Answered step by step

Verified Expert Solution

Question

1 Approved Answer

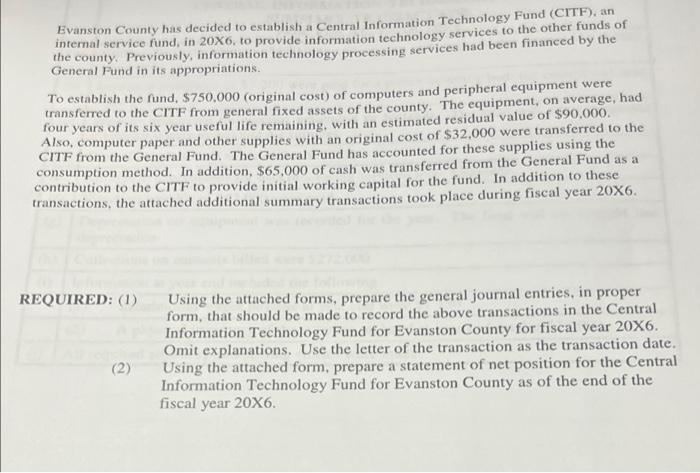

Evanston County has decided to establish a Central Information Technology Fund (CITF), an internal service fund, in 20X6, to provide information technology services to

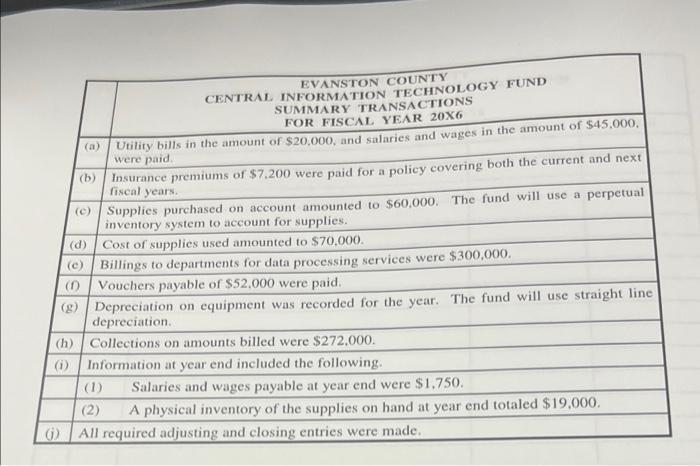

Evanston County has decided to establish a Central Information Technology Fund (CITF), an internal service fund, in 20X6, to provide information technology services to the other funds of the county. Previously, information technology processing services had been financed by the General Pund in its appropriations. To establish the fund, $750,000 (original cost) of computers and peripheral equipment were transferred to the CITF from general fixed assets of the county. The equipment, on average, had four years of its six year useful life remaining, with an estimated residual value of $90,000. Also, computer paper and other supplies with an original cost of $32,000 were transferred to the CITF from the General Fund. The General Fund has accounted for these supplies using the consumption method. In addition, $65,000 of cash was transferred from the General Fund as a contribution to the CITF to provide initial working capital for the fund. In addition to these transactions, the attached additional summary transactions took place during fiscal year 20X6. REQUIRED: (1) (2) Using the attached forms, prepare the general journal entries, in proper form, that should be made to record the above transactions in the Central Information Technology Fund for Evanston County for fiscal year 20X6. Omit explanations. Use the letter of the transaction as the transaction date. Using the attached form, prepare a statement of net position for the Central Information Technology Fund for Evanston County as of the end of the fiscal year 20X6. EVANSTON COUNTY CENTRAL INFORMATION TECHNOLOGY FUND SUMMARY TRANSACTIONS FOR FISCAL YEAR 20X6 (a) Utility bills in the amount of $20,000, and salaries and wages in the amount of $45,000, were paid. (b) (h) (c) (g) (i) (d) Cost of supplies used amounted to $70,000. (e) Billings to departments for data processing services were $300,000. (1) Vouchers payable of $52,000 were paid. Depreciation on equipment was recorded for the year. The fund will use straight line depreciation. Collections on amounts billed were $272,000. Insurance premiums of $7.200 were paid for a policy covering both the current and next fiscal years. Supplies purchased on account amounted to $60,000. The fund will use a perpetual inventory system to account for supplies. Information at year end included the following. (1) Salaries and wages payable at year end were $1,750. (2) A physical inventory of the supplies on hand at year end totaled $19,000. All required adjusting and closing entries were made. (j) (1) Date EVANSTON COUNTY CENTRAL INFORMATION TECHNOLOGY FUND GENERAL JOURNAL FOR FISCAL YEAR 20X6 Explanation Debit Credit EVANSTON COUNTY CENTRAL INFORMATION TECHNOLOGY FUND STATEMENT OF NET POSITION FOR FISCAL YEAR 20X6

Step by Step Solution

★★★★★

3.36 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started