Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Every six months, Harmizan takes an inventory of the consumer debts that he has outstanding. His records is showing that he still owes RM4,000 on

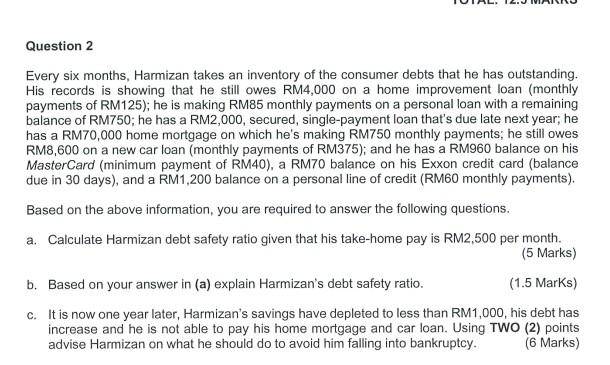

Every six months, Harmizan takes an inventory of the consumer debts that he has outstanding. His records is showing that he still owes RM4,000 on a home improvement loan (monthly payments of RM125); he is making RM85 monthly payments on a personal loan with a remaining balance of RM750; he has a RM2,000, secured, single-payment loan that's due late next year; he has a RM70,000 home mortgage on which he's making RM750 monthly payments; he still owes RM8,600 on a new car loan (monthly payments of RM375); and he has a RM960 balance on his MasterCard (minimum payment of RM40), a RM70 balance on his Exxon credit card (balance due in 30 days), and a RM1,200 balance on a personal line of credit (RM60 monthly payments). Based on the above information, you are required to answer the following questions. a. Calculate Harmizan debt safety ratio given that his take-home pay is RM2,500 per month. (5 Marks) b. Based on your answer in (a) explain Harmizan's debt safety ratio. (1.5 MarKs) c. It is now one year later, Harmizan's savings have depleted to less than RM1,000, his debt has increase and he is not able to pay his home mortgage and car loan. Using TWO (2) points advise Harmizan on what he should do to avoid him falling into bankruptcy. (6 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started