Everything blank has to be answered

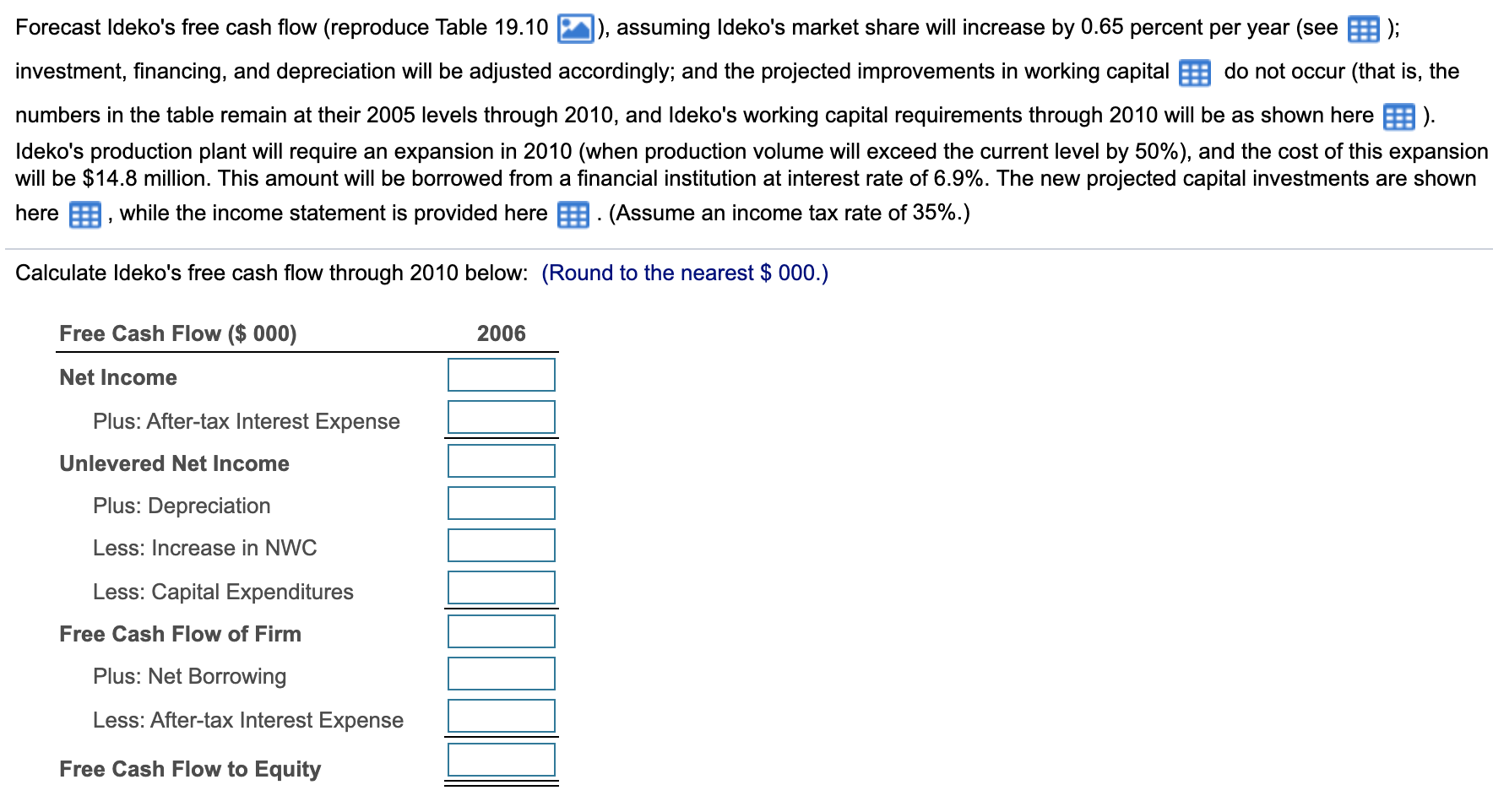

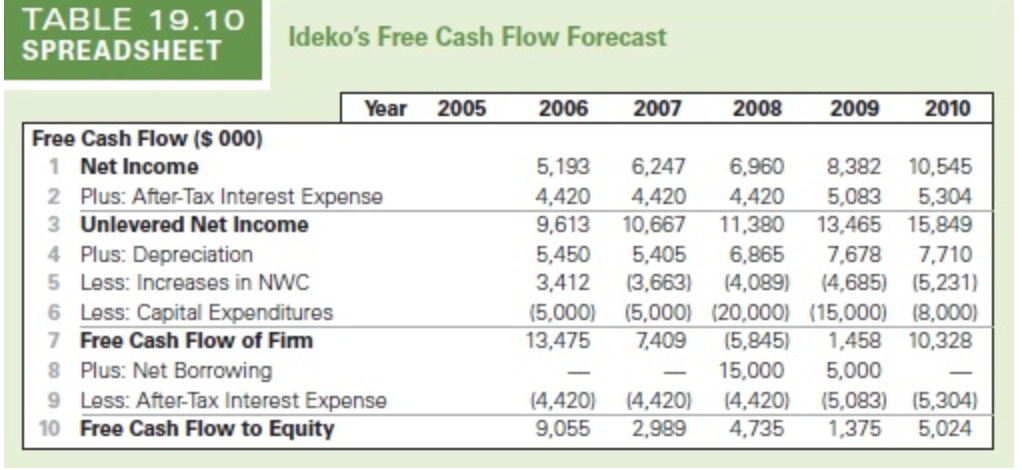

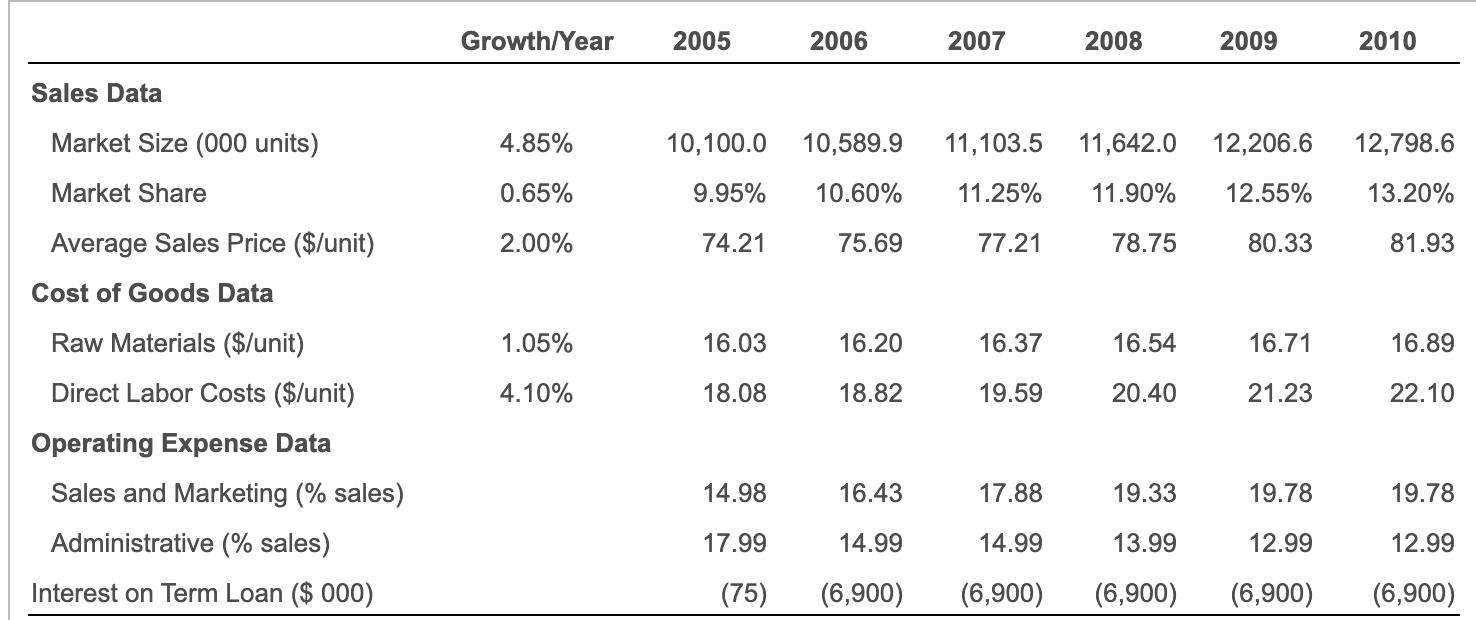

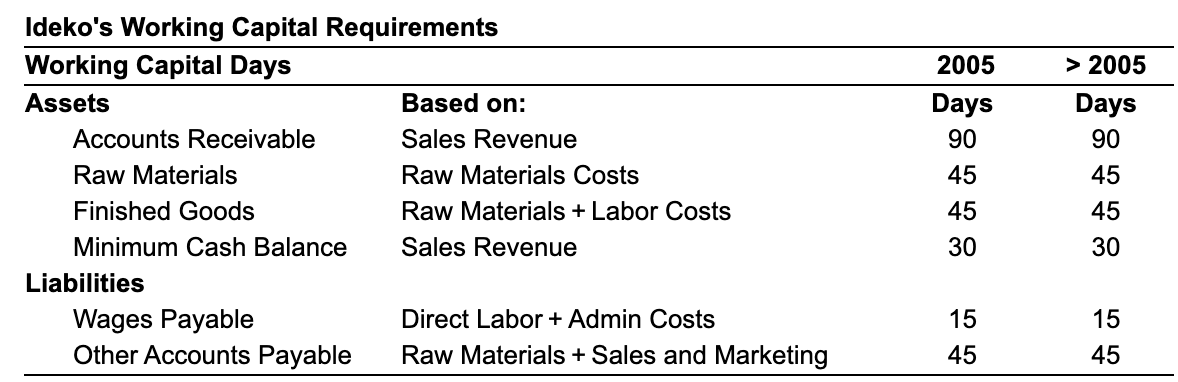

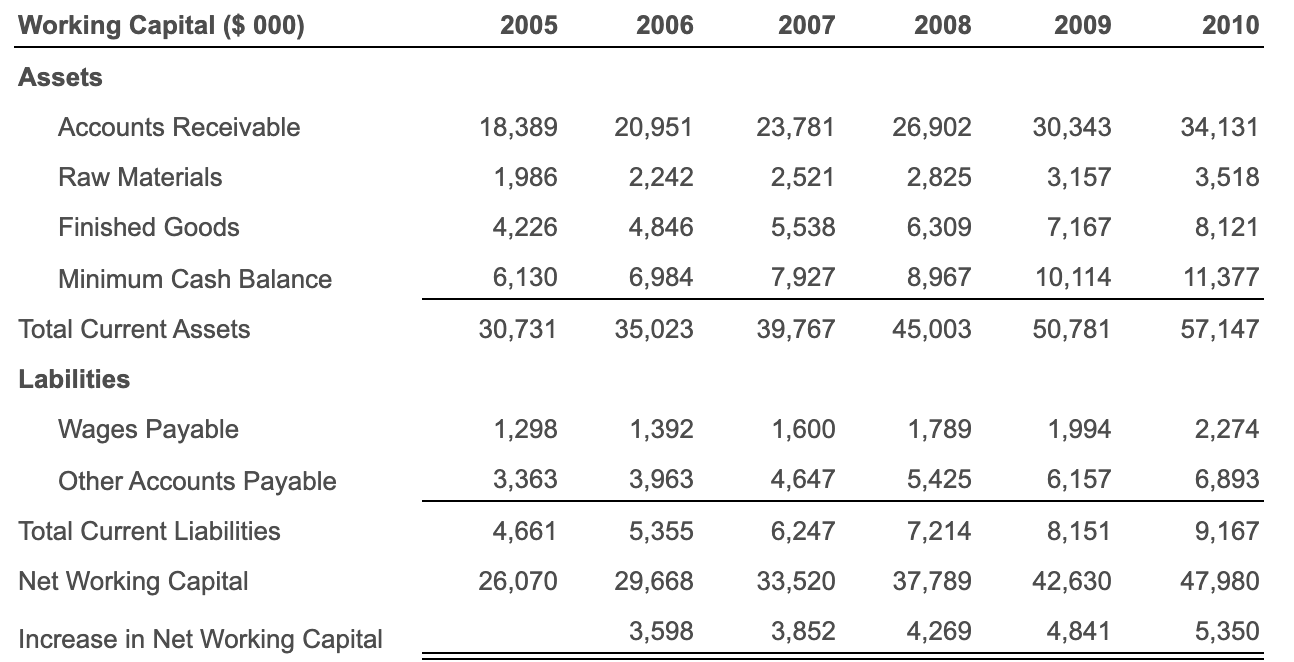

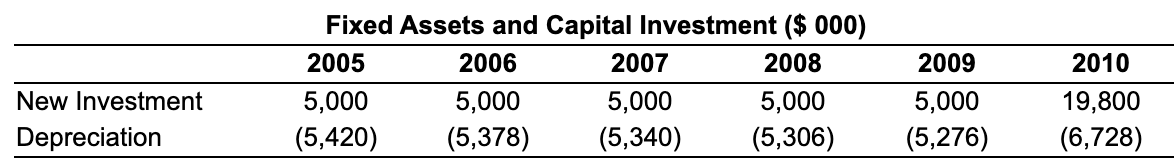

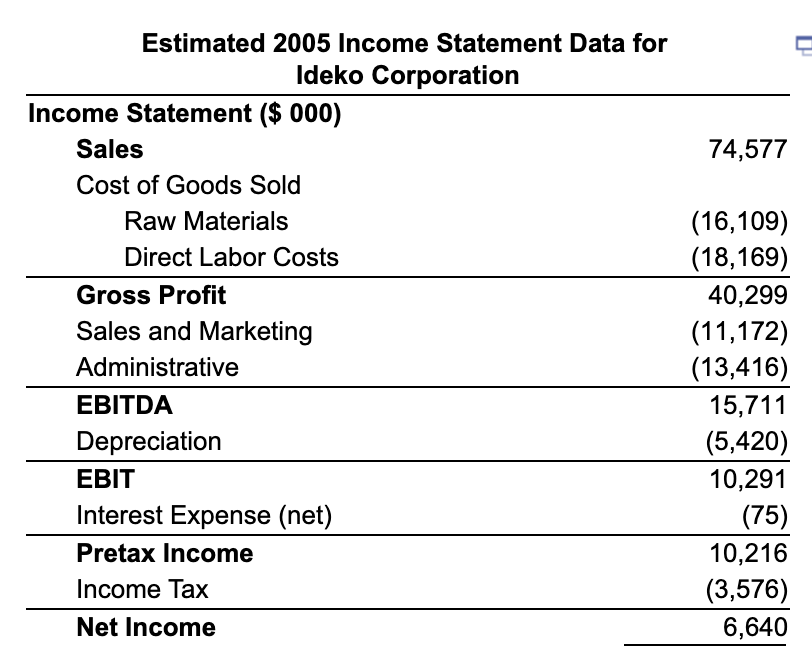

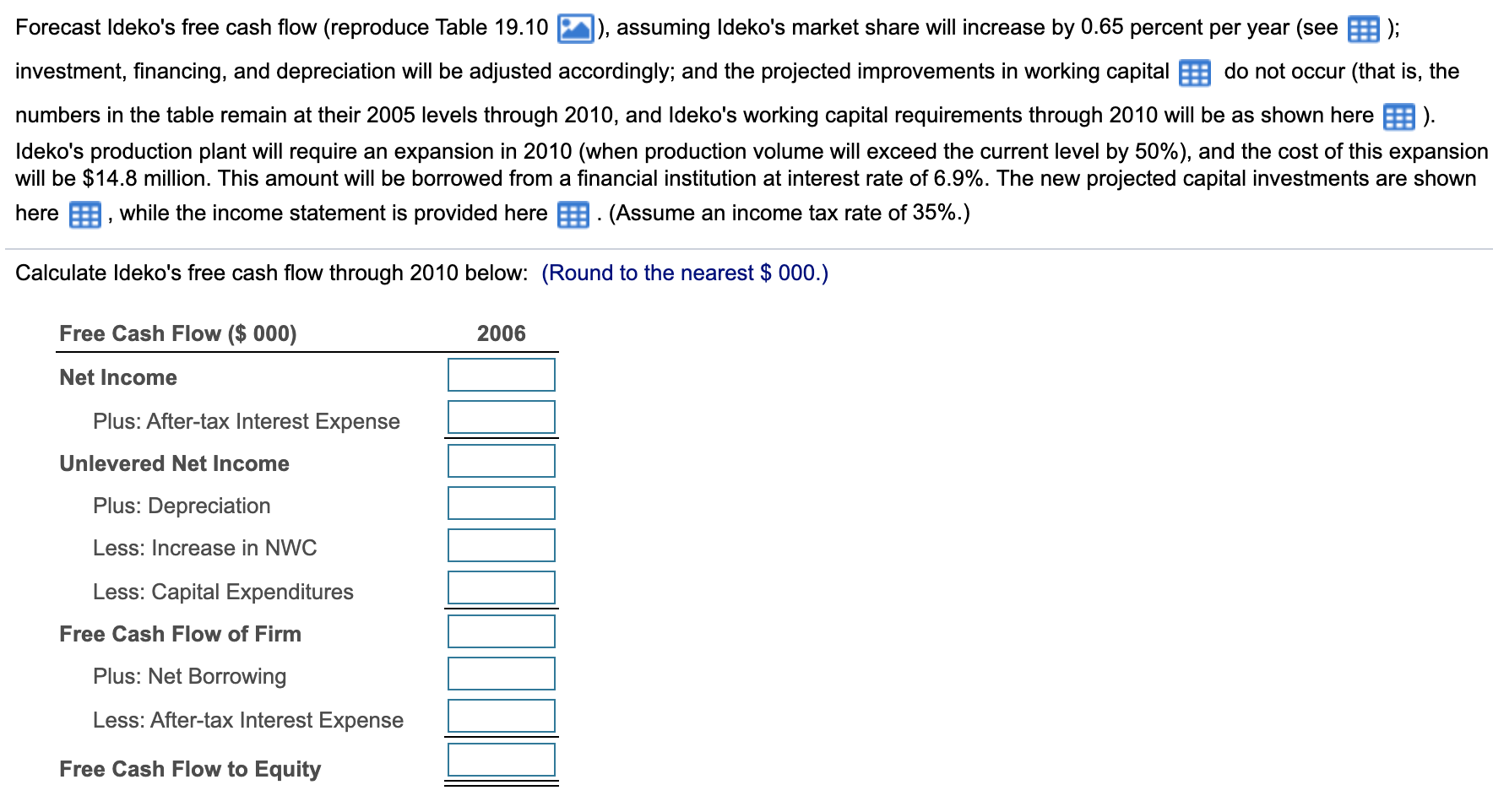

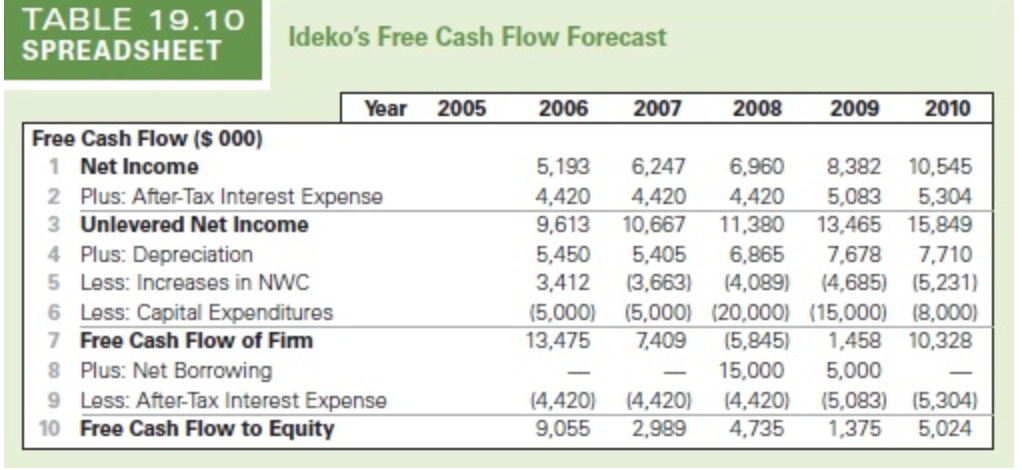

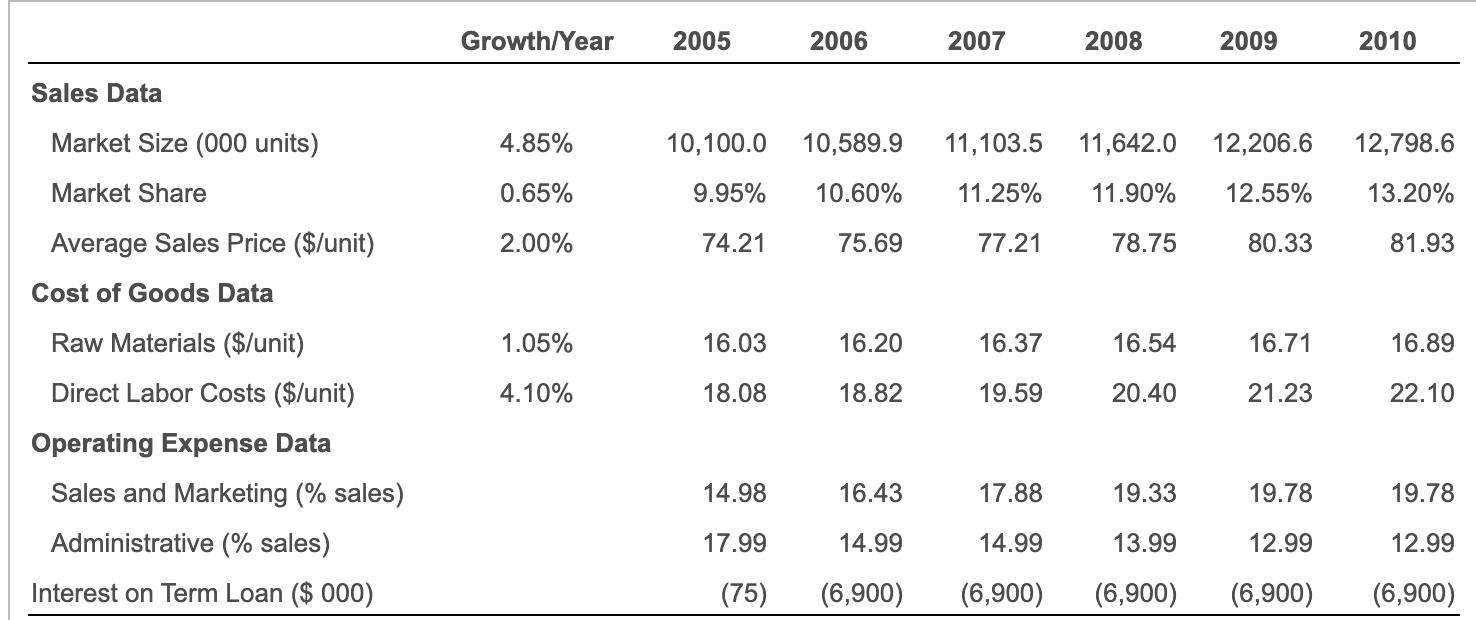

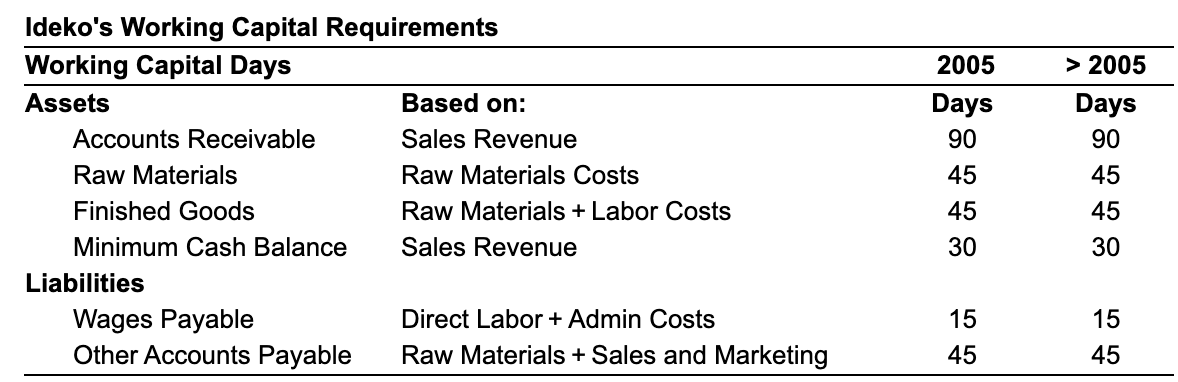

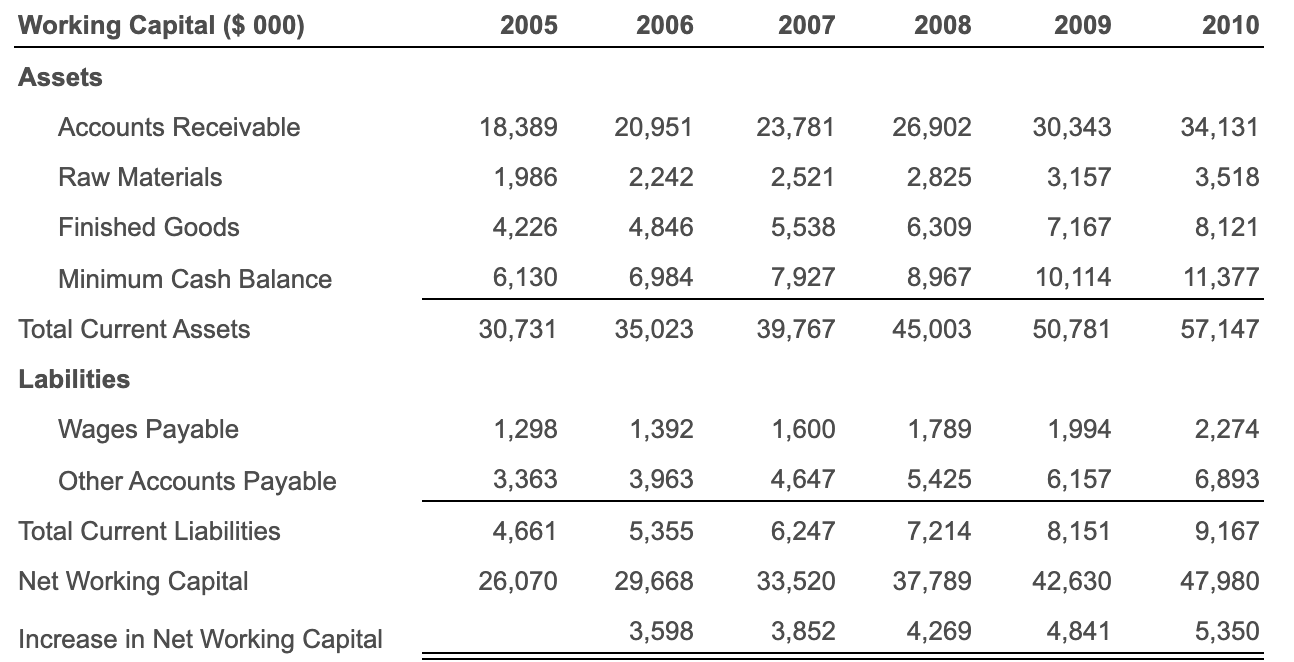

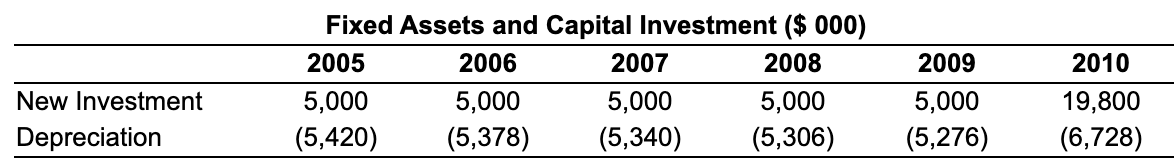

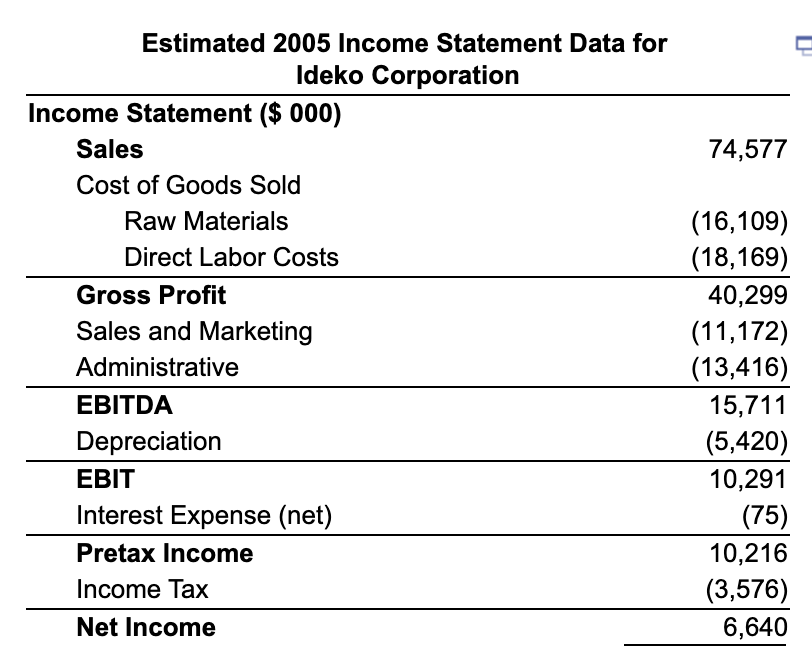

Forecast Ideko's free cash flow (reproduce Table 19.10 ]), assuming Ideko's market share will increase by 0.65 percent per year (see ); investment, financing, and depreciation will be adjusted accordingly; and the projected improvements in working capital E: do not occur (that is, the numbers in the table remain at their 2005 levels through 2010, and Ideko's working capital requirements through 2010 will be as shown here ). Ideko's production plant will require an expansion in 2010 (when production volume will exceed the current level by 50%), and the cost of this expansion will be $14.8 million. This amount will be borrowed from a financial institution at interest rate of 6.9%. The new projected capital investments are shown here, while the income statement is provided here : - (Assume an income tax rate of 35%.) Calculate Ideko's free cash flow through 2010 below: (Round to the nearest $ 000.) Free Cash Flow ($ 000) 2006 Net Income Plus: After-tax Interest Expense Unlevered Net Income Plus: Depreciation Less: Increase in NWC Less: Capital Expenditures Free Cash Flow of Firm Plus: Net Borrowing Less: After-tax Interest Expense Free Cash Flow to Equity TABLE 19.10 SPREADSHEET Ideko's Free Cash Flow Forecast 2006 2007 2008 2009 2010 Year 2005 Free Cash Flow ($ 000) 1 Net Income 2 Plus: After-Tax Interest Expense 3 Unlevered Net Income 4 Plus: Depreciation 5 Less: Increases in NWC 6 Less: Capital Expenditures 7 Free Cash Flow of Firm 8 Plus: Net Borrowing 9 Less: After-Tax Interest Expense 10 Free Cash Flow to Equity 5,193 4,420 9,613 5,450 3,412 (5,000) 13,475 6,247 6,960 8,382 10,545 4,420 4,420 5,083 5,304 10,667 11,380 13,465 15,849 5,405 6.865 7,678 7.710 (3,663) (4,089) 14.685) (5,231) (5,000) (20,000) (15,000) (8,000) 7,409 15,845) 1,458 10,328 15,000 5,000 (4,420) (4,420) (5,083) (5,304) 2,989 4,735 1,375 5,024 (4,420) 9,055 Growth/Year 2005 2006 2007 2008 2009 2010 Sales Data Market Size (000 units) 4.85% 10,100.0 10,589.9 11,103.5 11,642.0 12,206.6 12,798.6 Market Share 0.65% 9.95% 10.60% 11.25% 11.90% 12.55% 13.20% Average Sales Price ($/unit) 2.00% 74.21 75.69 77.21 78.75 80.33 81.93 Cost of Goods Data 1.05% 16.03 16.20 16.37 16.54 16.71 16.89 4.10% 18.08 18.82 19.59 20.40 21.23 22.10 Raw Materials ($/unit) Direct Labor Costs ($/unit) Operating Expense Data Sales and Marketing (% sales) Administrative (% sales) Interest on Term Loan ($ 000) 14.98 16.43 17.88 19.33 19.78 19.78 17.99 14.99 14.99 13.99 12.99 12.99 (75) (6,900) (6,900) (6,900) (6,900) (6,900) 2005 Days 90 > 2005 Days 90 45 45 Ideko's Working Capital Requirements Working Capital Days Assets Based on: Accounts Receivable Sales Revenue Raw Materials Raw Materials Costs Finished Goods Raw Materials + Labor Costs Minimum Cash Balance Sales Revenue Liabilities Wages Payable Direct Labor + Admin Costs Other Accounts Payable Raw Materials + Sales and Marketing 45 45 30 30 15 15 45 45 Working Capital ($ 000) 2005 2006 2007 2008 2009 2010 Assets Accounts Receivable 18,389 20,951 23,781 26,902 30,343 34,131 Raw Materials 1,986 2,242 2,521 2,825 3,157 3,518 Finished Goods 4,226 4,846 5,538 6,309 7,167 8,121 Minimum Cash Balance 6,130 6,984 7,927 8,967 10,114 11,377 Total Current Assets 30,731 35,023 39,767 45,003 50,781 57,147 Labilities Wages Payable 1,298 1,392 1,600 1,789 1,994 2,274 Other Accounts Payable 3,363 3,963 4,647 5,425 6,157 6,893 Total Current Liabilities 4,661 5,355 6,247 7,214 8,151 9,167 Net Working Capital 26,070 29,668 33,520 37,789 42,630 47,980 Increase in Net Working Capital 3,598 3,852 4,269 4,841 5,350 2010 Fixed Assets and Capital Investment ($ 000) 2005 2006 2007 2008 5,000 5,000 5,000 5,000 (5,420) (5,378) (5,340) (5,306) New Investment Depreciation 2009 5,000 (5,276) 19,800 (6,728) 74,577 Estimated 2005 Income Statement Data for Ideko Corporation Income Statement ($ 000) Sales Cost of Goods Sold Raw Materials Direct Labor Costs Gross Profit Sales and Marketing Administrative EBITDA Depreciation EBIT Interest Expense (net) Pretax Income Income Tax Net Income (16,109) (18,169) 40,299 (11,172) (13,416) 15,711 (5,420) 10,291 (75) 10,216 (3,576) 6,640 Forecast Ideko's free cash flow (reproduce Table 19.10 ]), assuming Ideko's market share will increase by 0.65 percent per year (see ); investment, financing, and depreciation will be adjusted accordingly; and the projected improvements in working capital E: do not occur (that is, the numbers in the table remain at their 2005 levels through 2010, and Ideko's working capital requirements through 2010 will be as shown here ). Ideko's production plant will require an expansion in 2010 (when production volume will exceed the current level by 50%), and the cost of this expansion will be $14.8 million. This amount will be borrowed from a financial institution at interest rate of 6.9%. The new projected capital investments are shown here, while the income statement is provided here : - (Assume an income tax rate of 35%.) Calculate Ideko's free cash flow through 2010 below: (Round to the nearest $ 000.) Free Cash Flow ($ 000) 2006 Net Income Plus: After-tax Interest Expense Unlevered Net Income Plus: Depreciation Less: Increase in NWC Less: Capital Expenditures Free Cash Flow of Firm Plus: Net Borrowing Less: After-tax Interest Expense Free Cash Flow to Equity TABLE 19.10 SPREADSHEET Ideko's Free Cash Flow Forecast 2006 2007 2008 2009 2010 Year 2005 Free Cash Flow ($ 000) 1 Net Income 2 Plus: After-Tax Interest Expense 3 Unlevered Net Income 4 Plus: Depreciation 5 Less: Increases in NWC 6 Less: Capital Expenditures 7 Free Cash Flow of Firm 8 Plus: Net Borrowing 9 Less: After-Tax Interest Expense 10 Free Cash Flow to Equity 5,193 4,420 9,613 5,450 3,412 (5,000) 13,475 6,247 6,960 8,382 10,545 4,420 4,420 5,083 5,304 10,667 11,380 13,465 15,849 5,405 6.865 7,678 7.710 (3,663) (4,089) 14.685) (5,231) (5,000) (20,000) (15,000) (8,000) 7,409 15,845) 1,458 10,328 15,000 5,000 (4,420) (4,420) (5,083) (5,304) 2,989 4,735 1,375 5,024 (4,420) 9,055 Growth/Year 2005 2006 2007 2008 2009 2010 Sales Data Market Size (000 units) 4.85% 10,100.0 10,589.9 11,103.5 11,642.0 12,206.6 12,798.6 Market Share 0.65% 9.95% 10.60% 11.25% 11.90% 12.55% 13.20% Average Sales Price ($/unit) 2.00% 74.21 75.69 77.21 78.75 80.33 81.93 Cost of Goods Data 1.05% 16.03 16.20 16.37 16.54 16.71 16.89 4.10% 18.08 18.82 19.59 20.40 21.23 22.10 Raw Materials ($/unit) Direct Labor Costs ($/unit) Operating Expense Data Sales and Marketing (% sales) Administrative (% sales) Interest on Term Loan ($ 000) 14.98 16.43 17.88 19.33 19.78 19.78 17.99 14.99 14.99 13.99 12.99 12.99 (75) (6,900) (6,900) (6,900) (6,900) (6,900) 2005 Days 90 > 2005 Days 90 45 45 Ideko's Working Capital Requirements Working Capital Days Assets Based on: Accounts Receivable Sales Revenue Raw Materials Raw Materials Costs Finished Goods Raw Materials + Labor Costs Minimum Cash Balance Sales Revenue Liabilities Wages Payable Direct Labor + Admin Costs Other Accounts Payable Raw Materials + Sales and Marketing 45 45 30 30 15 15 45 45 Working Capital ($ 000) 2005 2006 2007 2008 2009 2010 Assets Accounts Receivable 18,389 20,951 23,781 26,902 30,343 34,131 Raw Materials 1,986 2,242 2,521 2,825 3,157 3,518 Finished Goods 4,226 4,846 5,538 6,309 7,167 8,121 Minimum Cash Balance 6,130 6,984 7,927 8,967 10,114 11,377 Total Current Assets 30,731 35,023 39,767 45,003 50,781 57,147 Labilities Wages Payable 1,298 1,392 1,600 1,789 1,994 2,274 Other Accounts Payable 3,363 3,963 4,647 5,425 6,157 6,893 Total Current Liabilities 4,661 5,355 6,247 7,214 8,151 9,167 Net Working Capital 26,070 29,668 33,520 37,789 42,630 47,980 Increase in Net Working Capital 3,598 3,852 4,269 4,841 5,350 2010 Fixed Assets and Capital Investment ($ 000) 2005 2006 2007 2008 5,000 5,000 5,000 5,000 (5,420) (5,378) (5,340) (5,306) New Investment Depreciation 2009 5,000 (5,276) 19,800 (6,728) 74,577 Estimated 2005 Income Statement Data for Ideko Corporation Income Statement ($ 000) Sales Cost of Goods Sold Raw Materials Direct Labor Costs Gross Profit Sales and Marketing Administrative EBITDA Depreciation EBIT Interest Expense (net) Pretax Income Income Tax Net Income (16,109) (18,169) 40,299 (11,172) (13,416) 15,711 (5,420) 10,291 (75) 10,216 (3,576) 6,640