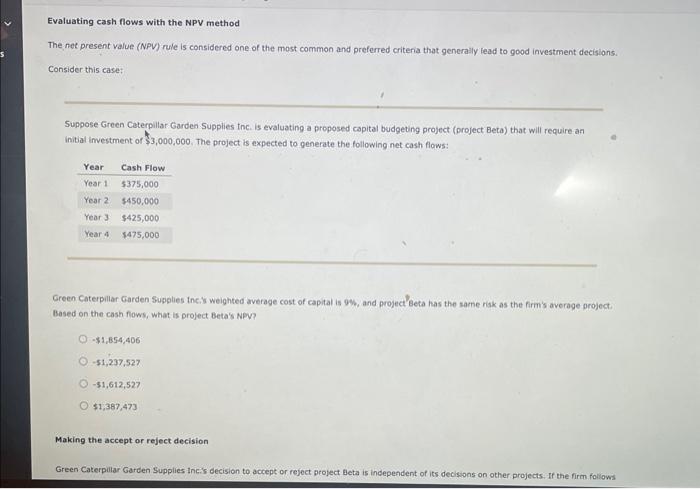

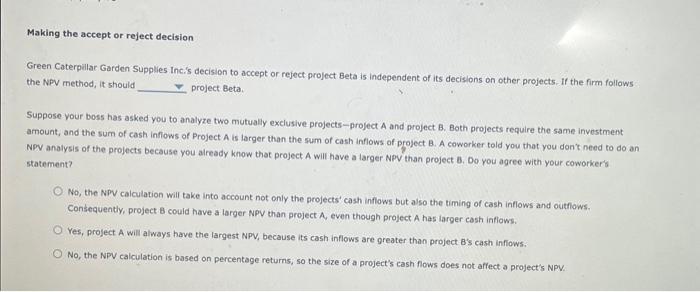

Evaluating cash flows with the NPV method The net present value (NPV) rule is considered one of the most common and preferred critena that generaily lead to good investment decisions. Consider this case? Suppose Green Caterpillar Garden Supplies tnc. is evaluating a proposed capital budgeting project (project Beta) that will require an initial investment of $3,000,000. The project is expected to generate the following net cash flows: Green Caterpillar Garden Supglies incis weighted average cost of capital is 9%, and project'Beta has the same risk as the firm's average project. Based on the cash flows, what is project Beta's NeV? $1,654,40651,297,52751,612,527$1,387,473 Making the accept or reject decision Making the accept or reject decision Green Caterpilar Garden Supplies. Incis decision to accept or reject project Beta is independent of its decisions on other projects. If the firm follows the NPV method, it should project Beta. Suppose your boss has asked you to analyze two mutually exclusive projects-project A and project B. Both projects require the same investment amount, and the sum of cash infiows of Project A is larger than the sum of cash inflows of project B. A coworker told you that you don't need to do an NPV analysis of the projects because you already know that project A will have a larger NPV than project B. Do you agree with your coworker's statement? No, the NPV calculation will take into account not only the projects' cash inflows but also the timing of cash inflows and outflows. Consequently, project B could have a larger NPV than project A, even though project A has larger cash infiows. Yes, project A will always have the largest NPV, because its cash inflows are greater than project B's cash inflows. No, the NPV calculation is based on percentage returns, so the size of a project's cash flows does not affect a project's NPY. Making the accept or reject decision Green Caterpilar Garden Supplies. Incis decision to accept or reject project Beta is independent of its decisions on other projects. If the firm follows the NPV method, it should project Beta. Suppose your boss has asked you to analyze two mutually exclusive projects-project A and project B. Both projects require the same investment amount, and the sum of cash infiows of Project A is larger than the sum of cash inflows of project B. A coworker told you that you don't need to do an NPV analysis of the projects because you already know that project A will have a larger NPV than project B. Do you agree with your coworker's statement? No, the NPV calculation will take into account not only the projects' cash inflows but also the timing of cash inflows and outflows. Consequently, project B could have a larger NPV than project A, even though project A has larger cash infiows. Yes, project A will always have the largest NPV, because its cash inflows are greater than project B's cash inflows. No, the NPV calculation is based on percentage returns, so the size of a project's cash flows does not affect a project's NPY