Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Several years ago Benny Jackson (125 Hill Street, Charleston, wV 25311) acquired an apartment building that currently generates a loss of $60,000. Benny's AGI

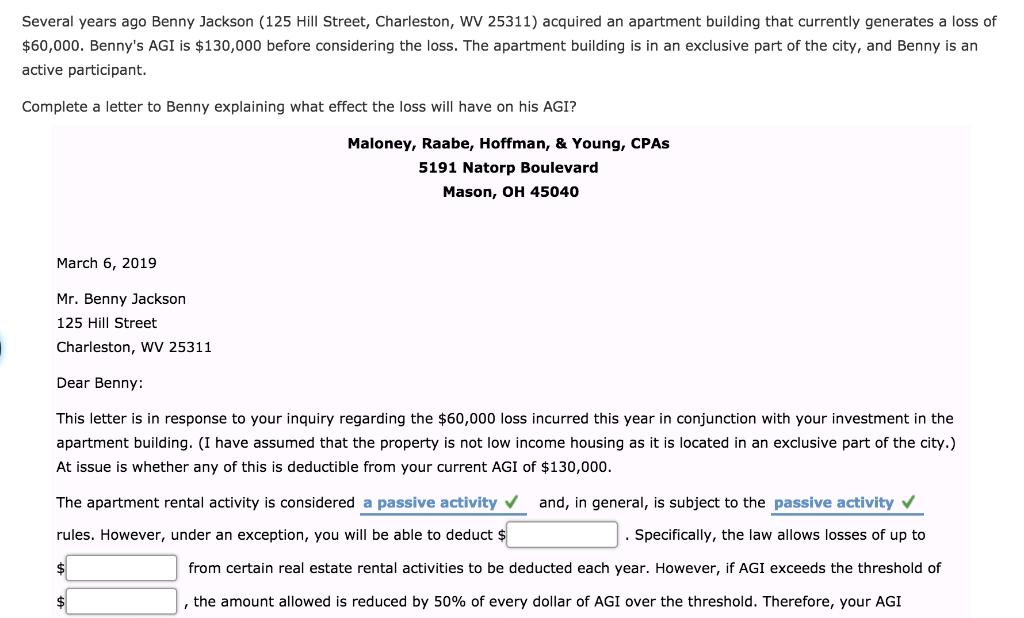

Several years ago Benny Jackson (125 Hill Street, Charleston, wV 25311) acquired an apartment building that currently generates a loss of $60,000. Benny's AGI is $130,000 before considering the loss. The apartment building is in an exclusive part of the city, and Benny is an active participant. Complete a letter to Benny explaining what effect the loss will have on his AGI? Maloney, Raabe, Hoffman, & Young, CPAS 5191 Natorp Boulevard Mason, OH 45040 March 6, 2019 Mr. Benny Jackson 125 Hill Street Charleston, WV 25311 Dear Benny: This letter is in response to your inquiry regarding the $60,000 loss incurred this year in conjunction with your investment in the apartment building. (I have assumed that the property is not low income housing as it is located in an exclusive part of the city.) At issue is whether any of this is deductible from your current AGI of $130,000. The apartment rental activity is considered a passive activity v and, in general, is subject to the passive activity v rules. However, under an exception, you will be able to deduct $ . Specifically, the law allows losses of up to from certain real estate rental activities to be deducted each year. However, if AGI exceeds the threshold of $4 ,the amount allowed is reduced by 50% of every dollar of AGI over the threshold. Therefore, your AGI becomes $ after the allowable $ loss is deducted. The remaining loss that is not deductible in the current year is suspended v If you have any additional questions or would like further clarification of this matter, please call me. Sincerely, John J. Hudgins, CPA

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started