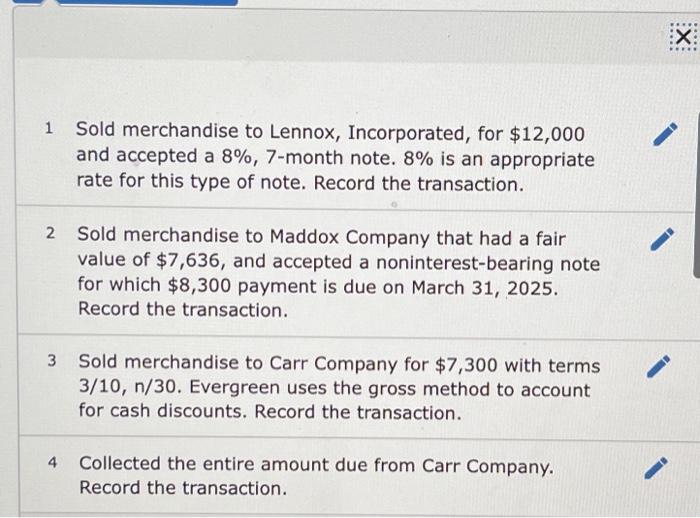

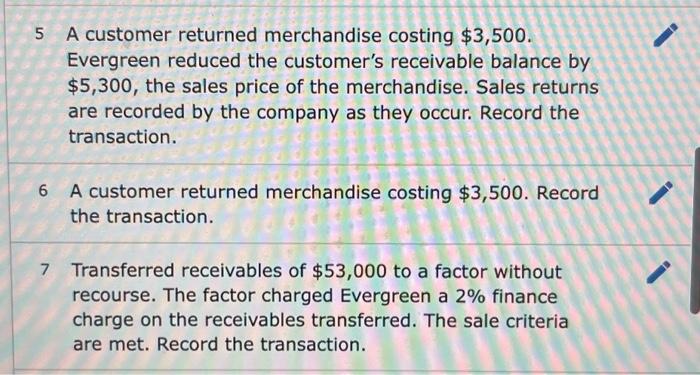

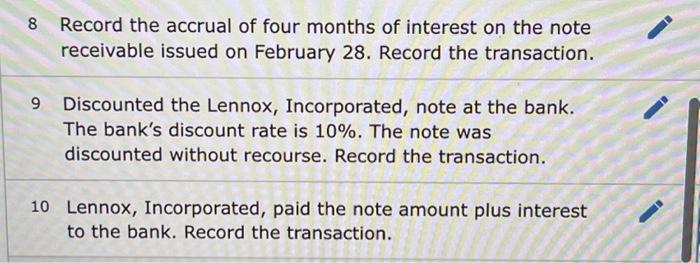

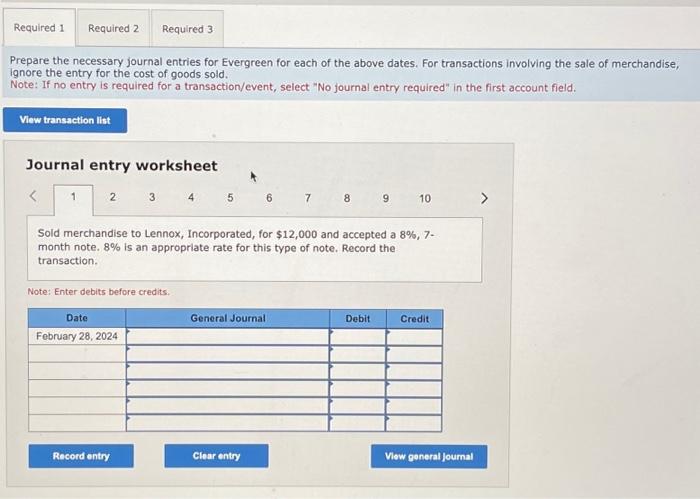

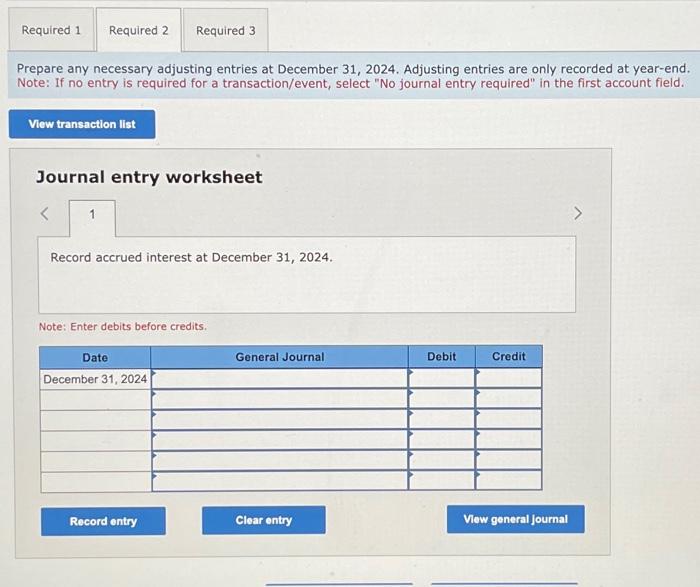

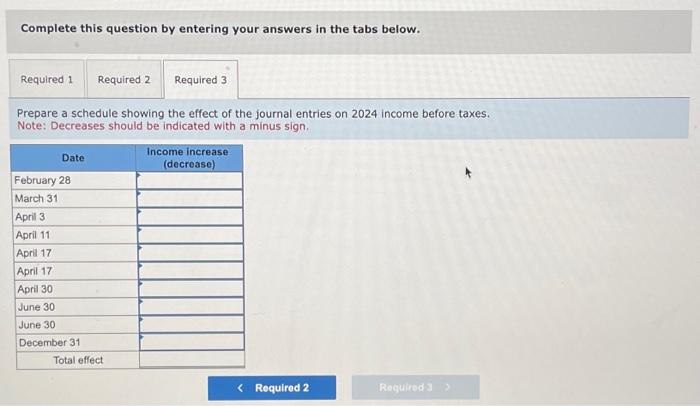

Evergreen Company sells lawn and garden products to wholesalers. The company's fiscal year-end is December 31. During 2024, the following transactions related to receivables occurred: February 28 sold merchandise to Lennox, Incorporated, for $12,000 and accepted a 88 , 7 -month note. 88 13 an appropriate rate for this type of note. Mareh 31 sold merehandise to Maddox Company that had a fair value of $7,636, and accepted a nonintereat-bearing note for which $8,300 payment in dae on March 31,2025 . April 3 sold merchandise to Carr Company for $7,300 with terms 3/10, n/30. Evergreen uses the gross nethod to account for cash discounta. Apri1 11 collected the entire amount due from Carr Company April 17 A customer returned merchandise costing $3,500. Evergreen reduced the customer's receivable balance by $5,300, the sales price of the merehandise. salen returne are recorded by the conpany as they occur. April 30 Transterred recelvables of $53,000 to a factor without recourse. The factor eharged Evergreen a 2t tinance charge on the receivabled transferred. The sale criteria are met. June 30 Diseounted the Lennox, Incorporated, note at the bank, the bank's discount rate is 100 . The note vas September 30 Lennox, Incorporated, paid the note anount plus interest to the bank. Required: 1. Prepare the necessary journal entries for Evergreen for each of the above dates. For transactions involving the sale of merchandise, ignore the entry for the cost of goods sold. 2. Prepare any necessary adjusting entries at December 31, 2024. Adjusting entries are only recorded at year-end. 3. Prepare a schedule showing the effect of the journal entries on 2024 income before taxes. 1 Sold merchandise to Lennox, Incorporated, for $12,000 and accepted a 8%,7-month note. 8% is an appropriate rate for this type of note. Record the transaction. 2 Sold merchandise to Maddox Company that had a fair value of $7,636, and accepted a noninterest-bearing note for which $8,300 payment is due on March 31, 2025. Record the transaction. 3 Sold merchandise to Carr Company for $7,300 with terms 3/10,n/30. Evergreen uses the gross method to account for cash discounts. Record the transaction. 4 Collected the entire amount due from Carr Company. Record the transaction. 5 A customer returned merchandise costing $3,500. Evergreen reduced the customer's receivable balance by $5,300, the sales price of the merchandise. Sales returns are recorded by the company as they occur. Record the transaction. 6 A customer returned merchandise costing $3,500. Record the transaction. 7 Transferred receivables of $53,000 to a factor without recourse. The factor charged Evergreen a 2% finance charge on the receivables transferred. The sale criteria are met. Record the transaction. 8 Record the accrual of four months of interest on the note receivable issued on February 28 . Record the transaction. 9 Discounted the Lennox, Incorporated, note at the bank. The bank's discount rate is 10%. The note was discounted without recourse. Record the transaction. 10 Lennox, Incorporated, paid the note amount plus interest to the bank. Record the transaction. Prepare the necessary journal entries for Evergreen for each of the above dates. For transactions involving the sale of merchandise, ignore the entry for the cost of goods sold. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Sold merchandise to Lennox, Incorporated, for $12,000 and accepted a 8%,7. month note. 8% is an appropriate rate for this type of note. Record the transaction. Note: Enter debits before credits. Prepare any necessary adjusting entries at December 31, 2024. Adjusting entries are only recorded at year-end. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Note: Enter debits before credits. Complete this question by entering your answers in the tabs below. Prepare a schedule showing the effect of the journal entries on 2024 income before taxes. Note: Decreases should be indicated with a minus sign