Answered step by step

Verified Expert Solution

Question

1 Approved Answer

* EVERY CHEGG EXPERT ANSWER I HAVE RECEIVED HAS BEEN WRONG AND I'VE USED ABOUT 6 - 7 OF MY QUESTIONS FOR THE MONTH ON

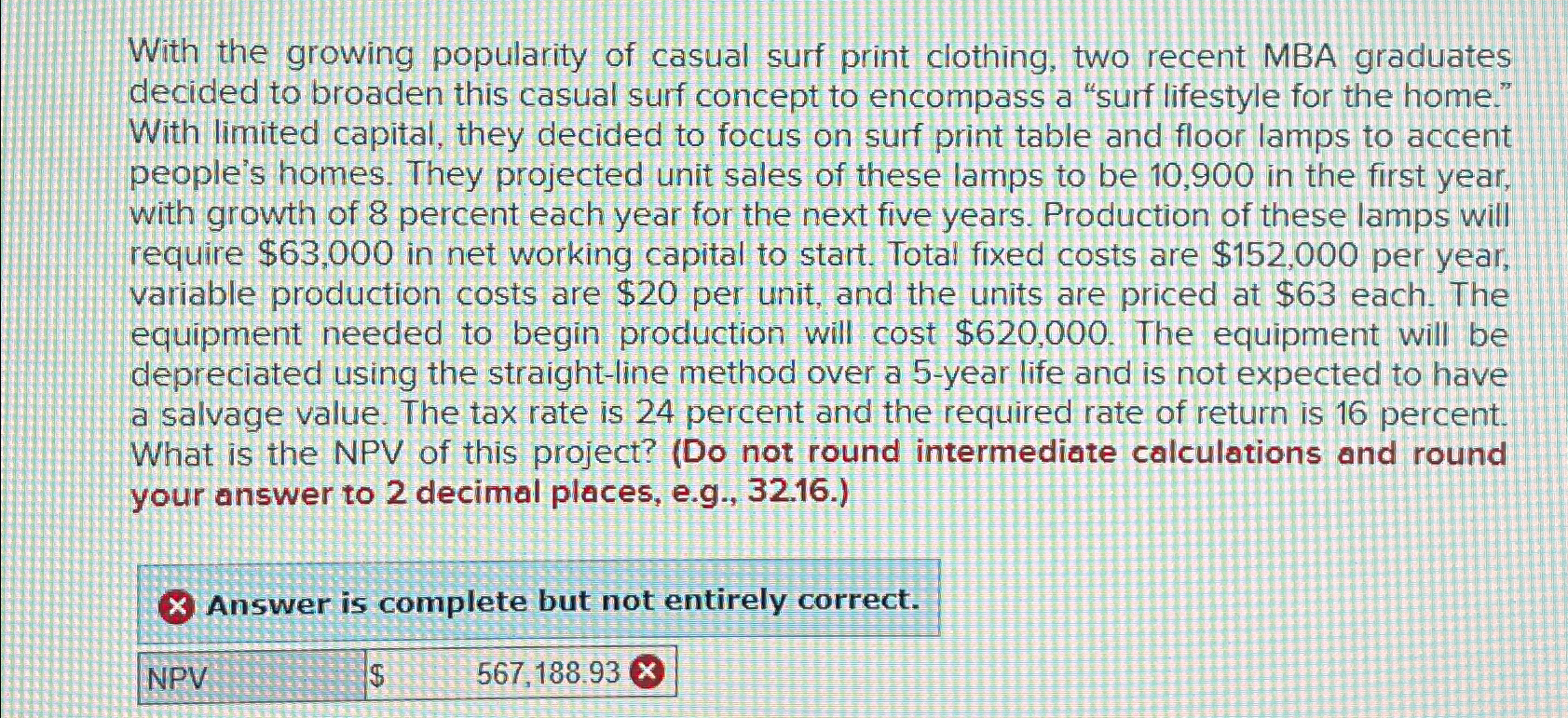

EVERY CHEGG EXPERT ANSWER I HAVE RECEIVED HAS BEEN WRONG AND I'VE USED ABOUT OF MY QUESTIONS FOR THE MONTH ON THIS PROBLEM NOW!!! please help!!! With the growing popularity of casual surf print clothing, two recent MBA graduates decided to broaden this casual surf concept to encompass a "surf lifestyle for the home." With limited capital, they decided to focus on surf print table and floor lamps to accent people's homes. They projected unit sales of these lamps to be in the first year, with growth of percent each year for the next five years. Production of these lamps will require $ in net working capital to start. Total fixed costs are $ per year, variable production costs are $ per unit, and the units are priced at $ each. The equipment needed to begin production will cost $ The equipment will be depreciated using the straightline method over a year life and is not expected to have a salvage value. The tax rate is percent and the required rate of return is percent. What is the NPV of this project? Do not round intermediate calculations and round your answer to decimal places, eg

Answer is complete but not entirely correct.

NPV

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started