Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Evaluating Financial Performance Ratio Analysis In this assignment, you will be comparing financial ratios between Wicked Good Cupcakes and the company you chose to blog

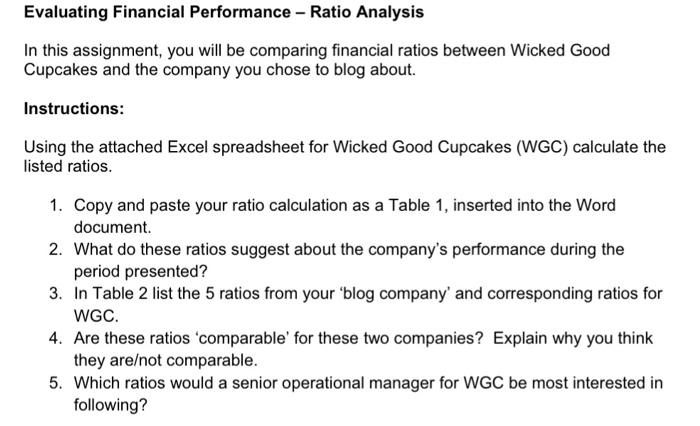

Evaluating Financial Performance Ratio Analysis

In this assignment, you will be comparing financial ratios between Wicked Good Cupcakes and the company you chose to blog about.

Using the attached Excel spreadsheet for Wicked Good Cupcakes (WGC) calculate the listed ratios.

| ANNUAL BALANCE SHEET | ||||||||||

| ($ Thousands) | ||||||||||

| 31-Dec-15 | 31-Dec-16 | |||||||||

| 31-Dec-15 | 31-Dec-16 | |||||||||

| ASSETS | Profitability Ratios (in %) | |||||||||

| Cash & Short-Term Investments | $17.11 | $25.05 | Return on equity | |||||||

| Net Receivables | $1.62 | $1.84 | Return on assets | |||||||

| Inventories | $42.72 | $39.68 | Return on invested capital | |||||||

| Prepaid Expenses | $0.00 | $0.00 | Profit margin | |||||||

| Other Current Assets | $3.38 | $2.93 | Gross margin | |||||||

| Total Current Assets | $64.84 | $69.49 | Turnover-Control Ratios | |||||||

| Asset turnover | ||||||||||

| Gross Plant, Property & Equipment | $63.75 | $58.28 | Fixed-asset turnover | |||||||

| Accumulated Depreciation | $36.16 | $32.61 | Inventory turnover | |||||||

| Collection period (days) | ||||||||||

| Net Plant, Property & Equipment | $27.58 | $25.67 | Days' sales in cash | |||||||

| Intangibles | $5.88 | $6.01 | Payables period | |||||||

| Other Assets | $6.16 | $5.81 | ||||||||

| Leverage and Liquidity Ratios | ||||||||||

| TOTAL ASSETS | $104.47 | $106.98 | Assets to equity | |||||||

| Debt to assets | ||||||||||

| LIABILITIES | Debt to equity | |||||||||

| Long Term Debt Due In One Year | $0.00 | $0.00 | Times interest earned | |||||||

| Accounts Payable | $10.59 | $11.91 | Current ratio | |||||||

| Taxes Payable | $1.87 | $2.01 | Acid test | |||||||

| Accrued Expenses | $7.19 | $6.91 | ||||||||

| Other Current Liabilities | $1.88 | $1.85 | ||||||||

| Total Current Liabilities | $21.54 | $22.67 | ||||||||

| Long Term Debt | $6.95 | $19.79 | ||||||||

| Deferred Taxes | $1.16 | $2.32 | ||||||||

| Other Liabilities | $3.04 | $2.43 | ||||||||

| TOTAL LIABILITIES | $32.68 | $47.21 | ||||||||

| EQUITY | ||||||||||

| Common Stock | $0.07 | $0.06 | ||||||||

| Capital Surplus | $27.25 | $24.31 | ||||||||

| Retained Earnings | $73.89 | $61.10 | ||||||||

| Less: Treasury Stock | $29.42 | $25.71 | ||||||||

| TOTAL EQUITY | $71.79 | $59.77 | ||||||||

| TOTAL LIABILITIES & EQUITY | $104.47 | $106.98 | ||||||||

| Common Shares Outstanding | $5.14 | $5.05 | ||||||||

| Annual Income Statement | ||||||||||

| ($ Thousands, except per share ) | ||||||||||

| Sales | $179.24 | $164.28 | ||||||||

| Cost of Goods Sold | $95.71 | $91.99 | ||||||||

| Gross Profit | $83.53 | $72.29 | ||||||||

| Selling, General, & Administrative Exp. | $56.36 | $50.65 | ||||||||

| Operating Income Before Deprec. | $27.17 | $21.64 | ||||||||

| Depreciation,Depletion,&Amortization | $5.85 | $5.89 | ||||||||

| Operating Profit | $21.33 | $15.74 | ||||||||

| Interest Expense | $0.88 | $0.56 | ||||||||

| Non-Operating Income/Expense | $0.93 | $0.31 | ||||||||

| Special Items | $0.00 | $0.00 | ||||||||

| Pretax Income | $21.38 | $15.49 | ||||||||

| Total Income Taxes | $7.23 | $5.60 | ||||||||

| Income Before Extraordinary | ||||||||||

| Items & Discontinued Operations | $14.15 | $9.90 | ||||||||

| Savings Due to Common Stock Equiv. | $0.00 | $0.00 | ||||||||

| Adjusted Net Income | $14.15 | $9.90 | ||||||||

| EPS Basic from Operations | $0.26 | $0.19 | ||||||||

| EPS Diluted from Operations | $0.25 | $0.19 | ||||||||

| Dividends Per Share | $0.02 | $0.00 | ||||||||

| Com Shares for Basic EPS | $5.06 | $5.12 | ||||||||

| Com Shares for Diluted EPS | $5.21 | $5.27 | ||||||||

|

| ||||||||||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started