Answered step by step

Verified Expert Solution

Question

1 Approved Answer

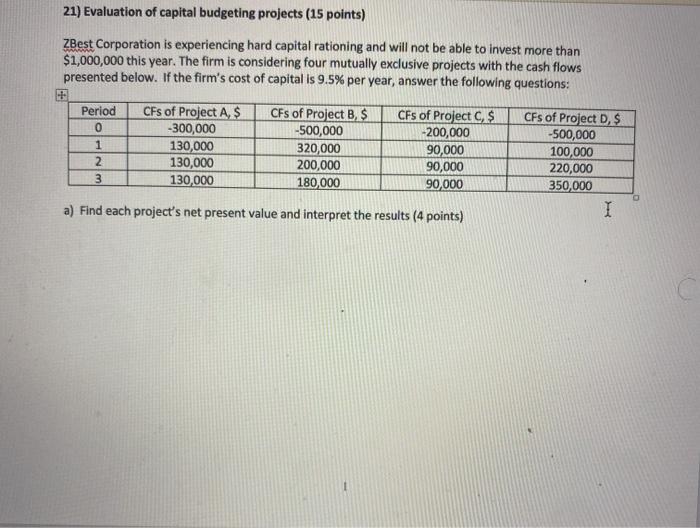

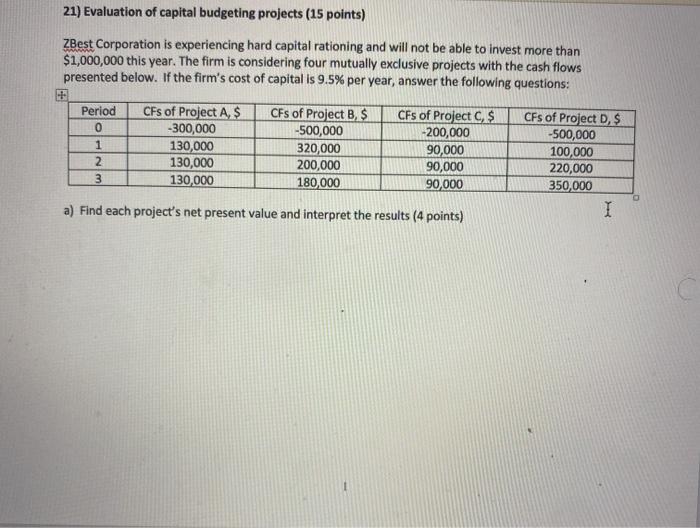

Evaluation of Capital Budgeting Projects 21) Evaluation of capital budgeting projects (15 points) ZBest Corporation is experiencing hard capital rationing and will not be able

Evaluation of Capital Budgeting Projects

21) Evaluation of capital budgeting projects (15 points) ZBest Corporation is experiencing hard capital rationing and will not be able to invest more than $1,000,000 this year. The firm is considering four mutually exclusive projects with the cash flows presented below. If the firm's cost of capital is 9.5% per year, answer the following questions: Period 0 1 2 3 CFs of Project A, $ -300,000 130,000 130,000 130,000 CFs of Project B. $ -500,000 320,000 200,000 180,000 CFs of Project C. $ -200,000 90,000 90,000 90,000 CFs of Project D, $ -500,000 100,000 220,000 350,000 I a) Find each project's net present value and interpret the results (4 points) 1 b) Find each project's profitability index and interpret the results (4 points) I c) Find each project's internal rate of return and interpret the results (4 points) d) Given the above findings, which project(s) should the firm accept and why? (3 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started