Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Even if you could do a similar problem so I understand how to do it, I would be grateful. Thank you! A hedge fund with

Even if you could do a similar problem so I understand how to do it, I would be grateful. Thank you!

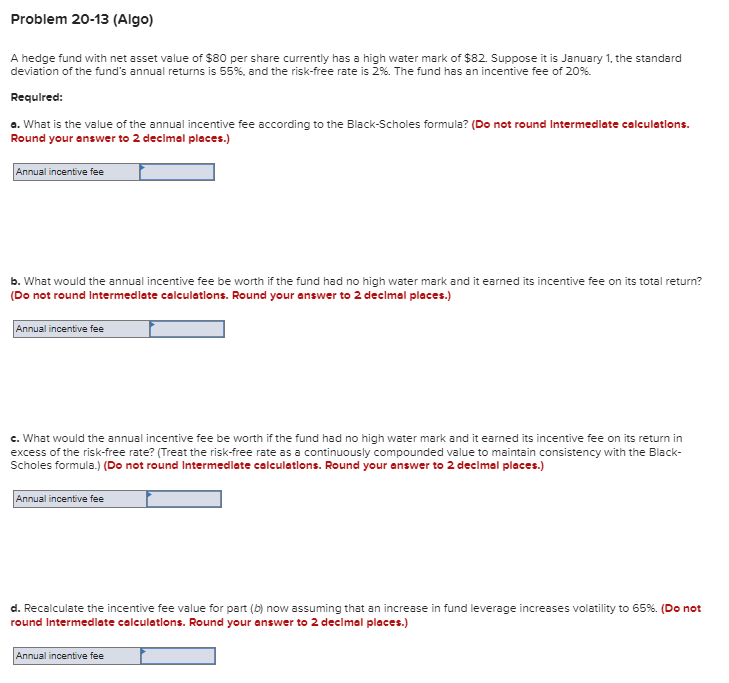

A hedge fund with net asset value of $80 per share currently has a high water mark of $82. Suppose it is January 1 , the standard deviation of the fund's annual returns is 55%, and the risk-free rate is 2%. The fund has an incentive fee 20%. Requlred: a. What is the value of the annual incentive fee according to the Black-Scholes formula? (Do not round Intermedlate caleulatlons. Round your enswer to 2 decimal places.) b. What would the annual incentive fee be worth if the fund had no high water mark and it earned its incentive fee on its total return? (Do not round Intermedlate calculations. Round your answer to 2 declmal places.) c. What would the annual incentive fee be worth if the fund had no high water mark and it earned its incentive fee on its return in excess of the risk-free rate? (Treat the risk-free rate as a continuously compounded value to maintain consistency with the BlackScholes formula.) (Do not round Intermedlate caleulatlons. Round your answer to 2 declmal places.) d. Recalculate the incentive fee value for part (b) now assuming that an increase in fund leverage increases volatility to 65%. (Do not round Intermedlate colculations. Round your answer to 2 declmal places.)

A hedge fund with net asset value of $80 per share currently has a high water mark of $82. Suppose it is January 1 , the standard deviation of the fund's annual returns is 55%, and the risk-free rate is 2%. The fund has an incentive fee 20%. Requlred: a. What is the value of the annual incentive fee according to the Black-Scholes formula? (Do not round Intermedlate caleulatlons. Round your enswer to 2 decimal places.) b. What would the annual incentive fee be worth if the fund had no high water mark and it earned its incentive fee on its total return? (Do not round Intermedlate calculations. Round your answer to 2 declmal places.) c. What would the annual incentive fee be worth if the fund had no high water mark and it earned its incentive fee on its return in excess of the risk-free rate? (Treat the risk-free rate as a continuously compounded value to maintain consistency with the BlackScholes formula.) (Do not round Intermedlate caleulatlons. Round your answer to 2 declmal places.) d. Recalculate the incentive fee value for part (b) now assuming that an increase in fund leverage increases volatility to 65%. (Do not round Intermedlate colculations. Round your answer to 2 declmal places.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started