Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Eve owns three houses, which she sold last year. The first was her personal residence in which she had a basis of $100,000 and

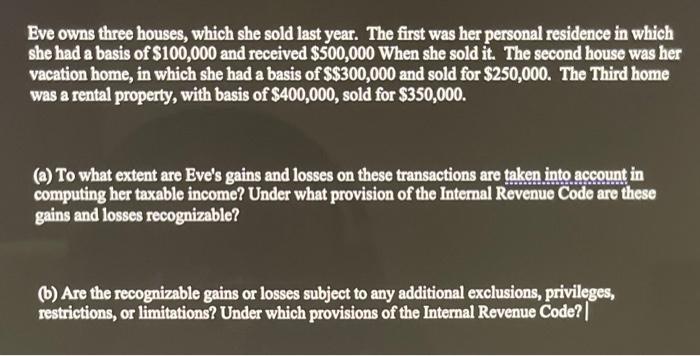

Eve owns three houses, which she sold last year. The first was her personal residence in which she had a basis of $100,000 and received $500,000 When she sold it. The second house was her vacation home, in which she had a basis of $$300,000 and sold for $250,000. The Third home was a rental property, with basis of $400,000, sold for $350,000. (a) To what extent are Eve's gains and losses on these transactions are taken into account in computing her taxable income? Under what provision of the Internal Revenue Code are these gains and losses recognizable? (b) Are the recognizable gains or losses subject to any additional exclusions, privileges, restrictions, or limitations? Under which provisions of the Internal Revenue Code? |

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

a As per Section 121 of IRS and Taxpayers Relief Act 1997 single ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started