Answered step by step

Verified Expert Solution

Question

1 Approved Answer

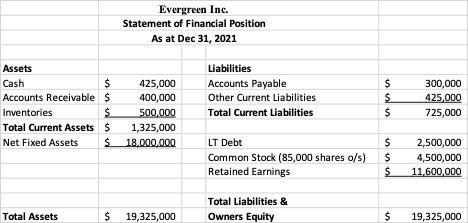

Evergreen Incs most recent Statement of Financial Position is given below. Additional Information: Current market price per common share = $ 195 Before tax cost

Evergreen Incs most recent Statement of Financial Position is given below.

Additional Information:

- Current market price per common share = $ 195

- Before tax cost of borrowing (secured loan) = 5%

- Weighted Average Cost of Capital =12%

- Net Income for 2021 = $925,000

- Target D/E ratio based on market values = 0.25

- Corporate tax rate = 35%

- One of the projects Evergreen is considering involves purchasing a new piece of manufacturing equipment. The capital budgeting analysis indicates that the equipment has a positive NPV of $500,000. The required initial investment in working capital for the project amounts to $50,000 payable at the beginning of the year and is growing at 10% annually over the life of the project. The equipment costs $1,400,000 to purchase, has a five-year useful economic life, and is a class 10 asset which has a CCA rate of 30% (assume half year rule applies). The salvage value of the equipment is $350,000 at the end of the five-year period. The equipment can be leased from Acel Leasing for five years for $300,000 per year, with the first payment payable at the beginning of the year. If Evergreen purchases the equipment, it will have annual operating costs of $50,000 per year. Under the terms of the lease, Acel will be responsible for the operating costs. Assume that the lease is a tax lease (qualified by the CRA for tax purposes). Calculate the Net Advantage to Leasing and explain whether the firm should buy or lease the asset. (17 marks)

- Calculate the maximum annual lease payment Evergreen would be willing to make. (5 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started