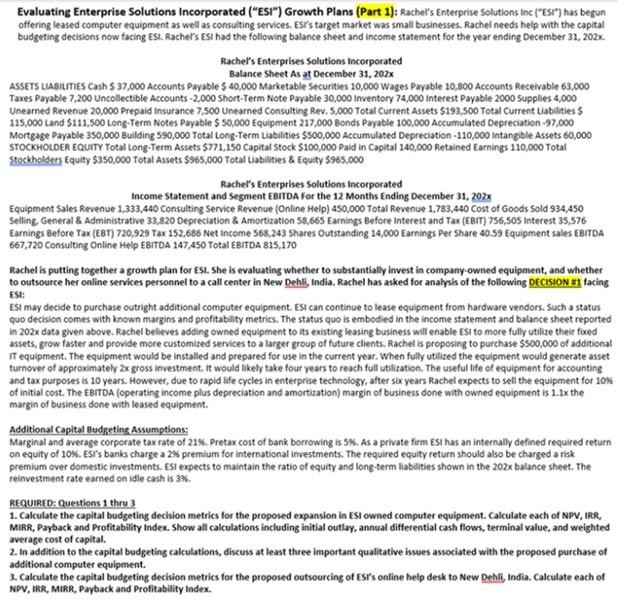

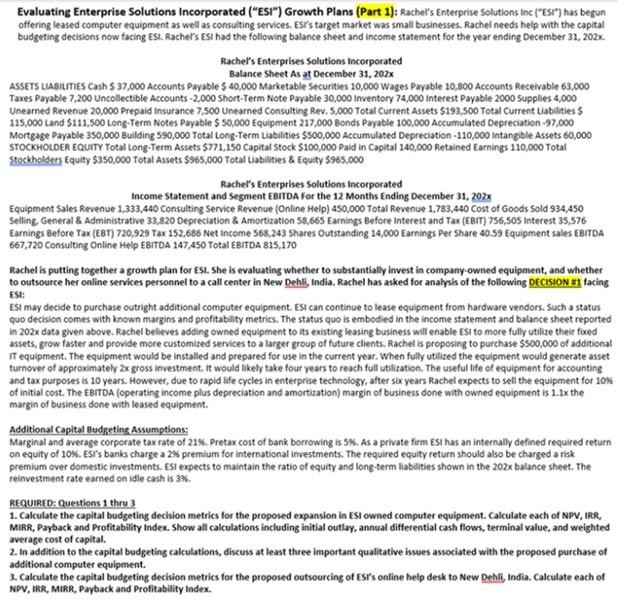

Evaluating Enterprise Solutions Incorporated ("ESI") Growth Plans (Part 1): Rachel's Enterprise Solutions inc ("Esi") has begun offering leased computer equipment as well as consulting services. ESr's target market was small businesses. Rachel needs help with the capital budgeting decisions now facing ESI. Racher's ESI had the following balance sheet and income statement for the year ending December 31 , 202x. Rachel's Enterprises Solutions incorporated Balance Sheet As at December 31, 202x ASSETS UABiumes Cash $37,000 Accounts Payable $40,000 Marketable Securities 10,000 Wages Payable 10,800 Accounts Recelvable 63,000 Taxes Payable 7,200 Uncollectible Accounts -2,000 Short-Term Note Payable 30,000 inventory 74,000 interest Payable 2000 Supplies 4,000 Unearned Revenue 20,000 Prepaid insurance 7,500 Unearned Consulting Rev, 5,000 Total Current Assets $193,500 Total Current Uabbilities $ 115,000 Land \$111,500 Long.Term Notes Payable \$ 50,000 Equipment 217,000 Bonds Payable 100,000 Accumulated Depreciation -97,000 Mortgage Payable 350,000 Bulding 590,000 Total Long-Term Labilties $500,000 Accumulated Depreciation - 110,000 intangible Assets 60,000 STOCKHOLDER EQuITY Total Long-Term Assets $771,150 Capital Stock $100,000 Paid in Capital 140,000 Retained Earnings 110,000 Total stockholdets Equity $350,000 Total Assets $965,000 Total vabilities \& Equity $965,000 Rachel's Enterprises Solutions incorporated Income statement and Segment EBroA for the 12 Months Ending December 31, 202x Equipment Sales Revenue 1,333,440 Consulting Service Revenue (Online Help) 450,000 Total Revenue 1,783,440 Cost of Goods Sold 934,450 Selling. General \& Administrative 33,820 Depreciation \& Amortization 58,665 Earnings Before interest and Tax ([8m) 756,505 Interest 35,576 Earnings Before Tax (EBT) 720,929 Tax 152,686 Net income 568,243 Shares Outstanding 14,000 Earnings per Share 40.59 Equipment sales EBIrDA 667,720 Consulting Online Help E8ITDA 147,450 Total EBITDA 815,170 Rachel is putting together a growth plan for ESI. She is evaluating whether to substantially invest in company-owned equipment, and whether to outsource her online services personnel to a call center in New Dehli, India. Rachel has asked for analysis of the following DFCision 31 facing FS: ESI may decide to purchase outright additional computer equipment. ESI can continue to lease equipment from hardware vendors. Such a status quo decision comes with known margins and profitability metrics. The status quo is embodied in the income statement and balance sheet reported in 202x data given above. Rachel believes adding owned equipment to its existing leasing business will enable tsi to more fully utilize their foced assets, grow faster and provide more customited services to a larger group of future clients. Rachel is proposing to purchase $500,000 of additional It equipment. The equipment would be installed and prepared for use in the current year. When fully utilized the equipment would generate asset turnover of approximately 2x gross investment. it would likely take four years to reach full utilization. The useful life of equipment for accounting and tax purposes is 10 years. However, due to rapid lde cycles in enterprise technology, after six years Rachel expects to sell the equipment for 10W of initial cost. The EBrTOA (operating income plus depreciation and amortization) margin of business done with owned equipment is 1.1 the margin of business done with leased equipment. Additional Capital Budgeting Assumptions: Marginal and average corporate tax rate of 21\%. Pretax cost of bank borrowing is SW. As a private firm ESI has an internally defined required return on equity of 10N. EST's banks charge a 2% premium for international investments. The required equity return should also be charged a risk premium over domestic investments. ESI expects to maintain the ratio of equity and long-term liablities shown in the 202x balance sheet. The reinvestment rate earned on idle cash is 3%. REQURRE: Questions 1 thru 3 1. Calculate the capital budgeting decision metrics for the proposed expansion in ESI owned computer equipment. Calculate each of NPV, IRR, MiRR, Payback and Profitability index. Show all calculations including initial outlay, annual differential cash flows, terminal value, and weighted average cost of capital. 2. In addition to the capital budgeting calculations, discuss at least three important qualitative isses associated with the proposed purchase of additional computer equipment. 3. Calculate the capital budgeting decision metrics for the proposed outsourcing of ESr's online help desk to New Dehli, India, Calculate each of NPV, IRR, MIRR, Payback and Profitability Index. Evaluating Enterprise Solutions Incorporated ("ESI") Growth Plans (Part 1): Rachel's Enterprise Solutions inc ("Esi") has begun offering leased computer equipment as well as consulting services. ESr's target market was small businesses. Rachel needs help with the capital budgeting decisions now facing ESI. Racher's ESI had the following balance sheet and income statement for the year ending December 31 , 202x. Rachel's Enterprises Solutions incorporated Balance Sheet As at December 31, 202x ASSETS UABiumes Cash $37,000 Accounts Payable $40,000 Marketable Securities 10,000 Wages Payable 10,800 Accounts Recelvable 63,000 Taxes Payable 7,200 Uncollectible Accounts -2,000 Short-Term Note Payable 30,000 inventory 74,000 interest Payable 2000 Supplies 4,000 Unearned Revenue 20,000 Prepaid insurance 7,500 Unearned Consulting Rev, 5,000 Total Current Assets $193,500 Total Current Uabbilities $ 115,000 Land \$111,500 Long.Term Notes Payable \$ 50,000 Equipment 217,000 Bonds Payable 100,000 Accumulated Depreciation -97,000 Mortgage Payable 350,000 Bulding 590,000 Total Long-Term Labilties $500,000 Accumulated Depreciation - 110,000 intangible Assets 60,000 STOCKHOLDER EQuITY Total Long-Term Assets $771,150 Capital Stock $100,000 Paid in Capital 140,000 Retained Earnings 110,000 Total stockholdets Equity $350,000 Total Assets $965,000 Total vabilities \& Equity $965,000 Rachel's Enterprises Solutions incorporated Income statement and Segment EBroA for the 12 Months Ending December 31, 202x Equipment Sales Revenue 1,333,440 Consulting Service Revenue (Online Help) 450,000 Total Revenue 1,783,440 Cost of Goods Sold 934,450 Selling. General \& Administrative 33,820 Depreciation \& Amortization 58,665 Earnings Before interest and Tax ([8m) 756,505 Interest 35,576 Earnings Before Tax (EBT) 720,929 Tax 152,686 Net income 568,243 Shares Outstanding 14,000 Earnings per Share 40.59 Equipment sales EBIrDA 667,720 Consulting Online Help E8ITDA 147,450 Total EBITDA 815,170 Rachel is putting together a growth plan for ESI. She is evaluating whether to substantially invest in company-owned equipment, and whether to outsource her online services personnel to a call center in New Dehli, India. Rachel has asked for analysis of the following DFCision 31 facing FS: ESI may decide to purchase outright additional computer equipment. ESI can continue to lease equipment from hardware vendors. Such a status quo decision comes with known margins and profitability metrics. The status quo is embodied in the income statement and balance sheet reported in 202x data given above. Rachel believes adding owned equipment to its existing leasing business will enable tsi to more fully utilize their foced assets, grow faster and provide more customited services to a larger group of future clients. Rachel is proposing to purchase $500,000 of additional It equipment. The equipment would be installed and prepared for use in the current year. When fully utilized the equipment would generate asset turnover of approximately 2x gross investment. it would likely take four years to reach full utilization. The useful life of equipment for accounting and tax purposes is 10 years. However, due to rapid lde cycles in enterprise technology, after six years Rachel expects to sell the equipment for 10W of initial cost. The EBrTOA (operating income plus depreciation and amortization) margin of business done with owned equipment is 1.1 the margin of business done with leased equipment. Additional Capital Budgeting Assumptions: Marginal and average corporate tax rate of 21\%. Pretax cost of bank borrowing is SW. As a private firm ESI has an internally defined required return on equity of 10N. EST's banks charge a 2% premium for international investments. The required equity return should also be charged a risk premium over domestic investments. ESI expects to maintain the ratio of equity and long-term liablities shown in the 202x balance sheet. The reinvestment rate earned on idle cash is 3%. REQURRE: Questions 1 thru 3 1. Calculate the capital budgeting decision metrics for the proposed expansion in ESI owned computer equipment. Calculate each of NPV, IRR, MiRR, Payback and Profitability index. Show all calculations including initial outlay, annual differential cash flows, terminal value, and weighted average cost of capital. 2. In addition to the capital budgeting calculations, discuss at least three important qualitative isses associated with the proposed purchase of additional computer equipment. 3. Calculate the capital budgeting decision metrics for the proposed outsourcing of ESr's online help desk to New Dehli, India, Calculate each of NPV, IRR, MIRR, Payback and Profitability Index