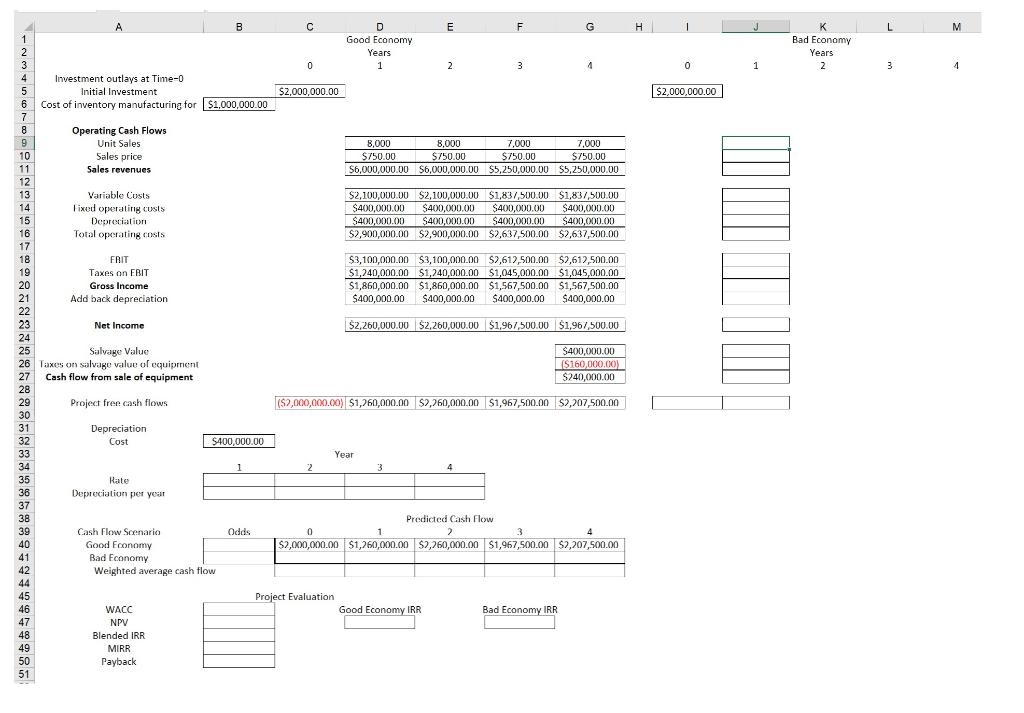

Evaluate this project. the required rate of return is 22.22 Project 3: This project is over the course of 4 years. You will need an investment of $2 million in year 0, $1 million of it in inventory for year 1 production. Depreciation is a straight line over the 4 years, and the salvage value at the end of the 4 years will be $400,000. Total inventory produced will be 40,000 units, and sales are expected to be 8000 in the 1st 2 years, and 7000 in the 3rd and 4th year, with the remainder in the 4th. Prices are expected to be set at $750 for the 4 years. There is a 50% chance the new product will not receive market share by the end of the 1st year, and if that occurs, sales will only be 10% of projections in the 1st year and the price will 20% less, and the remainder of the inventory will have to be scrapped. The project will be abandoned before production starts on the second year of inventory. The machinery would be resold at the book value at the end of the 1st year. The fixed cost is $400,000 per year and the variable cost are 35% of revenue. The tax rate is at 40%.

Evaluate this project. the required rate of return is 22.22 Project 3: This project is over the course of 4 years. You will need an investment of $2 million in year 0, $1 million of it in inventory for year 1 production. Depreciation is a straight line over the 4 years, and the salvage value at the end of the 4 years will be $400,000. Total inventory produced will be 40,000 units, and sales are expected to be 8000 in the 1st 2 years, and 7000 in the 3rd and 4th year, with the remainder in the 4th. Prices are expected to be set at $750 for the 4 years. There is a 50% chance the new product will not receive market share by the end of the 1st year, and if that occurs, sales will only be 10% of projections in the 1st year and the price will 20% less, and the remainder of the inventory will have to be scrapped. The project will be abandoned before production starts on the second year of inventory. The machinery would be resold at the book value at the end of the 1st year. The fixed cost is $400,000 per year and the variable cost are 35% of revenue. The tax rate is at 40%.

H 1 J M K Bad Economy Years 2. 0 1 3 4 $2,000,000.00 B c D E F G 1 Good Economy 2 Years 3 0 1 2 3 4 4 Investment outlays at Time-O 5 Initial Investment $2,000,000.00 6 Cost of inventory manufacturing for $1,000,000.00 7 7 8 Operating Cash Flows 9 Unit Sales 8,000 8,000 7,000 7,000 10 Sales price $750.00 $750.00 $750.00 $ $750.00 11 Sales revenues $6,000,000.00 $6,000,000.00 $5,250,000.00 $5,250,000.00 12 13 Variable Custs $2,100,000.00 $2,100,000.00 $1,837,500.00 $1,837,500.00 14 Fixed operating costs $400,000.00 $400,000.00 $400,000.00 $400,000.00 15 Depreciation $400,000.00 $400,000.00 $400,000.00 $400,000.00 16 Total operating costs $2,900,000.00 $2,900,000.00 $2,637,500.00 $2,637,500.00 17 18 FRIT $3,100,000.00 $3,100,000.00 52,612,500.00 52,612,500.00 19 Taxes on FBIT $1,240,000.00 $1,240,000.00 $1,045,000.00 $1,045,000.00 20 Gross Income $1,860,000.00 $1,860,000.00 $1,567,500.00 $1,567,500.00 21 Add back depreciation $400,000.00 $400,000.00 $400,000.00 $400,000.00 22 23 Net Income $2,260,000.00 $2,260,000.00 $1,967,500.00 $1,967,500.00 24 25 Salvage Value $400,000.00 26 Taxes on salvago value of equipment ($160,000,00) 27 Cash flow from sale of equipment $240,000.00 28 29 Project free cash flows (52,000,000.00) $1,260,000.00 $2,760,000.00 $1,967,500.00 $2,207,500.00 30 31 Depreciation 32 Cost $400,000.00 33 Year 34 1 2 4 35 Rate 36 Depreciation per your 37 38 Predicted Cash Flow 39 Cash Flow Scenario Odds 1 2 3 4 40 Good Economy $2,000,000.00 $1,260,000.00 $2,760,000.00 $1,967,500.00 $2,207,500.00 41 Bad Economy 42 Weighted average cash flow 44 45 Project Evaluation 46 WACC Good Economy IRR Bad Economy IRR 47 NPV 48 Blended IRR 49 MIRR 50 Payback 51 3 H 1 J M K Bad Economy Years 2. 0 1 3 4 $2,000,000.00 B c D E F G 1 Good Economy 2 Years 3 0 1 2 3 4 4 Investment outlays at Time-O 5 Initial Investment $2,000,000.00 6 Cost of inventory manufacturing for $1,000,000.00 7 7 8 Operating Cash Flows 9 Unit Sales 8,000 8,000 7,000 7,000 10 Sales price $750.00 $750.00 $750.00 $ $750.00 11 Sales revenues $6,000,000.00 $6,000,000.00 $5,250,000.00 $5,250,000.00 12 13 Variable Custs $2,100,000.00 $2,100,000.00 $1,837,500.00 $1,837,500.00 14 Fixed operating costs $400,000.00 $400,000.00 $400,000.00 $400,000.00 15 Depreciation $400,000.00 $400,000.00 $400,000.00 $400,000.00 16 Total operating costs $2,900,000.00 $2,900,000.00 $2,637,500.00 $2,637,500.00 17 18 FRIT $3,100,000.00 $3,100,000.00 52,612,500.00 52,612,500.00 19 Taxes on FBIT $1,240,000.00 $1,240,000.00 $1,045,000.00 $1,045,000.00 20 Gross Income $1,860,000.00 $1,860,000.00 $1,567,500.00 $1,567,500.00 21 Add back depreciation $400,000.00 $400,000.00 $400,000.00 $400,000.00 22 23 Net Income $2,260,000.00 $2,260,000.00 $1,967,500.00 $1,967,500.00 24 25 Salvage Value $400,000.00 26 Taxes on salvago value of equipment ($160,000,00) 27 Cash flow from sale of equipment $240,000.00 28 29 Project free cash flows (52,000,000.00) $1,260,000.00 $2,760,000.00 $1,967,500.00 $2,207,500.00 30 31 Depreciation 32 Cost $400,000.00 33 Year 34 1 2 4 35 Rate 36 Depreciation per your 37 38 Predicted Cash Flow 39 Cash Flow Scenario Odds 1 2 3 4 40 Good Economy $2,000,000.00 $1,260,000.00 $2,760,000.00 $1,967,500.00 $2,207,500.00 41 Bad Economy 42 Weighted average cash flow 44 45 Project Evaluation 46 WACC Good Economy IRR Bad Economy IRR 47 NPV 48 Blended IRR 49 MIRR 50 Payback 51 3

Evaluate this project. the required rate of return is 22.22 Project 3: This project is over the course of 4 years. You will need an investment of $2 million in year 0, $1 million of it in inventory for year 1 production. Depreciation is a straight line over the 4 years, and the salvage value at the end of the 4 years will be $400,000. Total inventory produced will be 40,000 units, and sales are expected to be 8000 in the 1st 2 years, and 7000 in the 3rd and 4th year, with the remainder in the 4th. Prices are expected to be set at $750 for the 4 years. There is a 50% chance the new product will not receive market share by the end of the 1st year, and if that occurs, sales will only be 10% of projections in the 1st year and the price will 20% less, and the remainder of the inventory will have to be scrapped. The project will be abandoned before production starts on the second year of inventory. The machinery would be resold at the book value at the end of the 1st year. The fixed cost is $400,000 per year and the variable cost are 35% of revenue. The tax rate is at 40%.

Evaluate this project. the required rate of return is 22.22 Project 3: This project is over the course of 4 years. You will need an investment of $2 million in year 0, $1 million of it in inventory for year 1 production. Depreciation is a straight line over the 4 years, and the salvage value at the end of the 4 years will be $400,000. Total inventory produced will be 40,000 units, and sales are expected to be 8000 in the 1st 2 years, and 7000 in the 3rd and 4th year, with the remainder in the 4th. Prices are expected to be set at $750 for the 4 years. There is a 50% chance the new product will not receive market share by the end of the 1st year, and if that occurs, sales will only be 10% of projections in the 1st year and the price will 20% less, and the remainder of the inventory will have to be scrapped. The project will be abandoned before production starts on the second year of inventory. The machinery would be resold at the book value at the end of the 1st year. The fixed cost is $400,000 per year and the variable cost are 35% of revenue. The tax rate is at 40%.